Lots of moving parts for pork producers to navigate

While this report will certainly go down as a surprise, it is a sigh of relief for pork producers as it projects an average price of $3.60 per bushel, down from the July report of $3.70.

August 12, 2019

Today’s USDA crop acreage report had the potential to be explosive and did not disappoint. Before I get into the numbers, let’s consider the framework and parameters from which the USDA was coming from with the data.

Dealing with what was almost assuredly record prevent plant acres and the incorporation of Farm Service Agency acreage data, which may not be consistent with the National Agricultural Statistics Service information

The change in objective yield data being pushed back to September in lieu of the traditional August effort containing ear and kernel counts — only farmer surveys and satellite data regressed against previous observations were used in this report

The USDA intentionally does not apply a weather bias for the balance of the growing season — no consideration of an early or late frost, no projections for temperatures or precipitation trends ��— even if the meteorological community was in complete agreement with a direction

A huge spread in crop maturity based on variation in planting dates and excess moisture in the spring

With that as backdrop, the USDA gave us another “wow” moment.

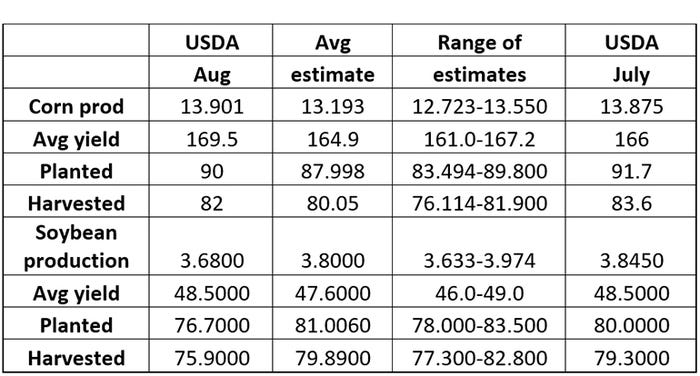

Corn yield was adjusted upward to 169.5 versus the July estimate of 166.0. NASS acres were 90 million planted, resulting in a total crop of nearly 14 million bushels. Both the planted acres and the yield were above the top end of the range of estimates published coming into this report This was way too much for the trade to absorb and resulted in corn trading limit-down soon after the report. The NASS information is contrasted with the FSA acreage numbers of 85 million acres and a record — by a factor of three times — prevent planting acres of over 11 million.

The apparent discrepancy between the two branches of the USDA is providing some conflict with those with a bullish bias who will be giving the “no way” explanation to this data. NASS went out of their way on this report to explain their methods and system, seemingly preempting the implied criticism of believability. As hard as it may be to swallow, I think we have to accept the reported acreage numbers as we continue to refine the yield numbers.

While this report will certainly go down as a surprise, it is a sigh of relief for pork producers as it projects an average price of $3.60 per bushel, down from the July report of $3.70.

Soybean acres were decreased a bit more than 3 million with yields consistent from the July report. This resulted in a rather blasé balance sheet relative to corn. Average bean price was left unchanged ($8.40) from the July projection.

On the revenue side, there is reason to be optimistic. Last week, the average price in China for hogs eclipsed the record values from 2016. In that year, Chinese pork production was reduced 5% which resulted in the record values. What happens when you lose 40% of your production? One province has witnessed price appreciation of nearly 50% in the past five weeks. In March, we got out in front of our skis a bit with the giddy prospects of the Chinese African swine fever situation resulting in a boon for U.S. pork producers only to see those hopes dashed. Fund money says, “call me when you see shipments.”

In July, we witnessed the shipment and another episode of prices falling from grace late in the month. Fund money says, “call me when you see record prices in China.” As of this week, we have witnessed the sustained shipments to China, record prices in that country, and a skittish fund community that is exhibiting more patience than their previous efforts. Our contacts in China continue to report a deteriorating health situation across the country and every reason to believe we will see higher prices in our future. Patience, please.

The cattle market received a severe blow over the weekend with the fire at Tyson’s Garden City, Kan., plant. Cattle shackle space relative to available animal supplies was running tight before this situation, and the loss of roughly 4.5% of the packing capacity adds even more strain to the cattle production community. Perhaps we in the pork industry need to count our blessings relative to the cowboys. The increase in pork profits (ushered in by the porcine epidemic diarrhea event of 2014) paved the way for three new plants and enough shackle space to accommodate our production advances. The forward curve for the pork producer, both the prospects for revenue and available shackles, looks favorable for the foreseeable future as long as we keep our production community clean of export-limiting disease.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like