Consumers expect April beef, pork prices to simmer down

Latest MDM survey shows Millennial, Gen Z respondents lead in ground pork consumption frequency.

Consumers’ willingness-to-pay decreased for four evaluated retail products – ribeye steak, ground beef, bacon and chicken breast—in March compared to February, while WTP increased for all evaluated Food Service meals, according to the latest Meat Demand Monitor.

The combined beef and pork projected market shares for March are 31% and 21%, respectively at the grocery store and 39% and 16% at the restaurant.

According to Glynn Tonsor, professor in the Department of Agricultural Economics at Kansas State University, while retail demand was lower in March 2023 than in February 2023 for bacon, it improved for pork chops, both month-over-month and over the past two years.

“In March 2023, pork chop demand was above demand in March 2021 but that is not the case for bacon,” says Tonsor.

A three-year comparison of March data shows consumers WTP on dollar per pound basis for pork chops in 2021: $6.73, 2022: $8.29 and 2023: $6.98, while bacon came in at 2021: $5.57, 2022: $7.06 and 2023: $5.40. Between 2021 and 2023, WTP for pork chops increased $0.25, as bacon decreased $0.17.

Launched in February 2020, the MDM project is funded in-part by Beef Checkoff and Pork Checkoff and tracks U.S. consumer preferences, views and demand for meat with separate analysis for retail and food service channels. The monthly survey is conducted online with more than 2,000 respondents reflecting the national population.

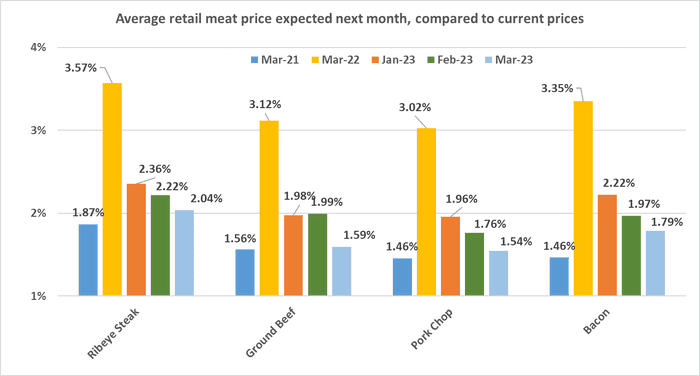

Respondents do expect future retail meat prices to continue to be moderate. In April, residents foresee increases of 2% (or less) in retail ground beef, pork chop and bacon prices with expectations approaching those from March of 2021.

Taste, freshness, price, and safety remain most important when purchasing protein. The importance of environmental impact increased most since February with price declining most in importance.

Respondents indicated that 73%, 49% and 68% consumed breakfast, lunch and dinner at home in March. In March, 15%, 25% and 31% had beef their prior day for breakfast, lunch and dinner. Pork was included in 17%, 11% and 20% of these meals.

In March, 71% of respondents self-declared as regular consumers of products derived from animal products, 11% indicated they are flexitarian/semi-vegetarian, and a combined 11% indicate they are either vegan vegetarian or vegetarian.

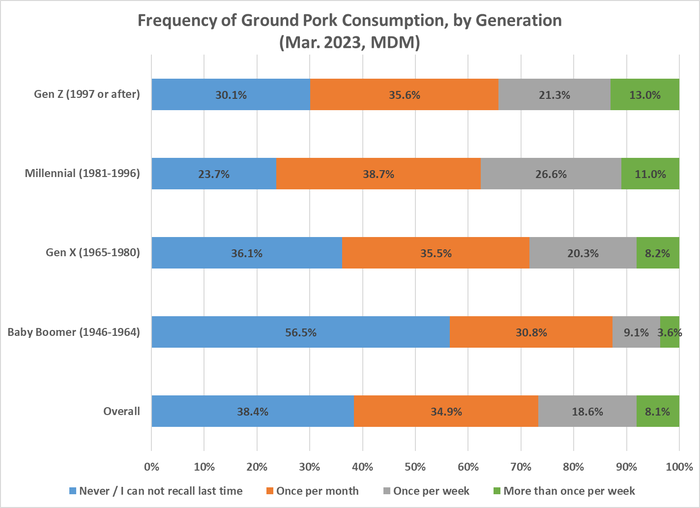

One surprising find in the March MDM survey was the elevated ground pork consumption among the younger generations, says Tonsor. Questioned with “what best describes how you consume ground pork at home,” respondents by generation could choose from one of three responses:

Typically have ground pork as a main, center of plate item.

Typically have ground pork as a meal ingredient.

Vary between having ground pork as a main, center of plate item and a meal ingredient.

More than one-in-three Millennial (1981-1996) and Gen Z (1997 or after) respondents indicated having ground pork at least once per week.

“Younger generations are more likely to have ground pork as a main, center of plate item than older generations,” Tonsor says. “ That said, all consumers (regardless of generation) are most likely to tell us they use ground pork as a meal ingredient.”

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)