The storm before the calm

Is the recent tumultuous trading behavior on the cusp of being over?

June 21, 2021

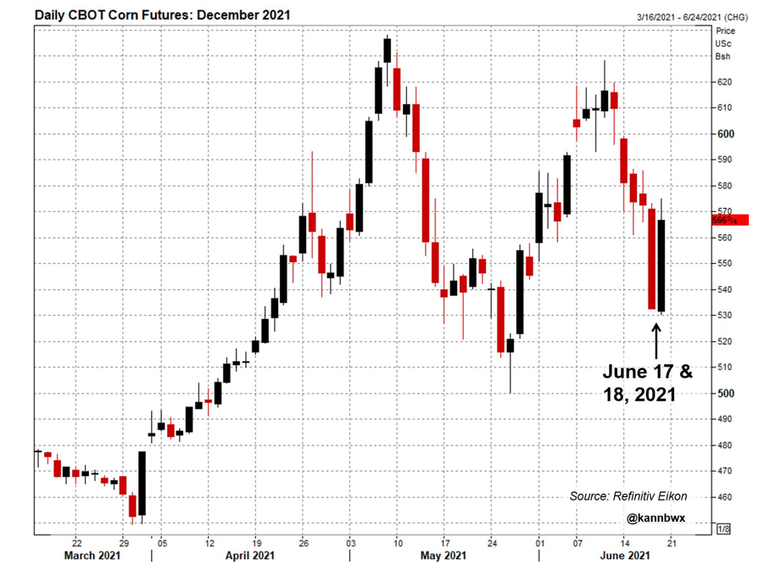

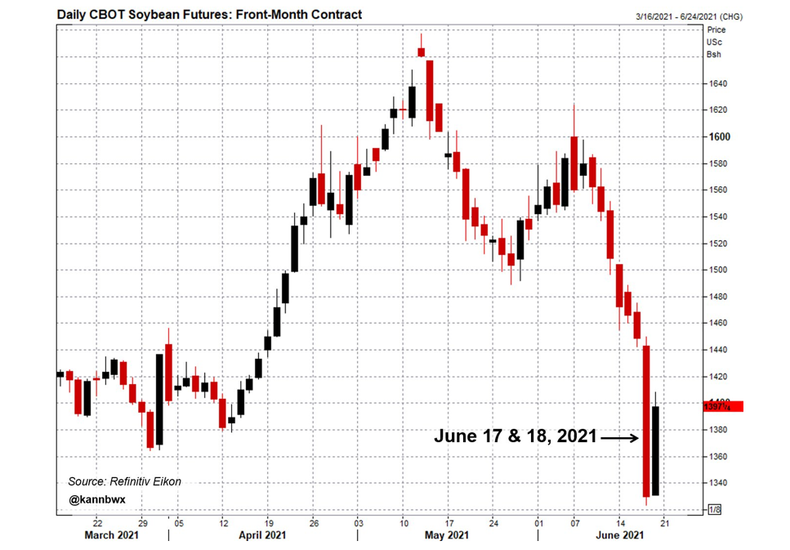

Volatility is nothing new for summer grain markets, but this year it is coming through in a more pronounced fashion as our balance sheets do not have the buffer to tolerate a deviation in production. Price movement has been sharp and severe as seen on the attached charts of corn and soybeans, with last week’s moves representing the spirit of the market – extra volatile. I would like to tell you that this tumultuous trading behavior is on the cusp of being over, but I do not believe this to be the case. These sharp moves apply to both the grain as well as the livestock markets.

Let’s address these markets in some form of logical evaluation of value. First, is the board price of corn justified at today’s levels? In a word, yes. IF we add the 2-3 million more acres that are anticipated to show up on the June 30th stocks and acreage report and IF we experience a moderation of the weather trend and IF demand remains static, then historical data would suggest the price of December corn at harvest will be less than $5.00 per bushel. The premium that is trading in the market is probably justified in the event that one of my capitalized “IF” situations changes.

We are in a critical couple of weeks of trade with the upcoming USDA report coinciding with a crop that will enter a production phase that will demand more moisture to successfully pollinate and produce adequate yield. Our subsoil conditions in the western belt are depleted and offer little reserve if the rains do not fall. Hence, our weather market that will not settle down until the crop is pollinated with reasonable assurances of something other than a production disaster is secured.

Meteorologically, the confidence level of predictions in the two-week-out forecast vary greatly depending on the metric. For instance, predicting wind is relatively easy as the pressure gradients dictate the movement and velocity with relative precision. Temperature follows wind and is dictated by the same forces. Rain, on the other hand, is a combination of art and science as the conjoining of energy and moisture in the atmosphere have to blend into a dance that is tougher to predict. Our prediction models that are published on a routine schedule should not be read with certainty, they are more of assembling of a fuzzy puzzle than a mathematical fact.

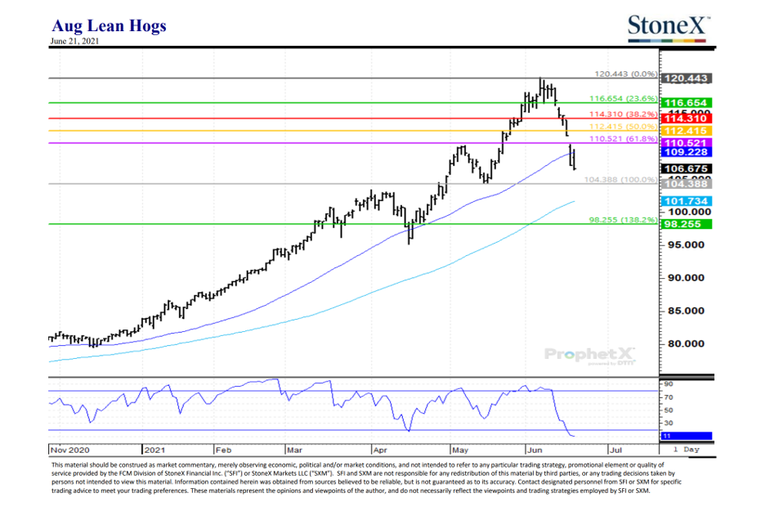

The second question to address is the volatility in the hog market – is it justified and when will it settle down? The contrast between the cash market and the board activity is stark with pigs on a carcass weight basis trading above the cutout. We have been here before, and it has always been an unsustainable situation. I suspect this one will not carry on too much longer before a correction takes place and we return to more routine relationships. The volatility in the livestock markets along with what we are experiencing in the grain market is largely coincidental. The pork producer is caught in the middle of two active markets that have a material impact on their bottom line. Our fall from grace when futures were trading at their highs in the mid-$120s to today’s levels have some fundamental underpinning with domestic supply being sufficient relative to offtake.

Dr. Steve Meyer has been insistent that the price appreciation in the hog market has been a demand-driven item given harvest numbers have not shown any decline or hole. Reports of some cuts getting heavy have compressed the cutout and were likely the catalyst for the recent downturn in value.

And then, of course, we have developments in the happenings (or reports therein) in China. Prices this week have fallen below $13 RMB/Ki, a solid 65% decline from their high and below the calculated breakeven price in the neighborhood of $17 RMB/Ki for the Chinese producer. Whatever flush we may have experienced relative to African swine fever bringing animals to market from the larger scale producers has been added to with the smaller producer segment now unprofitable with a corn/hog ratio compressed to levels that traditionally have represented liquidation.

Brett Stuart, founder and president of Global AgriTrends, our go-to guy in the private sector as it relates to exports, has lowered his expectations of exports given this latest development. Before we assume that the bloom is fully off the rose, remember that we will get a hard reset of supply expectations at the end of the month with the upcoming USDA “Hogs and Pigs” report. Preliminary expectations are for the breeding and marketing herd to both be down a touch (two percent?). We remind readers that the year-over-year comparisons need to be evaluated in consideration to the aberrant numbers during the COVID adjustments of 2020. We are going to be in this pickle for the next few reports until we can compare the released values to year-ago numbers for comparison sake.

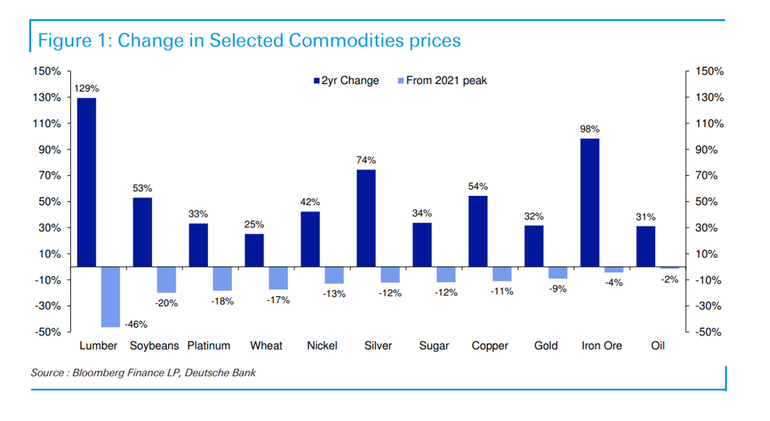

This phenomenon that we are experiencing is not confined to our industry. Attached is a chart that depicts the price movement of several other items with their price movement relative to the pre-COVID scenario and their fall from grace where applicable (think lumber). Somebody slapped the card table and the parcheesi pieces are not in their assigned location.

The bottom line of interpretation amidst all of these gyrations is to not get caught up in the noise. If you are able to secure protection at profitable levels – I like options and the insurance products as my first line of execution – in the throes of volatility then that is a “must” with the significance of the moving parts price relative to your profitability. I suspect it will be later in the summer until both the hog market and the grain market calm down to a level that we would call normal. It has been a good run for pork producers after some dark days. We have healed up several balance sheets; let’s keep them healthy.

Comments in this article are market commentary and are not to be construed as market advice.Trading is risky and not suitable for all individuals. For more information, contact Joseph Kerns.

Sources: Joseph Kerns, Partners for Production Agriculture, who are solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like