September's Hogs and Pigs report implied hog slaughter will be up 3% from last year’s record and that it will increase another 3% or so in 2018. Either hog slaughter will need to be higher than the inventory implies, or slaughter weights will need to increase, or both. It is likely weights will increase.

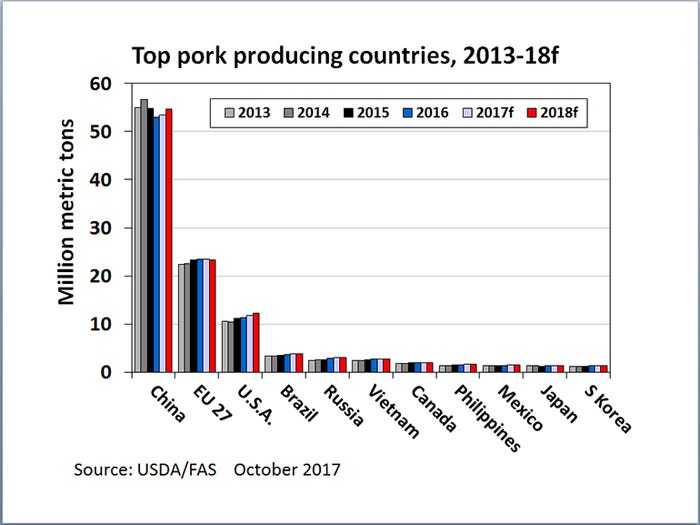

Twice each year the USDA’s Foreign Agricultural Service updates their estimates of world meat production and trade. Their October numbers predict world pork production will be up 1.0% this year and up 1.8% in 2018. Except for the European Union and Japan, major pork-producing countries are expanding production.

USDA/FAS is predicting that U.S. pork production will be up 3.6% this year and up 4.0% next year. They think Chinese pork production will be up 1.0% this year and up 2.3% next year. EU pork production is expected to be down 0.5% this year and down 0.2% next. Canadian pork production is forecast to be up 2.4% this year and up 2.0% next year.

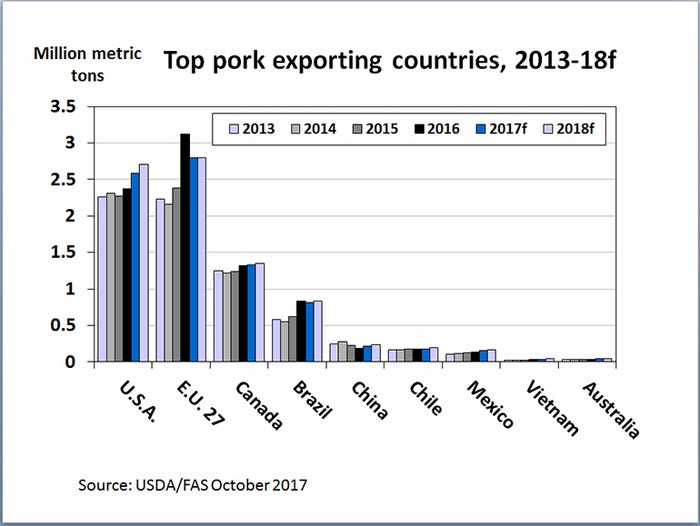

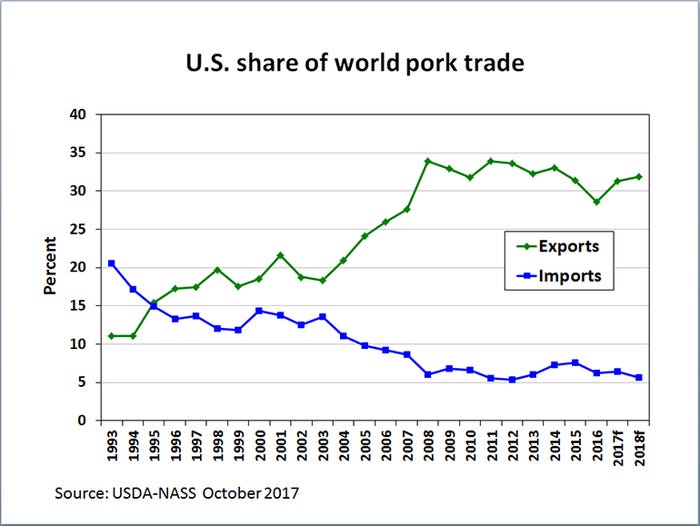

FAS expects world pork exports to be down 0.6% this year, but up 2.6% in 2018. U.S. pork exports are predicted to be up 8.9% this year and up 4.5% next year. They expect EU pork exports to be down 11.8% this year and unchanged next. The forecast is for Canadian pork exports to be up 0.8% this year and up 1.5% next, with Brazilian pork exports down 2.6% this year and up 2.5% next.

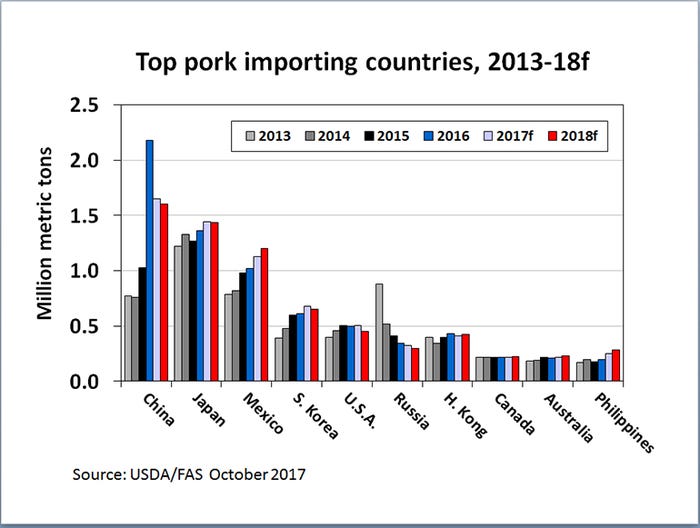

U.S. pork imports will be down 1.2% this year and up 2.1% in 2018 according to the FAS. In addition, the world’s largest pork importer, China, is expected to be down 24.3% this year and down 3.0% next year. FAS predicts Canadian pork imports will be up 2.3% this year and up 2.3% next. Mexican pork imports are expected to continue to increase.

U.S. live hog imports are expected to total 5.632 million head this year, down 0.4% from 2016; but then up 1.2% in 2018 with 99% of these hogs coming from Canada.

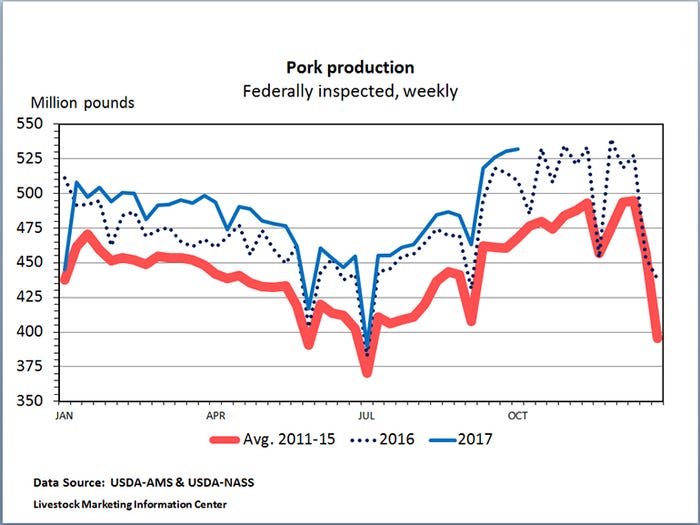

Lots of hogs and two new slaughter plants mean hog slaughter keeps setting records. Prior to this fall, the record daily kill was 448,608 hogs on Dec. 12, 2016. Preliminary data say that four times last week packers slaughtered 463,000 hogs in a single day. Daily slaughter will set more records as the new plants continue to ramp up.

Last year, pork production totaled a record 24.941 billion pounds. USDA is predicting that this year’s pork production will be 3.5% higher and that domestic pork production will increase another 4.0% in 2018.

The September Hogs and Pigs report implied 2017 hog slaughter will be up 3% from last year’s record and that it will increase another 3% or so in 2018. Either hog slaughter will need to come in a bit higher than the inventory implies, or slaughter weights will need to increase, or both. It is likely weights will increase.

Since the U.S. population increases by less than 1% per year, a lot of the extra pork coming out of packing plants will need to go into exports. Rising supply per person typically means falling prices. USDA has forecast that per capita pork disappearance will increase 0.3 pounds this year and then increase another 1.1 pounds in 2018.

Pork exports are doing well this year. Through August, 14 of the top 18 foreign destinations for U.S. pork had bought more than during January-August 2016. The only major declines were in exports to China and Hong Kong.

Through August, U.S. pork production was up (453.8 million pounds or 2.8%) compared to a year earlier; U.S. pork exports were up (298.1 million pounds or 8.9%); and U.S. pork imports were up (5.7 million pounds or 0.8%) compared to a year earlier. That combination means the net change in the domestic available pork supply was up 161.4 million pounds or 1.2%.

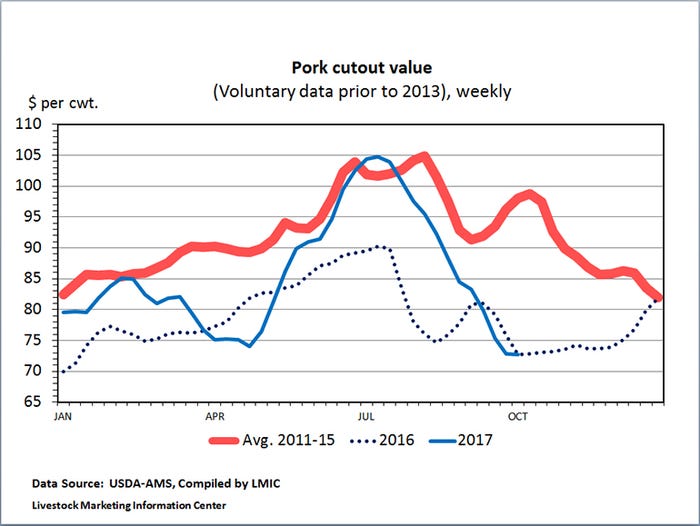

The national average negotiated base carcass price of hogs was $61.55 per hundredweight at the start of September and $47.95 per hundredweight at the end, a drop of 22%. The pork cutout value fell 12% during the month. Steadily increasing hog slaughter was the primary cause. The price decline was likely hastened by slow pork movement at retail. The average retail price of pork was $3.985 per pound in September. That was up 5 cents from August, up 15.2 cents from July, up 19.6 cents from September 2016, and the highest for any month since January 2015. It is difficult to speed pork movement when consumer prices are rising.

USDA’s October World Ag Supply and Demand Estimates increased estimated 2017 corn production slightly, but left the corn price forecast unchanged. USDA expects the 2017-18 marketing year farm price of corn to average $3.20 per bushel, give or take 40 cents.

Domestic meat demand is likely to continue strong. Consumer sentiment is at a 13-year high. The Dow Jones Industrial Average, the S&P 500 and the NASDAQ were all at record levels on Friday. A strong economy typically translates into with strong meat demand.

USDA will release the Livestock Slaughter report for September on Thursday and the October Cattle on Feed report on Friday of this week. Based on preliminary data, it looks like September hog slaughter was up 1.0% from a year earlier, despite one fewer week day than in September 2016. The number of cattle on feed has been above the year-ago level every month this year.

About the Author(s)

You May Also Like