Hog market provides profit opportunity

Many hogs have been hedged either with futures or options over the past two months. When summer prices hit $100, a lot of producers moved to price some or all of their inventory.

May 6, 2019

It doesn’t appear that much matters except tweets these days.

That’s true at least in the immediate future and likely so further out. President Trump’s weekend threats to increase tariffs and/or impose tariffs on a new list of goods from China sent markets into a tailspin today. Hogs were off the $3 per hundredweight limit from June 2019 through May 2020 and every other contract on the board lost at least $2.50 per hundredweight. Corn was down in spite of corn planting progress that is at just over half the level it has been on this date over the past five years — and more rain being forecast for much of the Corn Belt. Soybeans lost ground, too, though that is somewhat understandable if planting intentions for corn are not met. Live cattle fell another $0.75 to $1.28 per hundredweight.

It was a tough day on top of a number of tough days for agriculture which is seemingly at the tip of President Trump’s trade war spear. I don’t think he intends that, it’s just the way it is.

So where do we stand and what do we do?

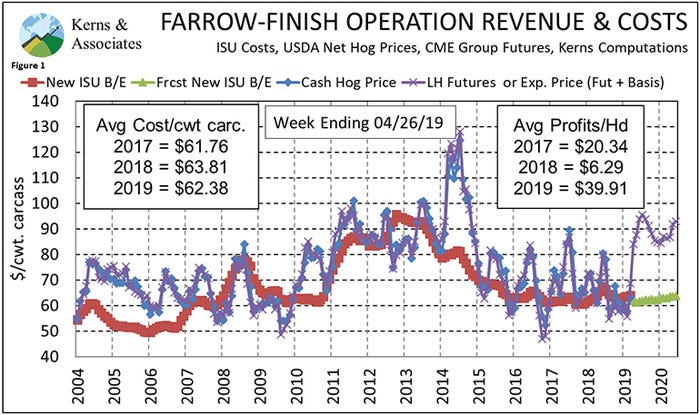

First, the U.S. pork industry is still looking at good profit prospects. Figure 1 shows our computations of profits offered by CME Group Lean Hogs, Corn and Soybean Meal futures and the production parameters represented by Iowa State University’s Estimated Costs and Returns for Iowa farrow-to-finish operations as of April 26. Note that we believe ISU’s estimates represent the best 20-25% of farrow-to-finish operations. Average commercial production cost estimates run roughly $5 per hundredweight higher than our computed numbers.

The cost numbers have changed little in the past few months but are trending down as corn and soybean meal lose ground. It is clear to see that Friday’s $62.38 per hundredweight is near the levels of the past three years. Large U.S. and world year-end stocks of both corn and soybeans will keep those costs in the low- to mid-$60s we believe even if the 2019 U.S. crop hits some difficulties. And let’s be clear — wet weather in April and early May is not a huge difficulty. Planting progress is a terrible indicator of final yield for both crops. The larger factor to watch now is just how many acres end up as “prevented-planting” acres for the federal crop insurance program. That category took 3 million acres in 2013 and some are thinking it could reduce corn acres a similar amount this year. The cutoff dates for corn vary from area to area but most are near the end of May.

Friday’s profit figures for 2009 ($39.91 per head) took a roughly $6 per head hit today. But even an average profit of “just” $33 per head would rank second all-time in our records, exceeded only by the porcine epidemic diarrhea virus-driven profits of 2014. Every Lean Hog contract on the board is, even after today’s selloff, priced at least $16 per hundredweight higher than the average cost discussed in the previous paragraph.

Second, nothing that has happened in the past 72 hours has changed the situation in China. We still do not know precisely what that situation is, but it hasn’t changed much since Friday. China’s pork industry is still going to fall far short of its normal production levels. China’s domestic pork supplies are still going to be much smaller — perhaps 25-30% — than in the recent past. China’s pork-eating consumers will not see enough pork in stores and markets to purchase as much as they have in the past. China’s imports will grow but the world is still limited in its ability to respond. Prices will rise to ration the available supply. We’ve been saying that for months and it is still true. Unfortunately, I can’t give you quantities or prices with any degree of confidence. All we know is they are going to be lower and higher, respectively.

Third, African swine fever still poses a huge risk to the U.S. industry. This situation has been cussed and discussed in every meeting I have attended this year. We will never know whether we have done enough to keep it out or just been blessed to have avoided it. I’ll take either one.

Finally, there is the question of what do you do? Many hogs have been hedged either with futures or options over the past two months. When summer prices hit $100, a lot of producers moved to price some or all of their inventory. As distant contracts have rallied in recent weeks, some of that coverage has been extended. But there are many producers who have not acted, betting that China’s needs would push hogs well beyond $100, perhaps to challenge the records we saw in 2014.

I really don’t know what the best approach is for you. I do know it is quite possibly different for most producers and depends on financial position, risk-tolerance levels, the existence of a lender relationship supportive of risk management and a host of other factors. It is my opinion at present that every producer should have in place two plans.

A plan to prevent catastrophic losses should ASF come to the United States. The probability of that happening is still low — remember that China has had foot-and-mouth disease and classical swine fever every day for the past five, 10, 20, whatever years and neither have come to the United States, but the impact would be enormous. I believe prices could fall to the $20s and stay there until U.S. producers could reduce hog supplies. That would take at least six months. Do you have a plan for that? I believe that plan must be a pricing plan as no borrowing plan can survive six months of $80 to $100 per-head losses.

A plan to capture the benefits of these strong markets. Note that I did not say “the strong markets we witnessed in March and April”. Those are gone for now and hopefully you took advantage of them. But this market is still offering excellent profits. Work with your adviser to develop a plan to take advantage of what you can while leaving as much top side potential available as you can afford.

I often remember a sign that my vo-ag instructor posted in our classroom. It said simply “Pray for rain but keep on hoeing.” The Twitter gods may someday smile on us but for now you must take control of everything you can, and the markets are still giving you wonderfully profitable opportunities to do that.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like