Take advantage of forward hog margin opportunities

Historical relative weakness in cash hog prices as measured by the “gross” packer margin has been a troublesome issue for producers — particularly those with packer contracts not based on cutout prices.

CME December Lean Hog futures have recently risen over $9 per hundredweight from the lows in August and September to the previous summer highs in late-June above $65 per hundredweight. Concerns of increased pork production from larger hog inventories have been quelled to some degree by indications of strong demand in both domestic and export channels. In addition, the startup of two new hog processing plants in Iowa and Michigan appears to have helped cash hog prices recover relative to pork cutout values.

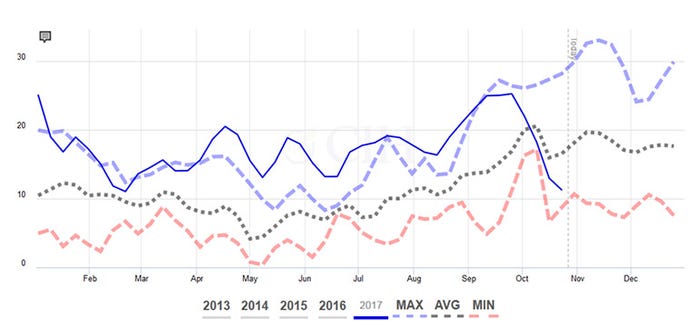

Historical relative weakness in cash hog prices as measured by the “gross” packer margin, or simply the spread between the 602 Pork Cutout and the 203 National Base Cash Price reported by USDA has been a troublesome issue for producers — particularly those with packer contracts not based on cutout prices. While this relationship does not reflect premiums received by producers nor other components of a packer’s actual margin, such as labor costs, drop credits, etc., this relationship has quickly moved from a five-year seasonal high to nearly a five-year seasonal low following strength in cash hog prices relative to cutout values since late-September (see Figure 1.)

Figure 1: (602 pork cutout – 203 national base cash price: five-year range)

For many producers, there has not been much incentive to hedge off of the board due to weak margins, although that now appears to be changing. Given recent strength in both cash hog prices and CME hog futures, forward margin opportunities have returned for hog producers. Figure 2 shows the relationship between June Lean Hog prices and the 602 pork cutout value as reported by the USDA. Forward futures have experienced significant gains recently on cutout, with the June contract moving from over a $28 per hundredweight discount back in July to a $5 premium recently relative to the 602 pork cutout value.

Figure 2: (June 2018 CME Lean Hog Futures – 602 pork cutout: three-year range)

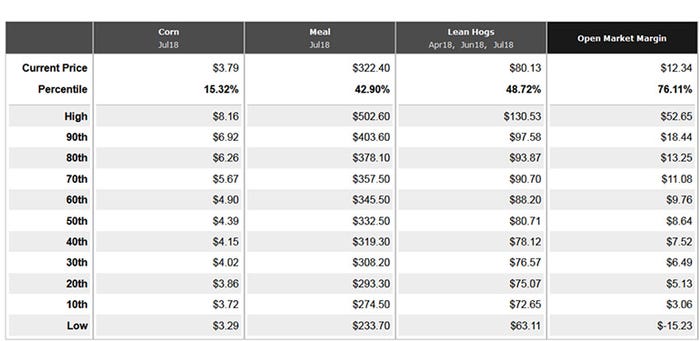

Meanwhile, looking at forward feed cost projections for a model Midwest hog operation, second quarter 2018 margins currently appear attractive from a historical perspective, as they are above the 70th percentile of the previous 10 years. At about $12.34 per hundredweight, the second quarter margin projection is also at the highest level for this point in the year since 2015, and just shy of the high of $16.07 per hundredweight in 2016. (See Figure 3.)

Figure 3: Second quarter 2018 projected hog margins vs. three-year range

While demand has certainly helped to support the market amidst record pork production, many producers continue to express concern over the market’s ability to absorb additional supply, given trade uncertainties, ongoing expansion and competition from other animal proteins. At the same time, producers would also like to participate in any further margin improvements through the remainder of this year into 2018 if hog prices manage to build on recent strength.

One way to potentially satisfy both concerns would be to manage forward hog values by selling into the current price strength, while retaining upside flexibility for potential price increases over time. By combining a forward packer sale or selling a deferred futures contract on the board with the purchase of a call option, hog producers may take advantage of a couple current opportunities. Not only are hog prices and forward margins attractive relative to recent history, call options just above the market are priced attractively relative to put options an equal distance away from current prices below the market.

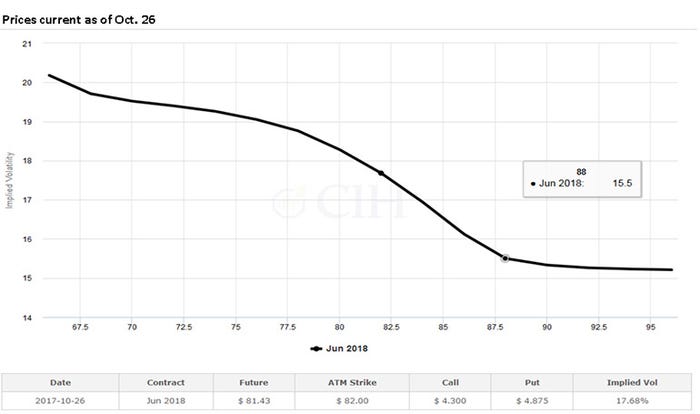

Figure 4 shows the volatility skew of June 2018 CME Lean Hog options. At 15.5%, the implied volatility of the June $88 strike price call is well below that of the $74 put, which is over 19% and further away from the current futures price of $81.45 per hundredweight. The call is also cheaper at a cost of $1.65 than the $74 put’s current premium of $1.85, and allows a producer to retain unlimited upside participation to higher prices should hogs move up significantly over the medium to longer term. In addition, the cost is not so high that it takes away measurably from the current margin opportunity should a producer commit to a fixed sale at existing price levels.

Figure 4: June 2018 CME lean hog implied volatility skew

Should producers wish to protect forward hog values, they should also take care to assure that forward feed costs are likewise covered to preserve deferred margin opportunities. Corn in particular is very cheap from a historical context, at the 15th percentile of the past decade (see Figure 5). In addition, corn option premiums are also very attractive to set maximum prices above the market, given the historically low level of corn option implied volatility at present.

Figure 5: Second quarter 2018 hog production margin statistics

If you’d like more information about how to protect forward hog margins, and how options can help you maintain the flexibility you need to navigate an increasingly uncertain hog margin landscape, please call CIH at 866-299-9333.

There is a risk of loss in futures and options trading. Past performance is not indicative of future results. Copyright © 2017 Commodity & Ingredient Hedging, LLC. All rights reserved.

About the Author(s)

You May Also Like