Reading into mixed messages that crisis is over

Higher demand or lower supply are the only ways to improve prices. I don't think demand will bounce back soon so that leaves just one option.

July 13, 2020

I and just about everyone else in the pork industry were eagerly or dreadfully awaiting USDA's June Hogs and Pigs Report. It was to be the first piece of objective inventory data since the entire COVID-19 situation developed in March. Win, lose or draw this report would provide us a fresh benchmark from which to work.

Hardly anyone likes the new benchmark. Nor should they.

That is not an indictment of the USDA. The quarterly Hogs and Pigs Report is a big job in normal times. Throw in a worldwide pandemic and it becomes monumental. Response rate is always an issue. Accuracy of survey responses, especially about the weight categories, is always a question. A tough job got tougher and we may never have data that verify or refute the reports. I am not quibbling with USDA's numbers. I just don't like what they mean for the future of hog producers.

Converting a stock variable (i.e. hog inventory) to a flow variable (i.e. slaughter) depends on accurate rates of change (i.e. pig survival, growth rates). Anyone want to offer a dependable number for either of those last two since April 1? I don't. "Normal" pig survival is difficult enough, but 2020 pig survival is almost impossible to estimate given slaughter interruptions, finishing capacity restrictions, backed up hogs, "hold" diets, differences in disposal costs across weights, etc. Same with growth rates. Those two facts mean that we won't even be able to compare actual slaughter retrospectively to inventories to see if the inventories were or were not correct.

I do not use USDA's weight category data. In fact, I don't use their litter size or farrowings, actual or intended, either. I do use their breeding herd number and I do use all of their numbers as checks against my model. My model says there are plenty of pigs, too. Not quite as many as USDA found, but nearly so.

Here is the rub: Hog slaughter the rest of this year and into early 2021 will not be determined by either USDA's hog numbers or mine. It will be determined by the number of shackle spaces that are operable.

While larger than it once was, that figure is still woefully short of hog numbers and will likely remain so.

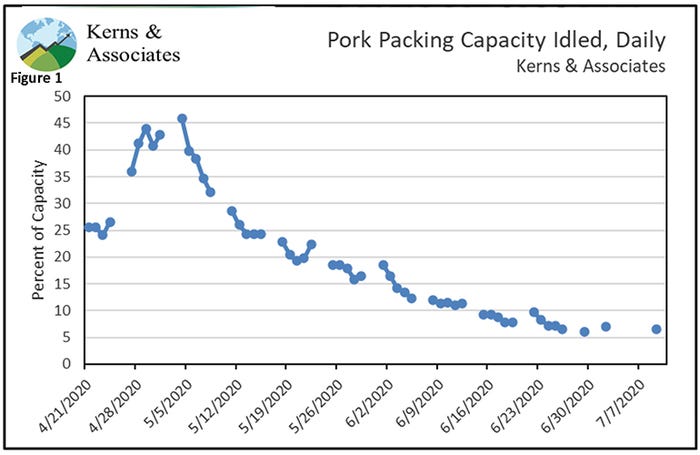

Figure 1 shows the results of our ongoing monitoring of idled packing capacity. The situation is not nearly as dire as it was in early May when nine plants were closed and nearly 40% of our capacity was not operating. And note that the figures for the past two weeks (7.1% and 6.6%, respectively) include one plant that was down for re-tooling so the true "we can't operate" number is down to 5% to 5.5%. But that isn't zero and taking out 5% of our barrow-gilt slaughter capacity means we can only harvest 2.621 million per week on 5.4 workdays.

The sector can still possibly handle 2.8 million but virtually every plant would have to run at max on weekdays and on Saturday to get there. It might happen once or twice, but I would not bet the farm about it being a frequent occurrence.

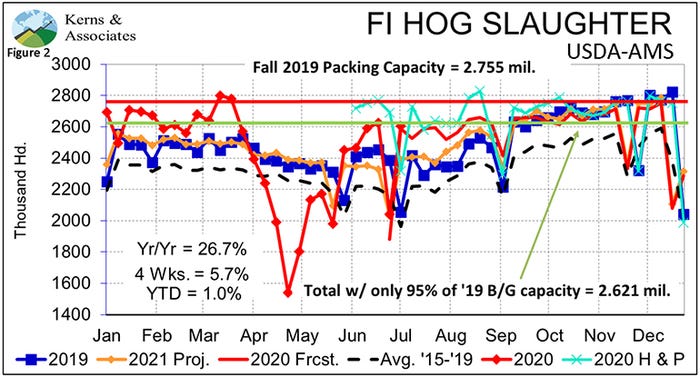

Figure 2 shows the combination of the capacity limitation and forecast slaughter. Note that the aqua-colored line is based on USDA's year-on-year change in various weight categories and year-ago slaughter for a given week. Just how are those numbers going to fit through 2.621 million normal shackles per week? Answer: They're not.

If USDA's June 1 180-plus inventory of 14.687 million was accurate, 917,000 of them have already been left on farms instead of being processed. If all of USDA's weight category inventories are accurate, that number grows to 1.631 million by the end of August, is basically flat through September and then grows by another 922,000 in the fourth quarter. Total backed up from June through year-end: 2.5 million.

And that is comparing USDA's fourth quarter numbers to my slaughter forecasts (red smooth line) that get very, very optimistic in November and December, requiring about 480,000 per day on weekdays and 350,000 on Saturday. I'm not at all confident the sector can do that and if it can't, the backed up number gets even larger.

Several pieces of information are leading some to claim that the "crisis" is either over or headed to a resolution. All are encouraging until you look at the actual numbers. Consider:

Packers are buying open market pigs again. This is undoubtedly true, but it appears to me that they are hardly chasing them at a robust $29.99 national negotiated weighted average on Friday. Against a cutout of $68.95. Does that sound like someone chasing a "short" hog supply? This is likely more a function of packers' catching up on their own supply and the supply of their core suppliers and now turning to the hogs from other producers.

Weights are down sharply from just a few weeks ago and are even below one year ago. That's what happens when you feed them to not gain weight. As colleague Dave Delaney calls it "Producers are current by weight."

There have been few, if any, reports of large destructions of market weight pigs since early on and the state-sponsored disposal facilities have hardly been used. True. Both of those are good things. But those hogs had to go somewhere and even accounting for gifts, loads to about every odd state you can think of, etc., we have not "disappeared" enough hogs to suggest that this fact means there are no backed up hogs in barns.

There have been few reports of euthanization of young pigs. Also true — but this is something that is rarely talked about and on-farm disposal of small pigs is far easier than is disposing of market-weight animals, so the whole process is easier to keep confidential. And I would say this point is actually a problem. Figure 2 shows that the packing sector can't handle all of the pigs that apparently reached weaning in the March-to-May quarter. September-to-November slaughter, and by extension December is problematic due to this point.

I do not like being the bearer of negative information. I'd rather be singing "Don't Worry, Be Happy." Actually, I wouldn't rather be singing that dreadful song, but I'd rather be sending that message. Unfortunately, I can't. The industry has more pigs than the packing sector can handle, and spot hog prices will remain "indeterminate" for the foreseeable future. Packers can pay $30 or $10 and get the same number of pigs.

Higher demand or lower supply are the only ways to improve prices. I don't think demand will bounce back soon so that leaves just one option. And it is a painful one to say the least.

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like