Where is the soft, fuzzy feel to the hog market?

Statements of “we have never been here before” are going to be commonplace as we are going to continue to experience record slaughter numbers rolling forward.

June 10, 2019

Water, water everywhere, but nary a drop to drink. This line from an old maritime poem may sum up my observation of the hog market.

We have optimism abounding with the prospect of increased exports based on the Asian African swine fever woes. We are coming into the traditional summertime price appreciation associated with decreased animal marketings. We have recently struck a deal with Mexico. And, U.S. packing capacity has recently outpaced production increases.

These should be happy times for the pork production community and — to be sure — we are profitable as an industry, but something does not feel soft and fuzzy. Our triple-digit summer month futures are in the rear-view mirror and the reality of more pigs and heavier weights has taken the sparkle out of the forward curve.

So, has the proverbial ship sailed and those who did not hedge everything miss the boat? I do not think so, but we may need to amend our expectations to more closely reflect the current reality.

Let’s look at the facts. A quick review of previous numbers levels show we have never experienced a 2.450 million head harvest in June. These statements of “we have never been here before” are going to be commonplace as we are going to continue to experience record slaughter numbers rolling forward. Additionally, the cool weather (which has put a dent in the potential of corn production, but more on that later) has whacked us on two fronts. First, it has thwarted many backyard barbeque plans so far this year and it has provided excellent conditions for animal growth. More production and heavier weights with the tapestry of an indoor-activity environment is not a recipe for success. It is against this backdrop of reluctant profitability that I suggest better days are ahead. We are on the cusp of what I think — think — will be a nice run in the hog market, even if does not fulfill the frothy levels of anticipation that we saw back in March.

Consider this: Even though we are experiencing record kill levels in June, our animal runs will decrease as we get deeper into the summer. That should help. Our export sales have been more impressive than the shipments over the past few months, the manifestation of those sales in the form of product moving off our shores and, perhaps more importantly, not being availed to the domestic market will move us up the demand curve for pricing discovery.

This is good news. Contracting animal marketings combined with contracting product availability should give us another opportunity to experience higher values. Some of this premium is built into the futures market, I suspect there is more blood left to squeeze out of the turnip. One positive that has recently evidenced is a slight uptick in Chinese prices. It is not to the magnitude of what we experienced in the first quarter of this year, but it is a widely-watched data point that will be necessary to appreciate if we are to feel the promise of higher markets. The commitment by several packing facilities to supply the new demand via plant alterations is something that can’t be ignored, we are just having to wait longer than I thought to see the higher prices.

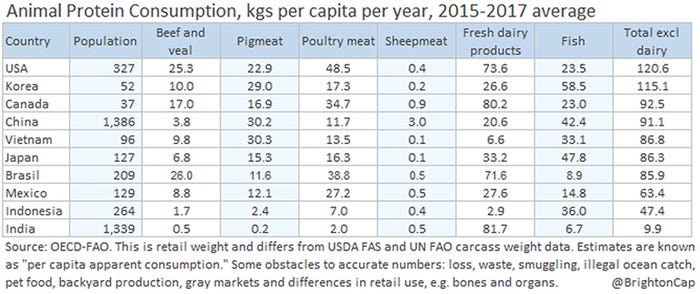

Finally, the attached table pulled from my Twitter feed may provide some hope on a couple of fronts. The quantity of product consumed by the United States leads the world, the growth in global economic prosperity should move the rest of the world closer to our degree of consumption and any growth in high population countries offers huge disappearance potential. I like our future.

The crop situation is going to be fascinating all year. I shared earlier that we have a situation in the hog market where “we have never been here before.” A similar situation is occurring in the grain markets. We are almost assuredly going to have more prevent-planting acres than ever before, perhaps by a magnitude of three times. The USDA will show us two important data points this week. First, the report out Monday afternoon will show both planting progress as well as our initial condition report of the year. The last week provided favorable planting conditions west of the Mississippi River and should be reflected in the report, the physical appearance of the crop — even in the areas that were able to get the bulk of the crop planted — is not fantastic. Stands, height and color could all stand some improvement, but the weather forecast largely returns to our cooler and wetter pattern later in the week.

The Tuesday report is the one I think will be most interesting. How the USDA deals with the pronounced delay in planting as it reflects to yield prospects and acreage is a monumental task. Whatever numbers we get, I anticipate the USDA will be more conservative than the commercial trade and we will quickly go back to trading weather forecasts. This report does have the potential to create some wild swings as the gross numbers reported will likely not jibe with traders’ expectations. If the Big Money is triggered, we could see some impressive price action. We have a gap in the charts at $4.05ish range in the July contract. That value may act as a magnet if we get a report with negative price implications.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like