Given the uncertainty of profit margins in the hog market, the best risk management strategy may be to establish option positions that will protect against greater losses.

Facing the prospects of less-than-profitable margins in the fourth and first quarters, many hog producers may be tempted to avoid establishing market positions that would lock-in those losses. However, the reality is that margins could deteriorate even further.

Given that uncertainty — as well as the potentially detrimental impact that further declines could have on an operation’s bottom line — the best risk management strategy may be to establish option positions that will protect against greater losses.

Options allow risk managers to bridge the gap between staying open and fully hedging — as well as how much of that gap they want to bridge. In that way, options offer a great deal of flexibility and control. However, options strategies can be complex. Determining which positions will have the most favorable impact on your bottom line requires precise value-based evaluations.

Options offer flexibility and control

Option positions can be structured to provide a range of different coverage strengths. The position strength, called “delta,” is a measure of the percentage terms a position will mimic the performance of a futures contract. For example, a 40% delta call option will increase $0.40 for every $1 increase in the futures contract. Conversely, a -60% delta put option will increase $0.60 for every $1 decrease in the futures contract. Delta can be measured not only for individual options but for an entire spread position including multiple options or futures and options combined together.

In addition to selecting the most appropriate delta for their needs, a producer should construct a strategy that takes full advantage of the relative pricing in an ever-changing options market. The measurement of these relative options prices is referred to as “implied volatility.” The higher the implied volatility, the higher the price of an option, and vice versa. Understanding implied volatility levels is a key step in the options’ price discovery process, as various positions with the same delta may have very different exposures to implied volatility.

In general, when implied volatility is low and has a seasonal tendency to increase, it makes sense to be net long options. When implied volatility is historically high and has a seasonal tendency to decrease, it makes sense to be net short options.

Precise measurements provide for clear strategy decisions

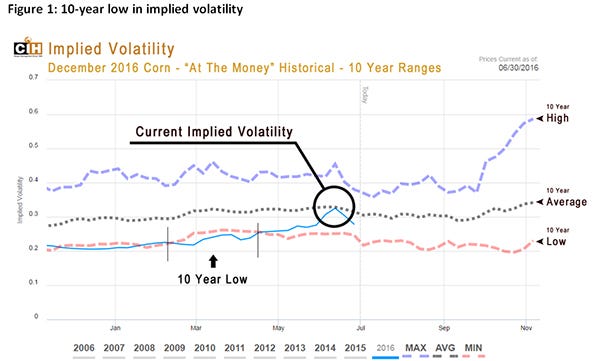

An example is illustrated in Figure 1. In early April of 2016, implied volatility in December 2016 corn options was at a 10-year low — which implies that December option prices were also at a 10-year low. At that point, a risk manager could have purchased call options to take advantage of the relatively low pricing. Through mid-June, both implied volatility and option prices then increased to average levels.

Because the long call had a positive delta, the position benefited from the increase in price levels. In addition, it held onto more of its value over time due to the rise in implied volatility. A savvy risk manager could have captured additional gains as implied volatility levels increased, by making an adjustment to the initial long call position: selling a call at a strike price above the market.

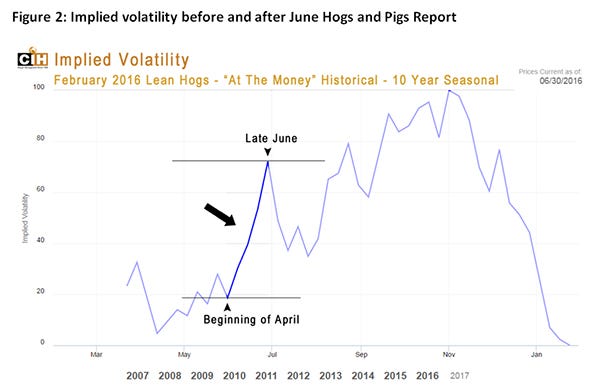

Recently, a rally in February 2017 lean hog futures in early to mid-June offered producers the opportunity to secure protection against losses. As illustrated in Figure 2, over the last 10 years, February ’17 implied volatility has generally increased in late-June as traders prepare for the USDA quarterly Hogs and Pigs report.

The implied volatility for each strike within a specific contract (called the implied volatility “skew”) provides us with a relative measure of value between options at different strike prices. Understanding this tendency for implied volatility to increase, we can drill down further into the February contract to determine an appropriate strategy.

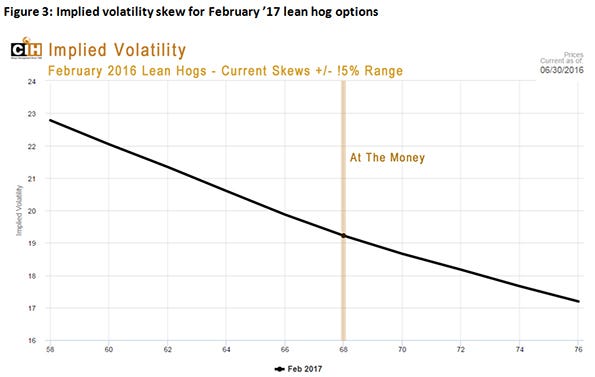

Figure 3 maps the implied volatility skew for February ’17 lean hog options. We can see that the “at the money” implied volatility for February ’17 lean hog options is around 19%. The 72 strike has an implied volatility of 18%. Therefore, by selling a future and simultaneously purchasing a 72 call, you can establish a -65% delta position while taking advantage of the current implied volatility, relative pricing of February ’17 options, as well as the seasonal tendency for implied volatility to increase.

Putting it all together

All of these variables — delta, implied volatility, relative pricing and seasonal tendencies — can be measured at any given point in time. For a risk manager, options strategies represent a highly effective and precise tool that allows you to exercise control over your margins and protect your operations against losses.

About the Author(s)

You May Also Like