Hindered by retaliatory duties in China and Mexico, the United States was the only major exporter to ship less pork in the first half of 2019.

September 11, 2019

The world’s leading exporters of pork and pork variety meat shipped 8% more in the first half of 2019 compared to the same period last year. A surge in European pork shipments to China/Hong Kong accounted for most of this growth, as China’s African swine fever-related pork deficit has intensified. The European Union saw a 13% increase in total first-half exports to 1.95 million metric tons, while Brazil’s exports increased by 25% to 342,000 mt. Canada’s first-half exports edged 2% higher to 598,000 mt, but China was its only growth driver and Canadian pork lost access to China near the end of June. Chile’s exports increased 12% to 110,250 mt, with growth also driven by China.

Hindered by retaliatory duties in China and Mexico, the United States was the only major exporter to ship less pork in the first half of 2019, with exports falling 2% in volume to 1.25 million mt. But with Mexico’s 20% retaliatory duty being lifted in late May, U.S. exports finished the first half on a strong note as June shipments increased 11% year-over-year to 212,887 mt (a full summary of first-half U.S. exports is available online). U.S. exports gained even more momentum in July, setting new monthly records for both volume (233,242 mt, up 32% year-over-year) and value ($623.3 million, up 34%). A full July summary can be found here.

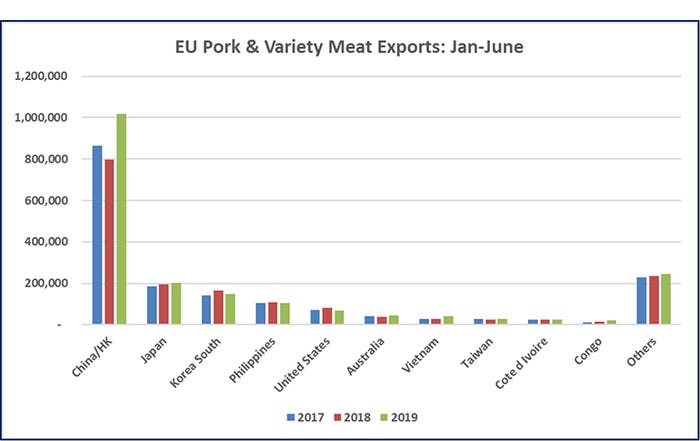

The EU’s first-half exports to China/Hong Kong climbed 28% from a year ago to 1.02 million mt, while exports to the rest of the world (930,713 mt, up 1%) were relatively steady with 2018’s pace. The European industry began to capitalize on improved access through the EU-Japan Economic Partnership Agreement, as exports to Japan increased 4% to 203,141 mt. EU exports also trended higher year-over-year to Australia (45,786 mt, up 17%), Vietnam (41,713 mt, up 39%) and Taiwan (28,057 mt, up 11%), while exports were lower to South Korea (147,106 mt, down 10%), the United States (67,522 mt, down 17%), Singapore (17,633 mt, down 11%) and South Africa (15,192 mt, down 15%).

The European industry also received a lift from China’s large imports of pig fat, which surged to 56,000 mt in the first half of 2019. This was up from just 4,400 mt in the same period last year and well above the 38,054 mt imported in the first half of 2017. The EU accounted for 79% (44,411 mt) of China’s fat imports while Canada (7,858 mt) was the other major supplier. When Russia closed to European pork in January 2014, one of the biggest hits was to pig fat. Although first-half EU fat exports were up 43% year-over-year to 139,595 mt, shipments were still well below the levels exported before the Russia closure (by comparison, EU exports were 178,000 mt in the first half of 2013).

The European Commission expects EU pork production to increase by 0.3% this year to a record 24.19 million mt, and further growth of 1.4% is expected in 2020. Exports are forecast to rise 12% this year and next year, while domestic EU pork consumption is expected to contract by 1.4% (32.1 kilograms per capita) and fall slightly again in 2020 as exports account for a larger share of production.

China’s strong demand has underpinned higher EU prices and is thus driving expansion where possible, although the threat of ASF continues to hang over the major pork-producing and exporting EU member states.

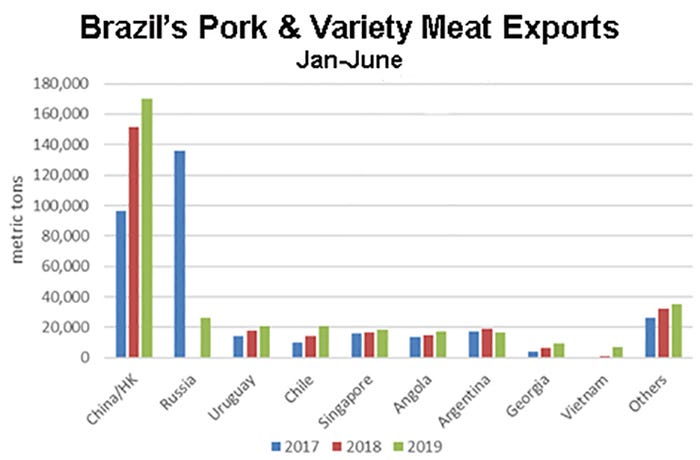

Brazil’s first-half exports to China were up 29% year-over-year to 92,192 mt, while exports to Hong Kong slowed 2% to 78,046 mt. This resulted in combined China/Hong Kong total of 170,237 mt, up 12%. Exports to Russia, which took about 40% of Brazil’s pork exports before closing to Brazilian pork near the end of 2017, totaled just 26,170 mt — about one-fifth of the pre-suspension volume. Brazil’s exports increased to Uruguay, Chile, Singapore, Angola, Georgia and Vietnam (7,239 mt, up from just 818 mt last year). Though volumes were small, Brazil also exported more pork to the United States (3,439 mt, +154%) and Korea (2,352 mt, +295%).

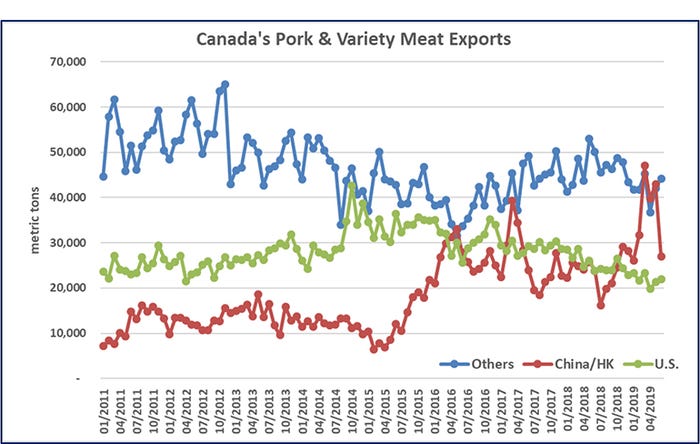

While Canada’s first-half exports edged up 2% from a year ago its reliance on China (211,968 mt, up 47%) presents a troubling outlook for the second half unless China lifts its suspension on imports of Canadian pork. Canada’s first-half exports to the United States, which is in a period of record production, were down 17% to 131,343 mt. Despite tariff relief from the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, first-half exports to Japan dropped slightly (116,430 mt, down 2%) and exports to Mexico were steady (56,980 mt) despite having a tariff advantage over U.S. pork from January through late-May.

Chile’s first-half exports to China were up 29% from a year ago to 47,579 mt, while exports to Japan increased 11% to 16,032 mt. Chile has not yet ratified the CPTPP, but Chile has long benefited from its economic partnership agreement with Japan. Although Chilean pork has not realized the further tariff benefits included in the CPTPP, especially for ground seasoned and processed pork products, the prospect of lower tariffs going forward has likely heightened interest among Japanese buyers. Exports to Russia increased 19% to 15,924 mt, but Chilean pork has lost share in Russia as Brazilian pork returns to the market. Chile saw a decline in exports to Korea (15,217 mt, down 10%).

The bigger story in Chile is that its first-half imports surged to 50,342 mt, up 48% from last year’s record pace. This included significant increases from Brazil (22,456 mt, up 61%), the United States (19,991 mt, up 76%) and Spain (2,379 mt, up 22%) while imports slowed from Canada (3,000 mt, -30%) and Poland (1,365 mt, -27%).

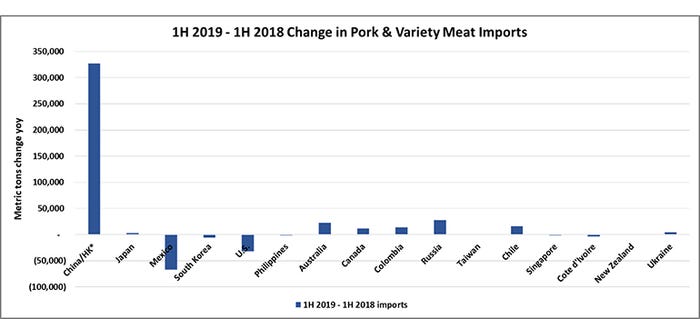

While China/Hong Kong clearly dominated first-half import growth with a year-over-year increase of 325,000 mt, volumes for the world’s other top pork importers were steady-to-higher in most markets. Aside from China/Hong Kong, the largest increases were in Russia (up 27,800 mt, though still well below levels reached earlier this decade), Australia (up 22,800 mt), Vietnam (up 21,400 mt), Chile (up 16,300 mt), Colombia (up 13,620 mt) and Canada (up 11,450 mt). Chile and Canada have been importing more pork as production is not growing fast enough to meet both domestic and international demand. Consumption is growing rapidly in Australia and Colombia, pushing imports to record levels.

The only countries importing significantly less pork in the first half were Mexico (down 67,000 mt) and the United States (down 32,000 mt). Mexico’s imports from the United States have rebounded nicely since duty-free status was restored, and a strong second half is anticipated. Monthly shipments will have to be extraordinarily high for this year’s final results to match last year, let alone the record year of 2017.

Source: U.S. Meat Export Federation, which is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like