Shell games and economic reality

Let’s get real: we are not going to be the first choice for pork origination in China given our trade spat.

May 13, 2019

The Chinese delegation has returned home in what is being described as an impasse, not a breakdown. Further talks on queue. Some in the pork production industry are getting a bit antsy to get a deal complete before they breathe easier. I am not so sure this is necessary. I believe the economic reality of the pork complex is already witnessing the shift in demand from China, you may have to just look around a bit more to see the evidence.

Let’s frame this one a bit and look for the smoke that may be indicative of a fire. First, a rise of pork prices in China may not be our sentinel marker of potential import demand. The attached chart shows the price of pork in China represented in their currency. Note the tight price relationship before the blowup of African swine fever in China created huge discrepancies. Lately, prices have consolidated at near 16 RMB per kilogram. When you do the math and conversions and freight considerations, 16 RMB per kilogram equates to roughly $125 per carcass hundredweight in the United States.

Could we live with prices remaining here and that economic incentive trickling back to our shores? You bet. We do not necessarily have to see the price of pork in China move higher to have a positive impact in our markets, we just need time for the system to trickle through and adjust.

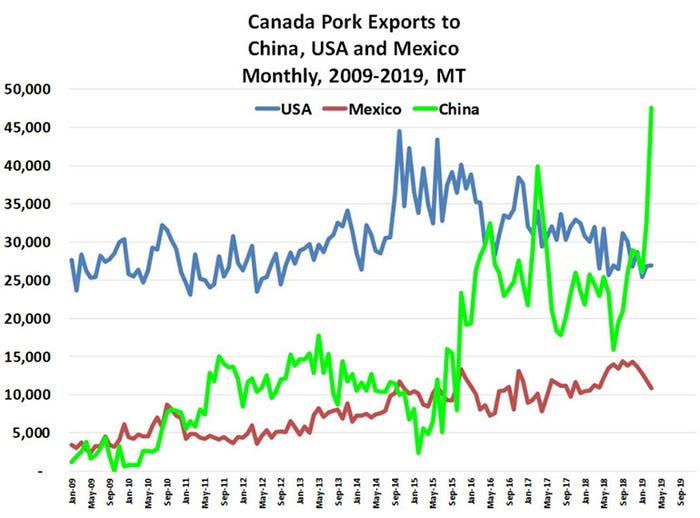

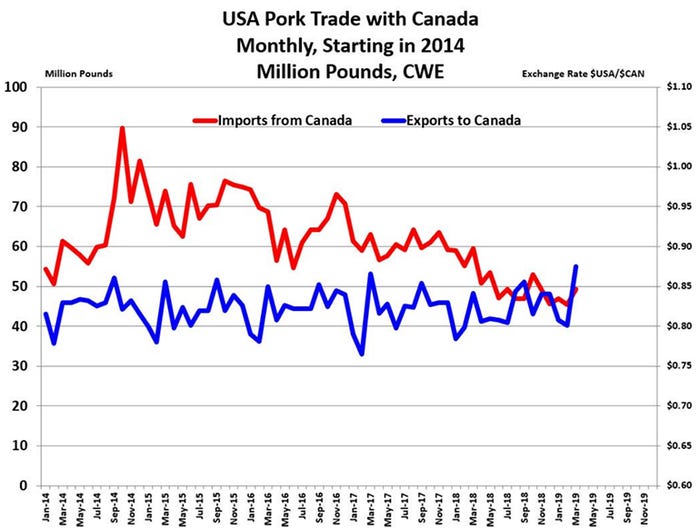

The second area where I find hope is the trade relationship between Canada and China. Let’s get real: we are not going to be the first choice for pork origination in China given our trade spat. Canada finds itself in a unique situation, too, with some friction over diplomatic issues — in general, the Canadians are a pretty lovable populace that is not a threat to world peace. Note on the charts below what their recent shipments to China have done (green line) — straight up. These changes of product flow do not occur in a vacuum. While Canada has been supplying more product to China, they have been shipping less to the rest of the world, the United States included. This is just a matter of moving a finite quantity of product to its highest value of demand, the tariffs are just distorting the linear flow of product. Where there is smoke, there is likely fire. Count on it.

Finally, our esteemed economist, Steve Meyer, has rerun his model and shared that today’s summer values are near where they should trade in the absence of a pronounced uptick in exports off our shores. I believe we have largely discounted any trade spike into the futures market, the cash index is currently trading roughly on par with the June contract. We do not have a lot of anticipated positive news priced into futures, seems to me that the surprise could come on the upside of the market.

We had a report from the USDA out on Friday; not a lot of good news for would-be bulls. The USDA did not adjust their yield model in consideration of the late planting. This created a heavy balance sheet if you take the corn numbers at face value. It seems to me that this one will largely play out over the next couple of weeks when we discover whether the weather moderates long enough to get the crop in the ground and assess just how much acreage is lost to preventive planting. The farmer has every motivation to drag his feet given that prevent-plant economics are more favorable than putting the crop in the ground. In the absence of a summer drought, the die has been seemingly cast for the corn balance sheet. It is hard to envision a summer drought right now given the long-term weather prospects and the abundant soil moisture in the Midwest. Harvest prospects for South America were bumped up; we have enough grain in the United States and across the world.

The bean balance sheet was equally as ominous, stopping just short of projecting a 1-billion-bushel carryout for next year. A cut in exports fell to the bottom line and was likely a fair indication of sales on the books that will not result in shipments. In fact, calculations in consideration of insurance provide little to no motivation for the soybean farmer to sell anything additional at this time — his insurance provisions cover him from this point down which adds no incentive for additional sales. The impact of ASF decreasing demand for inputs will be most bluntly felt in the soy complex, I suspect we are in the throes of a longer downturn in the bean market.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like