Higher hog prices, at last

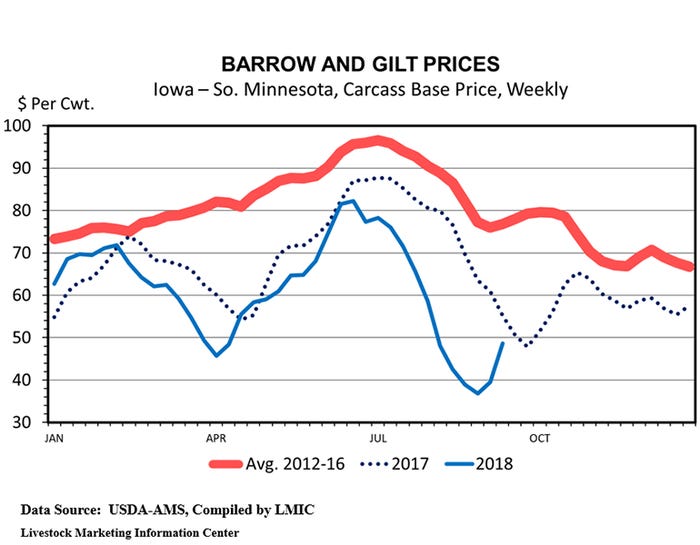

If hog prices follow the pattern of 2017, the low for the year could be behind us. The 2017 low in hog prices came on Sept. 28 at $47.18 per hundredweight.

On the last day of August, spot market hog prices averaged $36.57 per hundredweight, which was less than half of what they were two months earlier. Aug. 31 hog prices were the lowest for any day since Oct. 31, 2002. Hog prices have recovered a bit from their sharp drop in July and August. Negotiated hog prices moved up to average $41.28 per hundredweight on Sept. 7 and $49.26 per hundredweight on Sept. 13. Hopefully, the week ahead will bring a further price increase.

If hog prices follow the pattern of 2017, the low for the year could be behind us. The 2017 low in hog prices came on Sept. 28 at $47.18 per hundredweight. As the red line in the chart above indicates, the annual low for hog prices usually comes late in the year. The primary reason being that hog slaughter has been highest in the fourth quarter for every year since 1986.

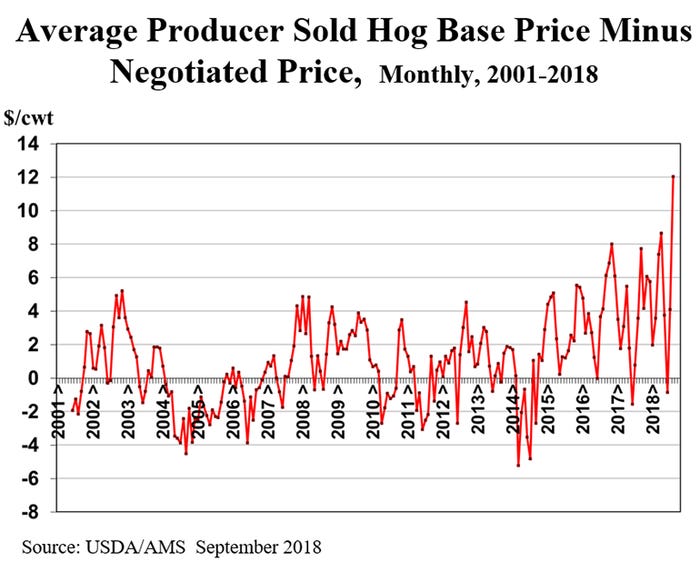

For a longtime the negotiated or spot market price of hogs has been widely used as a proxy for the average hog price. That approach no longer works well. For producer sales on a carcass weight basis, the base price averaged $0.42 per hundredweight higher than the negotiated price for the years 2002-14. The average producer sold base price was $3.58 per hundredweight higher than the negotiated price for the years 2015-17. Thus far in 2018, the average producer sold base price has averaged $5.07 per hundredweight higher than the negotiated price.

Likely causes for the increasing gap between negotiated price and average price is a continuing decline in the number of hogs sold on the spot market, and the increasing use of formula contracts tied to the pork cutout value.

The growing spread between spot price and average price means that using the negotiated price to calculate profitability underestimates the profitability of hog farms and overestimates the profitability of hog packers.

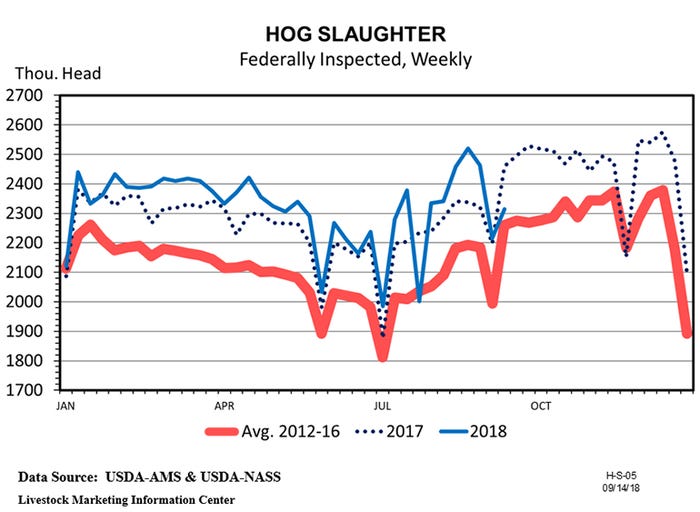

Hurricane Florence had an impact on the hog industry last week as East Coast slaughter plants were idled by the big storm. Hog slaughter last week totaled only 2.315 million head. That was up 4.5% from the holiday-shortened previous week, but down 5.9% from the same week last year.

Summer hog slaughter was below the level indicated by the June market hog inventory. Since June 1, hog slaughter has been up 2.3%. The June Hogs and Pigs report implied it would be up 3.4%. It appears likely that there will be a downward revision in the June market hog inventory when the September inventory report comes out next week.

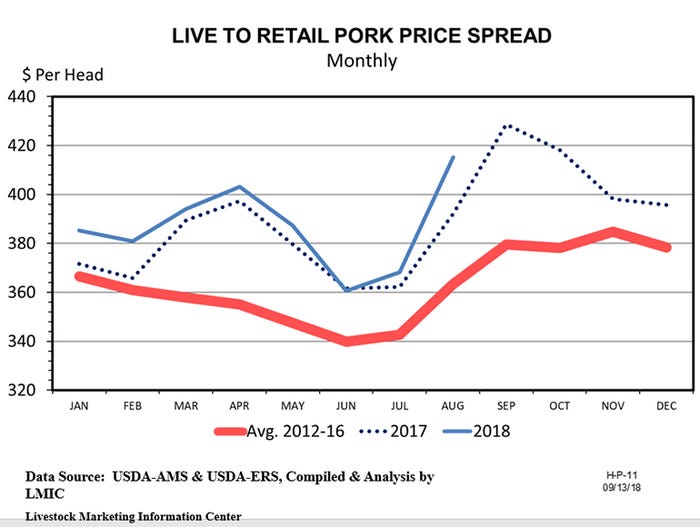

The average price of pork in grocery stores during August was $3.817 per pound, up 8.6 cents from July, but down 11.8 cents from August 2017. Retail pork prices have been below the year-ago level each of the last three months.

The packer spread (farm-wholesale) during August was 59.9 cents per pound, down 7.6 cents from July but up 2.1 cents from August 2017. The wholesale-retail spread was $2.57 per pound in August, up 47.6 cents from month before and up 21.9 cents from August 2017. The total price spread (live to retail), $3.169 per pound, was the widest since September 2017.

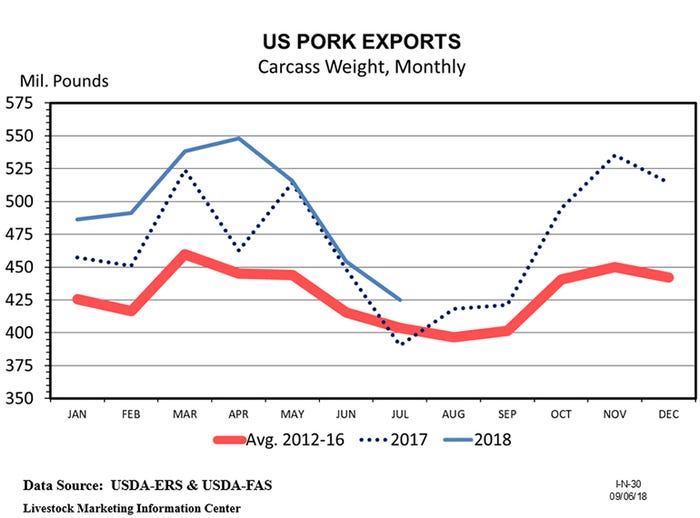

July pork imports were down 6.3% year-over-year and exports were up 8.9%. July was the third consecutive month with imports below the year-ago level and the 12th consecutive month with exports above year-earlier. July pork imports equaled 4.3% of production while exports equaled 21.4% of production.

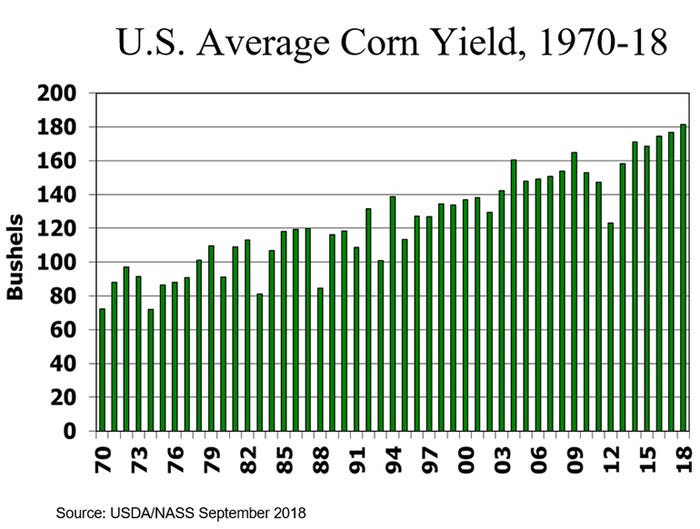

USDA’s September World Agricultural Supply and Demand Estimates provided good news about feed costs for livestock producers. USDA boosted expected corn yield by 2.9 bushels to 181.3 bushels per acre, making this the third consecutive record year. Total corn production is pegged at 14.827 billion bushels, the second largest ever after the 2016 harvest. The marketing year average corn price is forecast to be $3.50 plus or minus 50 cents.

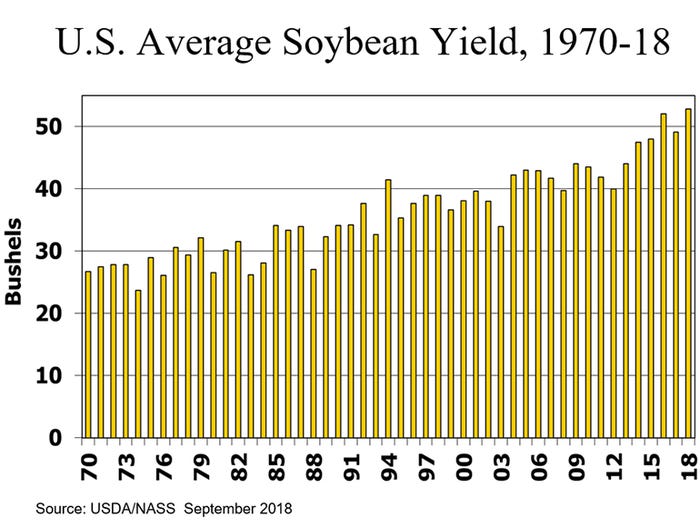

The 2018 soybean yield is forecast to be a record 52.8 bushels per acre, breaking the previous record set in 2016. Total soybean production, 4.693 billion bushels, is forecast to be record high for the third consecutive year.

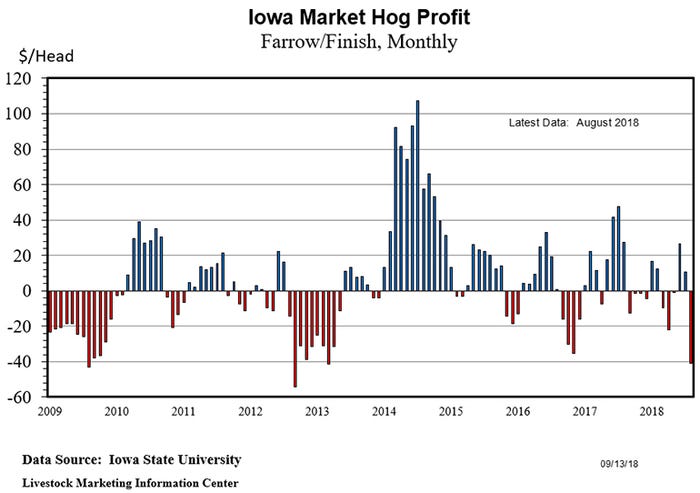

Calculations by Lee Schulz at Iowa State University peg farrow to finish losses at $40.71 per head marketed during August. That is down from a profit of $10.82 per head in July and the worst red ink since March 2013. Schulz estimates the cost of production for August at $62.47 per hundredweight (carcass) or $46.86 per hundredweight (live). Cost of production is likely to decline slightly during harvest.

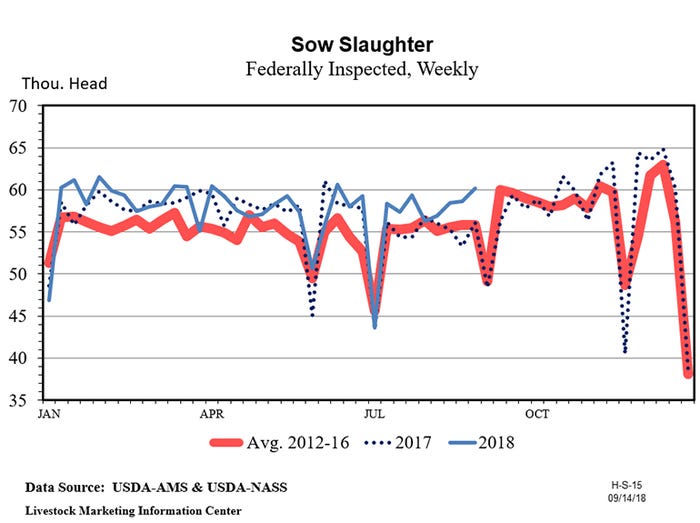

The June Hogs and Pigs report forecast summer and fall farrowings would each be up 1.6% compared to last year. Given the red ink hog producers are experiencing, even smaller farrowings may lay ahead. Sow slaughter has been above the year-earlier level nine of the last 10 weeks.

On Thursday afternoon, USDA will release their monthly Livestock Slaughter report. Preliminary data indicate August hog slaughter was up 4.6%. August 2018 had the same number of slaughter days as last year. The September Cattle on Feed report will be released on Friday afternoon. Cold Storage numbers come out next Monday. The Quarterly Hogs and Pigs report will be issued on Sept. 27.

About the Author(s)

You May Also Like