Global pork exports surge as four largest suppliers set records

U.S. pork exports increased 8% in volume (2.31 million mt) and 7% in value ($5.94 billion) in 2016.

March 8, 2017

By U.S. Meat Export Federation Staff

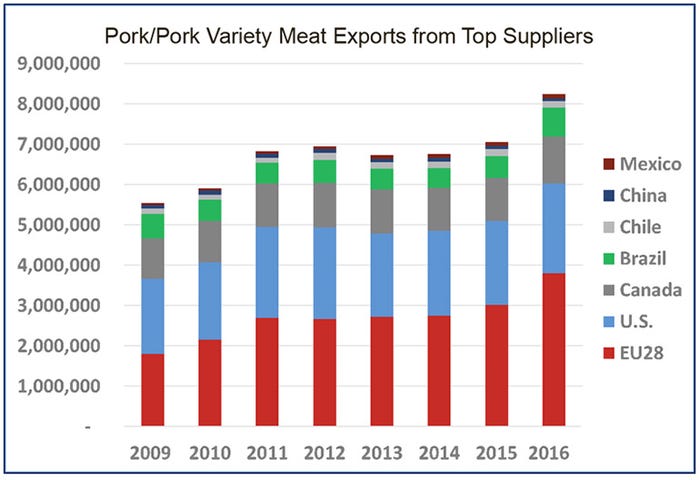

Global pork export volume set a new record in 2016, with the top seven exporters shipping about 8.3 million metric tons — an increase of 17% (or 1.2 million mt) year-over-year. Exports were record-large for all four main suppliers: the European Union, the United States, Canada and Brazil.

U.S. pork exports increased 8% in volume (2.31 million mt) and 7% in value ($5.94 billion) in 2016. A full summary of 2016 U.S. pork exports is available from the U.S. Meat Export Federation website.

EU exports were up 26% to 3.8 million mt, with value up 28% to $8.44 billion. China/Hong Kong took 2.19 million mt, up 51%, with the rest of the world taking 1.6 million mt, up 3%. Exports were also higher year-over-year to Japan, South Korea, the Philippines, the United States and Vietnam. Among these key export destinations, the EU is in the late stages of free trade agreement negotiations with Japan, in early FTA talks with the Philippines, has signed — but not yet implemented — an FTA with Vietnam and has an FTA in place with Korea.

Canada’s 2016 exports were up 7% in both volume (1.15 million mt) and value ($2.78 billion). The United States was still the largest destination for Canadian pork, but Canada’s exports to the United States (372,614 mt, down 8%) accounted for only 32% of its total exports compared to 38% in 2015. Exports to China more than doubled (309,456 mt, up 143%), accounting for 27% of Canadian exports (up from 12% in 2015). Exports to Japan were down slightly to 196,925 mt, but like the United States, Canada shipped a new record volume of chilled pork to Japan. Exports to Mexico were modestly higher (101,531 mt, up 2%).

Following a 10% increase in 2015, Brazil’s exports gained even more momentum last year — climbing 33% to a record 713,700 mt. Export value increased 16% to $1.46 billion. Russia continued to be Brazil’s top market, but volume increased only slightly to 242,040 mt. Exports to Hong Kong, Brazil’s second largest export market, were up 32% to 163,320 mt. Exports to China increased from only 5,000 mt in 2016 to 87,855 mt. With the exceptions of Angola and Venezuela, Brazil experienced widespread growth to its other export markets.

Mexico’s pork exports continued to grow in 2016, increasing 11% in volume (111,257 mt) and 12% in value ($455.3 million). Exports to Japan, Mexico’s leading market, increased 5% to 82,198 mt, accounting for 74% of total exports. Korea surpassed the United States as Mexico’s second largest export destination, with exports reaching 13,976 mt, up 46%. For the past two years, Mexico has been the largest supplier of chilled pork to Korea, mainly single-ribbed bellies and CT butts. Mexico’s exports to the United States increased 19% in 2016, to 13,053 mt.

Chile’s 2016 exports were essentially flat, declining less than 1% to 175,851 mt, while export value fell 3% to $433.3 million. A 30% increase in exports to China (74,058 mt) and larger exports to Japan (27,462 mt, up 7%) offset lower volumes to Korea, Russia and Mexico.

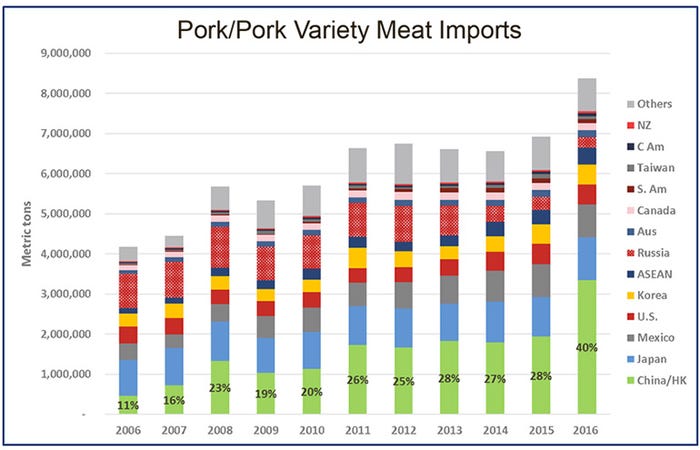

While China/Hong Kong dominated 2016 pork import growth, imports were also record-large for Japan, Mexico and the Philippines, as well as in several smaller markets including Chile, Vietnam, New Zealand, Thailand and Uruguay. Imports entering the United States and Canada were fairly steady with 2015 levels, while Mexico’s imports were up 1% from the 2015 record. Russia’s imports continued to decline, down 15% year-over-year and less than half of the volume imported in 2013, prior to Russia’s ban on European pork. Imports were also lower for Australia, Singapore, Taiwan, the Ivory Coast and South Africa.

China/Hong Kong’s combined 2016 pork and variety meat imports reached 3.37 million mt, a 74% increase from 2015. When excluding variety meats, pork imports were 1.9 million mt, up 93%. Inventory numbers suggest that China will continue to import large volumes at least into mid-2017, although large profits are currently supporting herd expansion and rebuilding.

Japan’s pork imports reached a record 1.07 million mt in 2016, up 7% year-over-year. Japanese import growth was led by the EU (340,813 mt, up 17%), but imports were also higher from all other main suppliers, including record-large chilled pork imports from the United States and Canada.

Korea’s pork imports were up 2% to 491,367 mt. Imports increased from the EU, Chile and Mexico, but declined from the United States and Canada. Although Mexico was the largest supplier of chilled pork to Korea, its share of total imports was only 3%.

For the Philippines, pork imports were a record 253,692 mt, up 25% year-over-year, led by growth from the EU but also increases from the United States and Canada.

Note: Totals based on Global Trade Atlas data

You May Also Like