Delayed USDA reports and Snake River jump: Hyped, but duds

U.S. production trumps market impact China ASF turmoil should have on prices.

February 11, 2019

Evel Knievel was a motorcycle daredevil who attempted more than 75 ramp-to-ramp jumps. One of his most hyped jumps was when he attempted to jump the Snake River Canyon in Idaho aboard a steam-powered rocket. Those of you who remember the television event from 1974 probably recall how the story ends. If you are too young, you may click here to watch it.

I reference this event as a comparison to this week’s long-awaited USDA report. It, too, had all the makings of a big moment. It, too, was a dud.

I was looking for a few more fireworks from the USDA report given that it had 1) the Dec. 1 stocks numbers, 2) the final yield numbers that we should have seen in January, 3) adjustments in demand for the past two months, and 4) updates of the South American growing season.

The numbers largely offset each other with both corn and soy exhibiting no clear direction after the report. If there is an interesting facet in the data, it is the U.S corn yields falling 2.5 bushels per acre from the December values and no longer representing a record number. Declining world soy numbers were countered by a decrease in Chinese demand.

Bottom line: There is no smoking gun, nothing here to rock your world regardless of your bias. The next big report will be at the end of March when we get planting intentions. In my opinion, corn is undervalued relative to soybeans on the 2019-20 balance sheet expectations. I like the spread play but little else.

Just a little too much

If you’re asking yourself, “when are we going to see some positive price movement in response to the Chinese African swine fever situation?” you are not alone. Stories of the calamity in that country continue to circulate with each iteration of production impact greater than the one before. Why, then, are we struggling to keep our cash trade in the shadow of $50 or so on a carcass basis, a solid $30 per pig loss for U.S. producers?

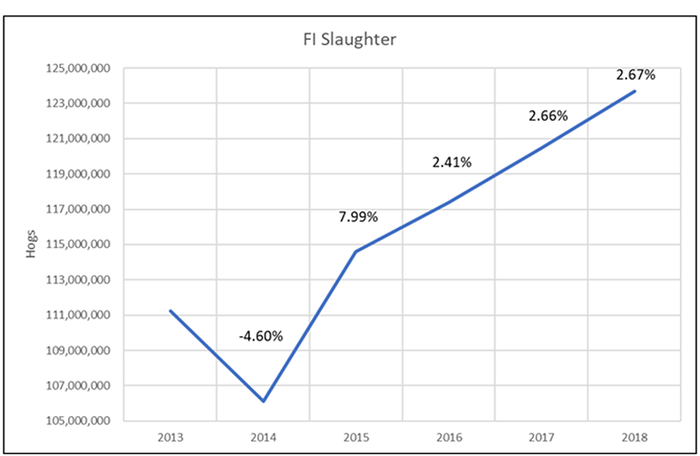

For starters, we have been on a significant roll with production increases in our post-porcine epidemic diarrhea era, rebounding from that event and continuing to surge numbers higher for the past four years and likely for the next couple as well (see chart below). Our harvest numbers so far in 2019 have been running ahead of schedule, adding to the dull thud of prices.

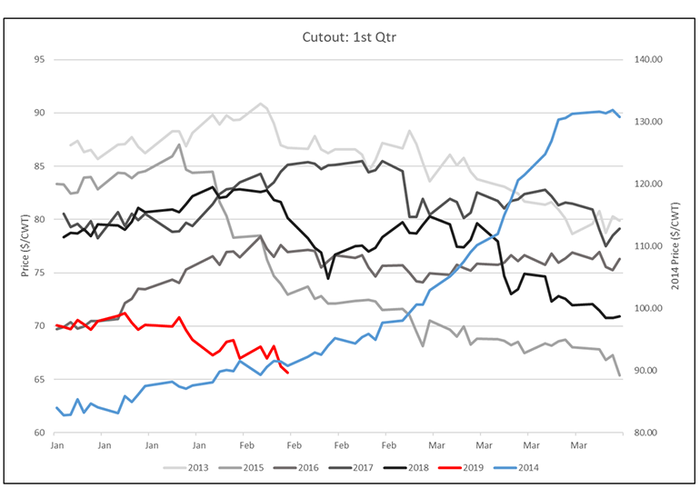

This has allowed processors to keep plants full and keep a lid on market hog prices. Before you blame everything on that ornery, greedy packer — take a look at the cutout chart. The value that the processing community is receiving for product out the door is also under compression. This is not about excessive packer margin, this is about depressed value for pork and the whole supply chain is feeling the pressure. (Note: the 2014 data is charted against the right Y axis to accommodate those values.)

What in the world is going on?

Will Trump and Xi reach an accord? Will we shut down the government again at the end of the week? There is no good way to handicap these things and our economic fate is resting on the impact of items where we have no control. It seems to me that you have to take one of two world views: we are on the cusp of something big breaking and Happy Days are ahead — or — this is going to be a long, drawn-out situation that will get darker before it gets better.

The optimist would cite the ASF stories in China as the biggest thing — ever — that will propel pork prices across the globe. Logical. The pessimist may note that liquidation is underway and could stay that way for a long time.

There are over 40 million pork producers in China. Think of this one as standing outside of an exit after an Ohio State football game and declaring that everyone is leaving, and the stadium will be empty soon. An hour or so later, you would be right. It takes a long time for a large mass to shift and a casual observation is likely insufficient to determine where we are in the liquidation process. Prices in the European Union have been flat and they, too, are looking east for the promise of better pricing. Click here to view an article that references a potential long-term thought process in this scenario, attached is a link that may be of interest.

The bottom line on the whole China-ASF situation, in my opinion, is this. For most of us, it will be the biggest thing to impact the hog industry in our lives. It is impossible to discern when the changes are initiated and exactly how they will play out. All we know right now is we have too much protein on the market to allow profits for the production community. Hope is not a strategy, but it did get Obama elected.

In other news, Japan has announced that classical swine fever (also known as hog cholera) has hit their industry and is impacting production, they have been clear of the disease since 1992. CSF is a death knell for those who export. Japan does not fit this situation with its minimal exports. Unlike ASF, there is a vaccine for CSF. The “problem” is that the blood titers are positive within a vaccinated herd, hence the export impact. This is a situation in Japan, it would be a problem for the United States or Canada.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like