If USDA's numbers are correct and if COVID-19 does not disrupt future hog processing, 2020 commercial hog slaughter should total nearly 133 million head.

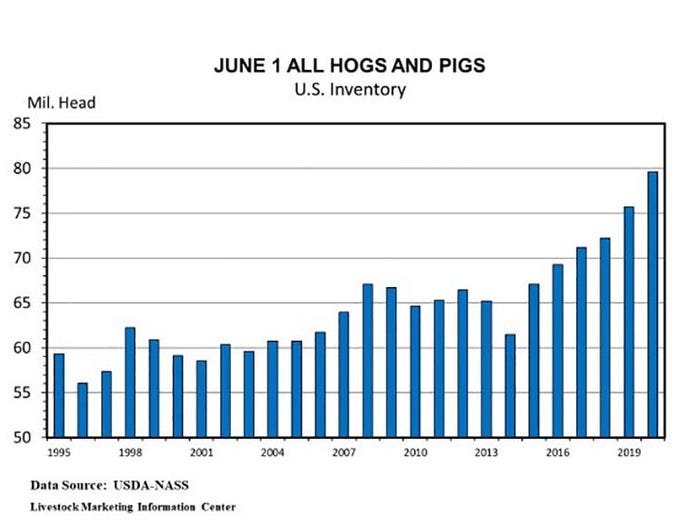

USDA's June Hogs and Pigs report was bearish. The U.S. swine herd is the largest of record for this time of year. USDA's June inventory survey put the hog herd at 79.634 million head, up 5.2% from a year ago and 1.5% above the pre-release trade forecast. The swine herd has grown each year since the porcine epidemic diarrhea virus cut production in 2014.

The table below shows the June 2020 hog inventory as a percent of the June 2019 inventory both for the average of pre-release trade forecasts and for the USDA Hogs and Pigs survey.

|

| Trade | USDA |

All hogs & pigs | 103.70% | 105.20% | |

Kept for breeding | 98.10% | 98.70% | |

Market hogs |

| 104.20% | 105.80% |

| Under 50 lbs | 97.80% | 99.80% |

| 50-119 lbs | 102.60% | 103.40% |

| 120-179 lbs | 105.60% | 111.80% |

| 180 lbs & up | 116.60% | 112.80% |

Mar-May pig crop | 99% | 101.40% | |

Mar-May pigs/litter | 99.60% | 100% | |

Sows farrowed |

|

| |

| Mar-May | 98.80% | 101.20% |

Farrowing intentions |

|

| |

| Jun-Aug | 95.20% | 95.40% |

| Sep-Nov | 95.50% | 94.60% |

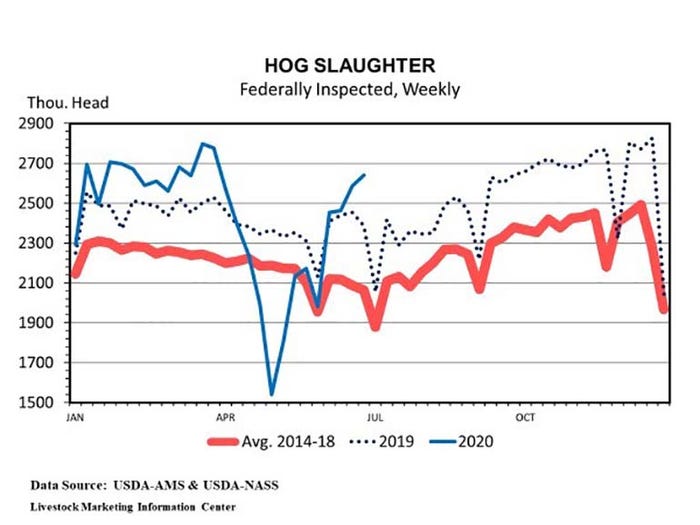

As one can see from the chart below, 2020 hog slaughter took a huge dip in April and May when COVID-19 forced packing plants to scale back operations. The coronavirus slowed hog processing and backed up hogs on farms. Hog slaughter was only 55% of capacity during the week ending on May 2. April-May hog slaughter was nearly 3 million head (14%) below expectations.USDA's numbers were higher than trade expectations for all categories except the 180-plus pound market hog inventory and September-November farrowing intentions.

A key question is whether actual hog slaughter will match the market hog inventories or whether COVID-19 and euthanizing will keep slaughter below the inventory levels.

We are more than half way through with slaughter of the 180-plus pounds market hog inventory group. USDA estimated the 180-plus pounds market hog inventory at 14.687 million head on June 1, up 12.8% from a year ago. Since June 1, federally inspected hog slaughter has totaled 10.128 million head and is up only 5% year-over-year. In two more weeks slaughter will have exceeded 15 million head since June 1 and will be well below the 12.8% increase implied by the pig report. Slaughter will need to average up 26% in the next two weeks to match the USDA number. Why the shortfall in expected slaughter? Backed up hogs and euthanized hogs.

When everything is right, U.S. hog packers can slaughter 500 thousand hogs in a single day and 2.8 million in a week. The inability to move hogs to slaughter on a timely basis led to diet modifications to slow rate of growth and to euthanizing some animals. Since there is no data on just how many pigs are being euthanized and at what age, hog slaughter may fall below USDA's market hog inventory.

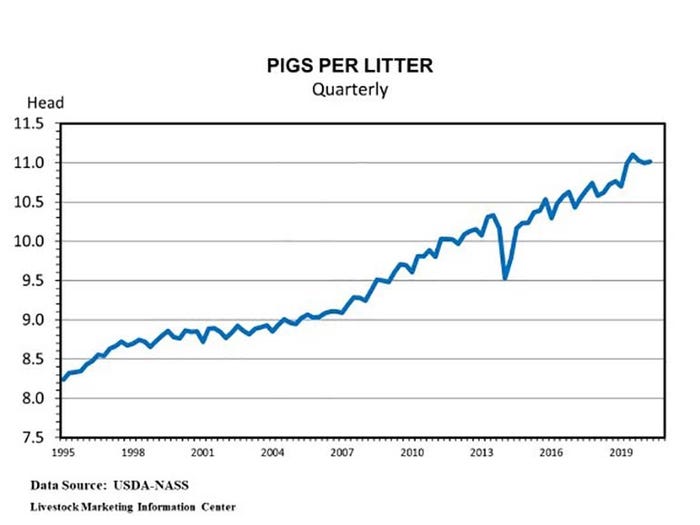

USDA said pigs per litter averaged 11.01 head during March-May. That was 0.1% above the spring of 2019 and the smallest increase since June-July of 2014. The likely reason for the small increase is strict culling by hog producers in the face of extremely low hog prices and limited space to house the huge hog inventory.

USDA says the March-May pig crop was up 1.4% (479,000 head) which is in line with spring farrowings (up 1.2%) and pigs per litter (up 0.1%). It does not lineup with the light weight market hog inventory group which was down 0.2%. This would imply fewer imports of weaner/feeder pigs and unusually high death loss. The number of weaner/feeder pigs imported from Canada during March-May was down 59,458 head (5.6%). Euthanization almost certainly contributed to increased death loss.

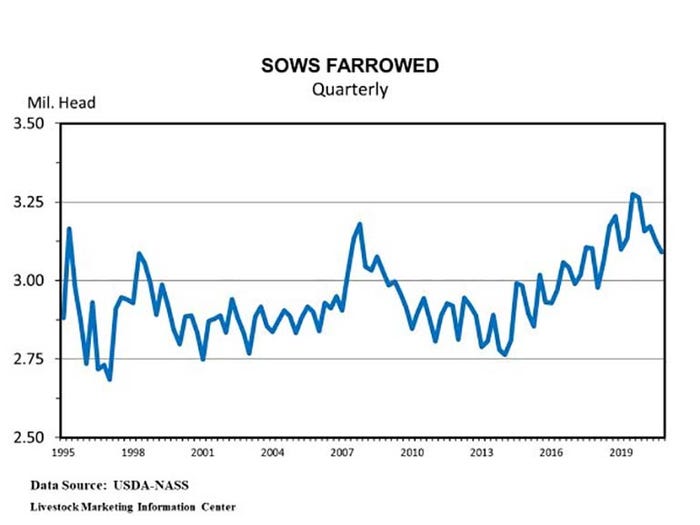

The number of sows farrowed during March-May was up 1.2% which was higher than both the trade expectation and the forecast in the March Hogs and Pigs report.

Farrowing intentions for June-August are down 4.6%. If pigs per litter are unchanged (for example), then the summer pig crop also should be down 4.6%, giving us the biggest decrease in hog slaughter since March-May of 2014. Farrowing intentions for September-November are down 5.4%.

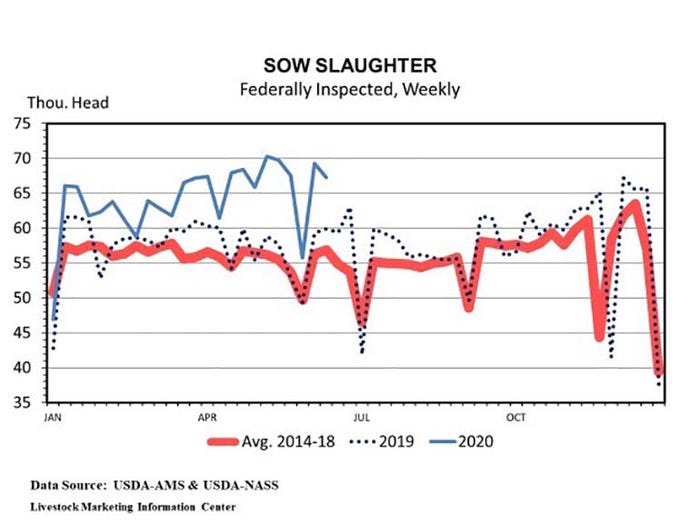

Sow slaughter supports the low farrowing intentions. Sow slaughter has remained very high in recent months. The spring drop in slaughter was of barrows and gilts, not sows. April-May sow slaughter was up 13.1%; barrow and gilt slaughter was down 14.8%.

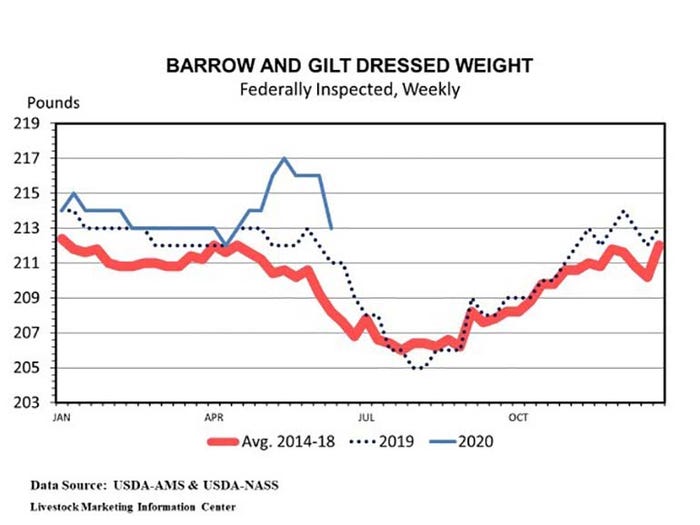

Spring slaughter weights have been above the year-ago level but not by as much as one would expect given the backlog in hog slaughter. It appears producers have worked to slow growth rates.

If USDA's numbers are correct and if the coronavirus does not disrupt future hog processing, 2020 commercial hog slaughter should total nearly 133 million head, up 2.3% from last year's record.

Projected Commercial Hog Slaughter |

Quarter |

2020-1 |

2020-2 |

2020-3 |

2020-4 |

Year |

The record for one day hog slaughter is 502,843 head processed on March 25. There have been two weeks with slaughter over 2.8 million head. Seasonally, hog slaughter is low during the summer. Last year weekly slaughter during July and August averaged a bit over 2.4 million for non-holiday weeks. Barring a resurgence of COVID-19 among packing plant workers, there should be enough slaughter capacity to handle the expected weekly runs of 2.6-2.7 million head during July and August.

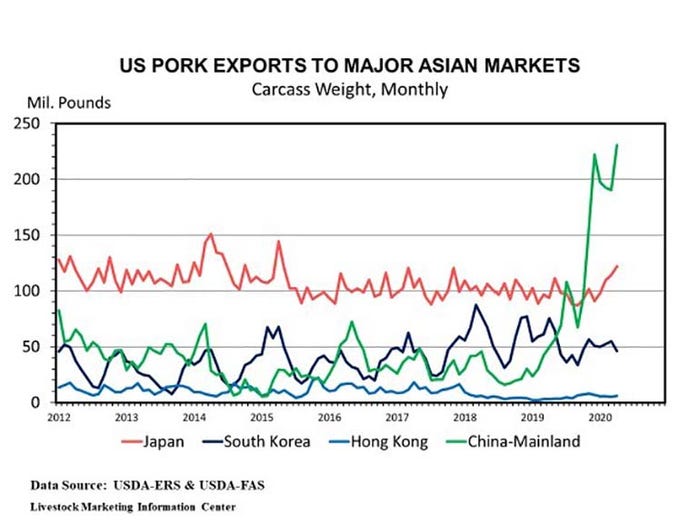

Pork exports to China have driven export demand in recent months. During the first four months of 2020 pork imports are down 21.8% and pork exports are up 35.2%. During the first third of 2020 imports equaled 2.8% of production and exports equaled 28.2% of production.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like