With pork demand getting all the attention, don’t forget supply

Export demand and the geopolitical environment provide the market with volatility and market analysts with fodder.

August 30, 2019

Much of the attention surrounding hog markets has focused on global demand over the past year, and with good reason. The United States lifted Mexican steel and aluminum tariffs in May. In turn, retaliatory tariffs on pork were removed in the highest volume pork export market for U.S. pork producers. Additionally, President Donald Trump at the recent G7 summit announced a trade agreement with Japan. Once implemented, this will place the United States back on a level playing field with international competitors in its highest value pork export market.

Meanwhile, African swine fever has destroyed, by some estimates, upwards of 30% of the total pig herd in China. This decrease in supply has created opportunity for exporting countries to fill the void in China, the world’s largest pork consumer. While U.S. producers face steep retaliatory tariffs in the Chinese market due to the ongoing trade war, this pork shortage should provide opportunities for back-filling other partner country demand needs, so the logic goes.

Given the seemingly bullish demand developments, why have lean hog futures dropped since their highs in April and come under more pressure as of late? It’s appropriate to look back at the oft forgotten other half of the economic equation: supply.

U.S. protein production creates competitive retail case

The expansion that the U.S. pork industry has embarked upon since the porcine epidemic diarrhea virus crisis in 2014 has led to five straight years of record pork production. The USDA estimates 2020 production will set another record at 28.4 billion pounds. Total slaughter this year should top 130 million head. The average U.S. consumer’s pork consumption patterns have changed over time as bacon has become a staple in new menu items, but per capita consumption of pork has largely been stagnant since the early 1980s.

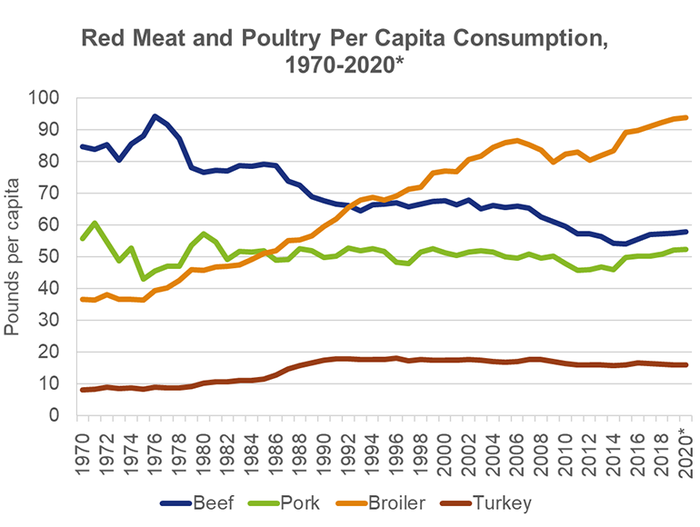

Often lost in the discussion of pork market forces is pressure exerted on American consumers from increased production of other animal proteins, as well. According to the USDA, total red meat and poultry production will be record large in 2019 and again in 2020. While beef and turkey per capita consumption have largely flatlined in recent years, chicken meat consumption has skyrocketed over the past four decades (see Figure 1). Competition in the retail meat case from other proteins weighs on the pork complex. The fresh beef and broiler complexes have increased at a slower rate through the first seven months of the year than pork retail prices.

A closer look at the pork carcass cutout

The CME lean hog index takes a weighted average for two consecutive weekdays for negotiated, swine or pork market formula, and negotiated formula hogs according to the National Daily Direct Hog Prior Day Report-Slaughtered Swine released by the USDA. As more hogs are priced off the cutout, the cutout in turn plays a larger role in the lean hog futures price. It is important to understand how it is constructed and what primals are driving changes to its value.

Mandatory price reporting of wholesale pork began in January 2013. The USDA pork carcass cutout is computed daily and provides an estimate of the value of a 205-pound hog carcass based upon current wholesale prices. The largest component of the calculation is the loin (25.23%), followed by hams (24.68%) and bellies (16.22%).

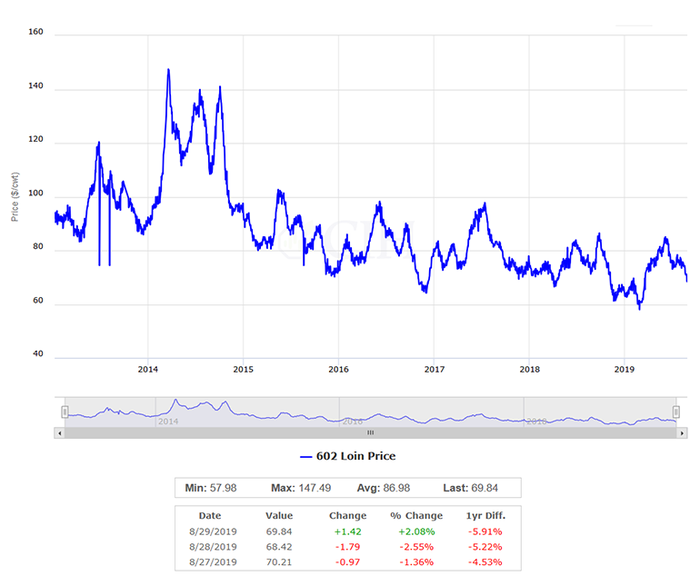

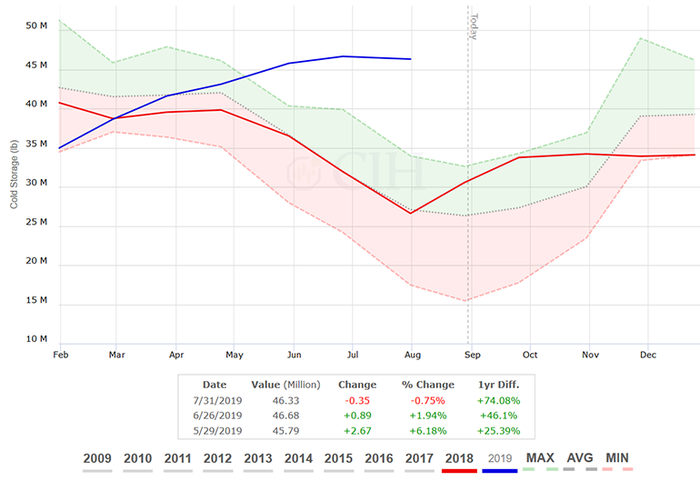

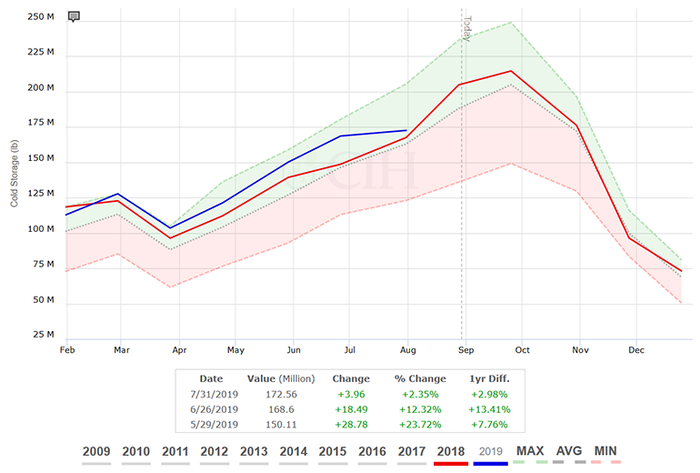

We typically observe a peak rise in price heading into the summer grilling season as demand picks up and production begins to wane in the loin primal. Over the past several years, the loin’s price movement has been largely subdued. Throughout the majority of 2019, the weekly loin primal value has lagged previous years’ levels. Heavier carcass weights and higher slaughter counts have pressured the primal, leading to new lows since mandatory reporting began (see Figure 2). USDA also reported end-of-July loin stocks in cold storage at a record high for July 31 since records began in 1960 (see Figure 3).

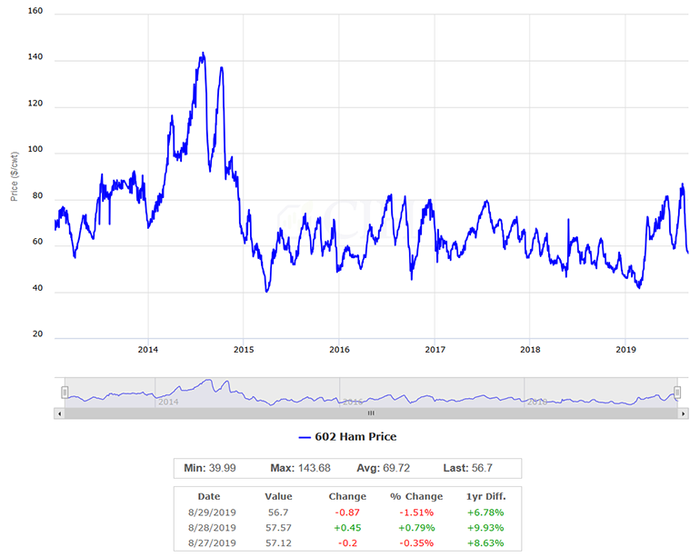

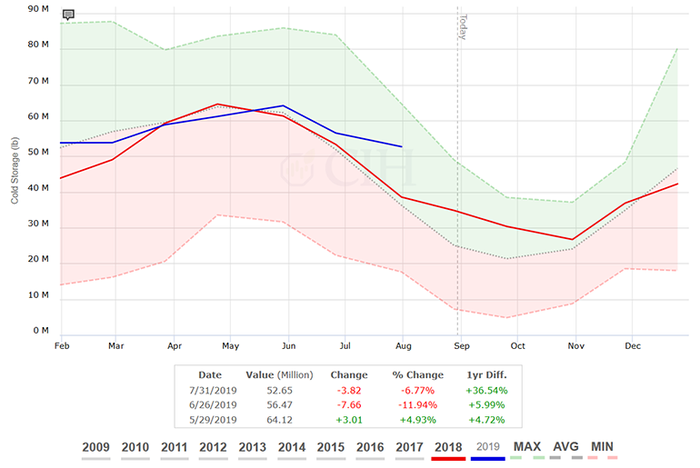

The ham primal, which accounts for the second largest share of the overall cutout, has had its share of volatility over the past year. Mexico is the largest market for U.S. pork exports, the lion’s share of which is chilled bone-in hams and shoulders. Up until May, these products faced a 20% tariff in the lucrative Mexican market. This, in turn, weighed on the carcass cutout in general and the ham primal in particular. The trade barrier caused ham stocks to soar to record levels earlier this year for the end of February timeframe. Hams hit a low of $59.64 per hundredweight heading into Independence Day before gaining $25 per hundredweight by the end of July.

The ham primal continues to be pressured as the industry looks for the Mexican export market to fully recover to pre-tariff levels, recently dropping back below the July low.

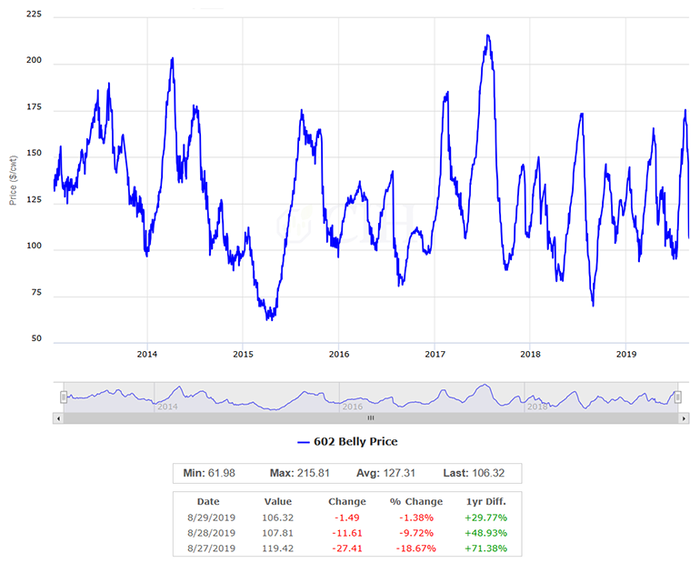

The third largest component, and the primal that has provided the most volatility to the cutout in recent years, is the belly. Despite record large pork belly production, belly stocks have remained largely in line with historical norms and relatively current. Bacon demand in the retail space has held up well — July 2019 bacon retail prices averaged $5.60 per pound, the third highest July price level over the past decade. As the popularity of bacon continues to grow, the ebb and flow of the belly primal has been the main driver of cutout movements.

Outlook

U.S. pork production is poised to grow by 5.5% in the fourth quarter and another 2.8% in 2020, according to the latest World Agricultural Supply and Demand Estimates report. Official export data are currently available through June 2019, which indicates pork exports are 2% lower than 2018. In order to achieve USDA projected export levels, exports must increase significantly between now and the end of the year.

A new quarterly hogs and pigs report will be released at the end of the month and if recent trends continue, we can expect to see significant improvements in litter rates contributing to a growing herd. As we move into the cooler months of fall, domestic supply tends to become more of a headwind and weigh on cash markets.

First quarter through third quarter margins next year exceed the 70th percentile of profitability over the past decade. While they lag the stronger profitability projected earlier this year, these levels may fit into some operations’ risk management strategy. Although the supply side looks to remain cumbersome for the foreseeable future, opportunities may present themselves ahead of time to protect favorable margins. For example, it was possible back in April to protect margins above the 90th percentile for the fourth quarter 2019 and throughout the majority of 2020. It is important to be ready to strike when the iron is hot and take advantage of favorable market opportunities that fit into your operation’s profitability goals.

Export demand and the geopolitical environment provide the market with volatility and market analysts with fodder. It is exciting to discuss bullish opportunities, but it is also necessary to recognize hard realities of the significant amount of protein we already have, and more heading our way. Given strong margins in deferred periods, producers may choose hedging strategies that would still allow for unlimited upside potential while retaining protection from lower price levels should the promising demand outlook change.

There is a risk of loss in futures trading. Past performance is not indicative of future results.

Source: Dustin Baker, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)