Hog prices are recovering

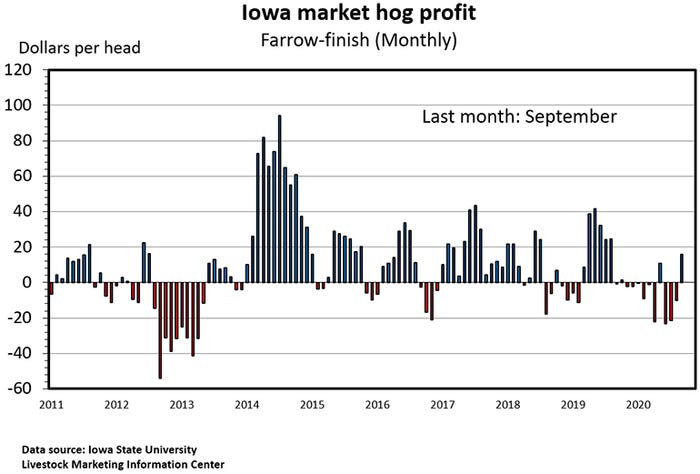

Farrow-to-finish operations earned $15.88 per hog sold during September, only the second profitable month this year.

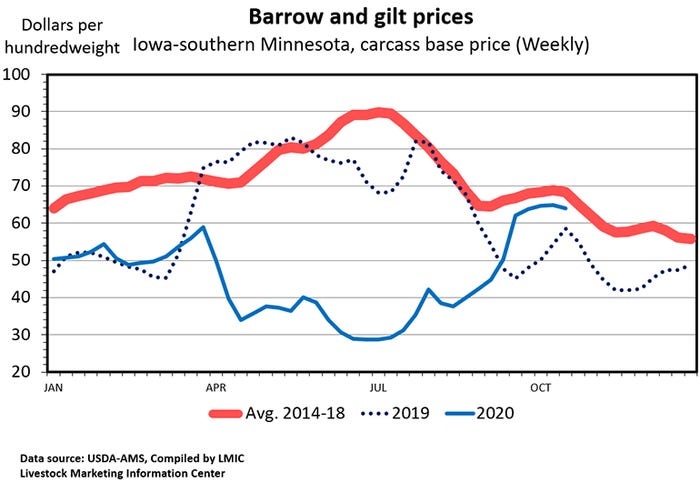

This year's average hog price is expected to be the lowest since 2002. Last spring, COVID-19 illness among packing plant workers caused a big drop in slaughter capacity. The resulting backlog of market-ready hogs pushed hog prices far below year-earlier levels. Prices lagged all through the summer but finally climbed above the year-ago level in September.

What does the future hold? Will a backlog of market hogs push prices back down this winter or will packers be able to process hogs on a timely basis?

USDA's quarterly hog inventory surveys give a way to estimate just how many hogs are backed up on the farm by comparing monthly hog slaughter to the market hog inventory weight groups and to lagged monthly pig crop.

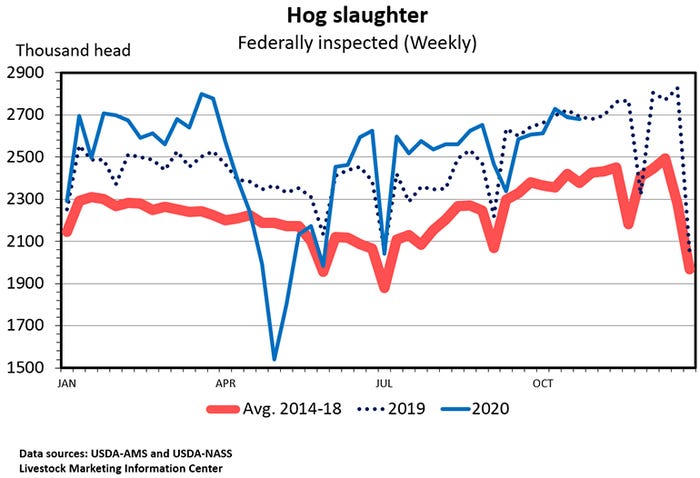

Hog slaughter has been below the year-ago level for six of the last eight weeks. During this period, hog slaughter was 0.8% below last year and 8.4% below the level implied by the September Hogs and Pigs Report.

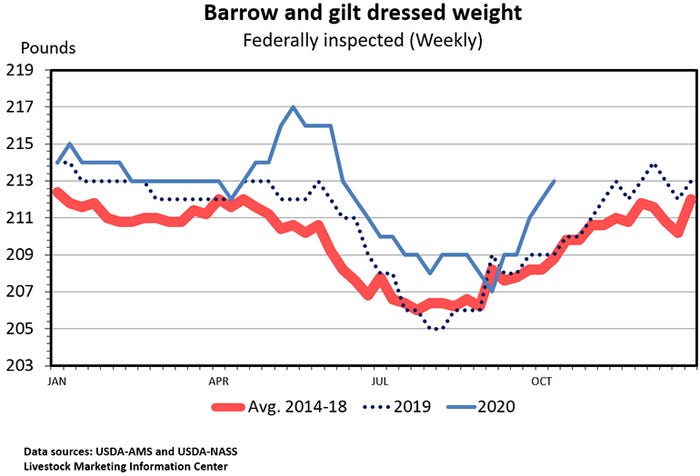

According to USDA-National Agricultural Statistics Service, the supply of heavy-weight market hogs (weighing 180 pounds or more) was up 12.8% on June 1 and up 9.8% on Sept. 1. These big increases have not shown up in hog slaughter.

March-to-May hog slaughter was 2.89 million (8.8%) short of the number implied by the last Hogs and Pigs Report. Some of the missing hogs were probably euthanized, but it is likely that most were carried over into summer.

June-to-August hog slaughter was 1.56 million (4.5%) short of the number implied by the last Hogs and Pigs Report. The smaller shortfall indicates that packers were able to process some of spring's backlogged hogs during the summer months when slaughter is typically low.

Thus far, September-to-November hog slaughter has been 1.9 million (8.8%) short of the number implied by the last Hogs and Pigs Report. That indicates packers are falling further behind in their efforts to process market hogs. Weekly hog slaughter has exceeded 2.7 million only once since March. Last year, weekly slaughter exceeded 2.7 million once in October, twice in November and three times in December. There are plenty of hogs to frequently push weekly slaughter above 2.7 million this fall, but are there enough healthy packing plant workers to support that level?

I am skeptical that packers will be able to slaughter more hogs during the fourth quarter than they did last year. The September Hogs and Pigs Report pegged the 120-plus pound market hog groups as up 7.8% and the under-120-pounds groups as down 3.5% year-over-year. We are now 70% of our way through slaughtering the 120-pound-plus groups and slaughter is down 0.8%.

If the under-120-pound group is down 3.5% it should allow packers to play catch up with backlogged hogs during the winter months.

Delayed marketings usually mean heavier slaughter weights. Barrow and gilt dressed weights have been above year ago for most weeks this year. However, the gap has not been as large as expected, probably due to producers adjusting diets to slow average daily gain.

Exports promising

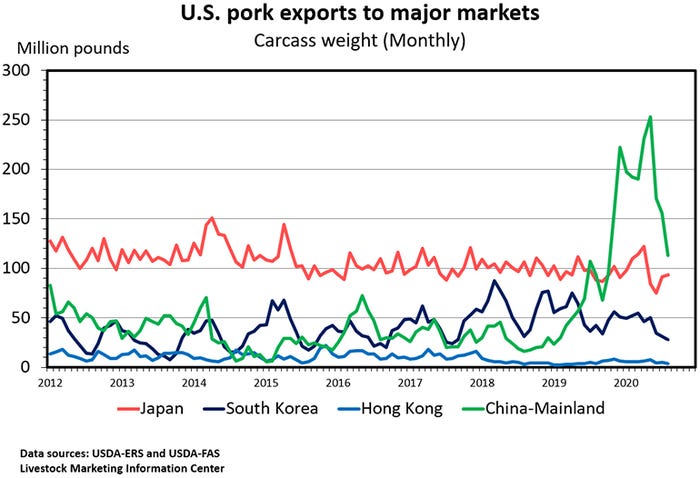

It has been a good year for international trade. Through August, U.S. pork exports were up 21% year-over-year and pork imports were down 10%. Exports equaled 26.5% of January-to-August pork production and imports equaled 3.1% of U.S. production. This does not include variety meats.

Were it not for a billion-pound increase in exports to China, U.S. exports would be down 182 million pounds compared to January-to-August 2019. There have been large declines in U.S. pork shipments to South Korea, Colombia, Mexico and Australia.

After three years of decline caused by African swine fever, the USDA's Foreign Agricultural Service is predicting Chinese pork production will be up 9.2% in 2021. That still leaves Chinese production 26.8% below their 2014 peak. World pork production is expected to be up 4.4% next year. The only major pork producer expected to be down in 2021 is South Korea.

Except for China and Hong Kong, most major pork importing countries are expected to import more in 2021 than this year. USDA is forecasting Chinese pork imports will be down 6.25% in 2021 but will still be the second highest of record.

The European Union and Canada are expected to export less pork in 2021. U.S. 2021 pork imports are forecast to be up by 34,000 metric tons (8.6%) and U.S. pork exports are forecast to be up by 1,000 metric tons (0.03%).

Imports of live hogs from Canada are expected to hold steady at 5.1 million head this year and next.

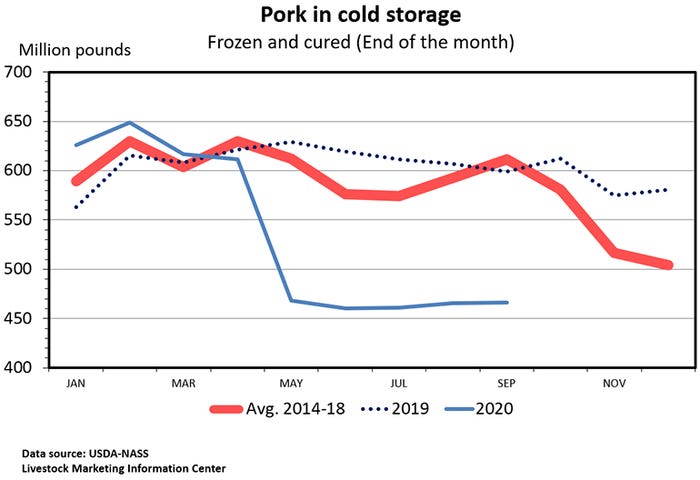

The supply of pork in cold storage was down more than 20% for each month May through September. This reflects lower-than-expected pork production this year due to packer problems.

On Friday, the December lean hog futures contract closed at $67.02 per hundredweight. June, July and August 2021 contracts closed above $78 per hundredweight. December 2021 closed at $62.90 per hundredweight, $4.12 below the nearby contract. The futures prices imply a typical seasonal price pattern in 2021 with a higher average than this year thanks to much stronger summer prices.

Expect higher production costs

Feed costs have been rising fast and are expected to remain high this winter. The December corn futures contract ended last week at $4.1925 per bushel, up 50 cents in a month and nearly $1 higher than in early August. The futures market expects corn prices to stay above $4 until the fall harvest of 2021.

December soymeal settled at $386.40 per ton Friday, up nearly $100 since early August. The cost of production for hogs sold in 2021 could be the highest since 2015.

Farrow-to-finish operations earned $15.88 per hog sold during September according to calculations by Lee Schulz at Iowa State University. This was only the second profitable month this year.

The average price of a pound of pork at retail was $4.053 during September. This was down 3.1 cents from August and down 19.2 cents from the record set in June. September was the fifth consecutive month above $4 per pound. The monthly retail pork price was under $4 for all of 2015-19.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like