Double-digit slaughter increases should persist for week or so

August 24, 2015

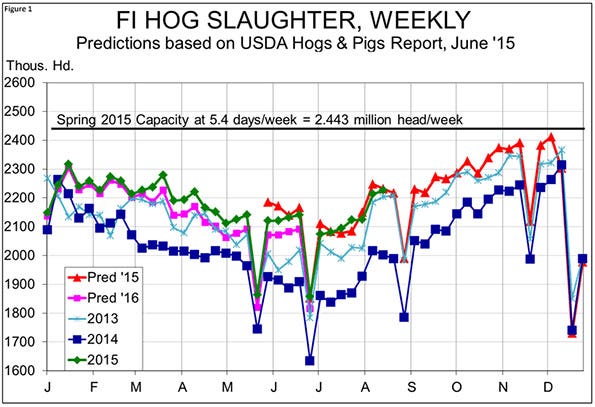

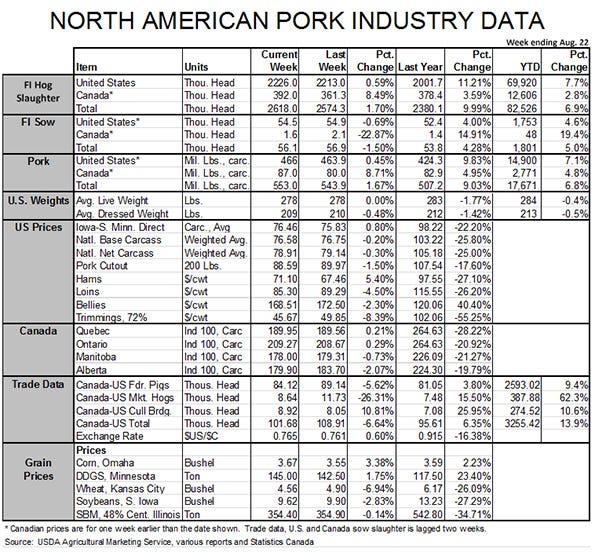

Hog slaughter remains large – expectedly so – as we finish summer and look toward fall. Last week’s total of 2.226 million head was 11.2% higher than one year ago. That figure is almost precisely the level predicted by the June Hogs and Pigs report.

Double-digit year-on-year increases should persist for a couple more weeks based on the report before year-on-year changes drop to less than 9% as we get into the June 1 119-pound and below market hog category.

The kickers to that scenario are the facts that packer margins have improved and hog basis levels are wide as cash hangs on to summer strength and October futures anticipate a significant break in hog prices. The first change provides incentives for packers to slaughter pigs and the second one provides incentives for producers to get them moved.

The two could push weekly slaughter totals higher than the June report suggested for September, but that very action could leave us more current going in to the fall, providing some support to pork markets by reducing tonnage.

Cool weather, fresh corn on the way

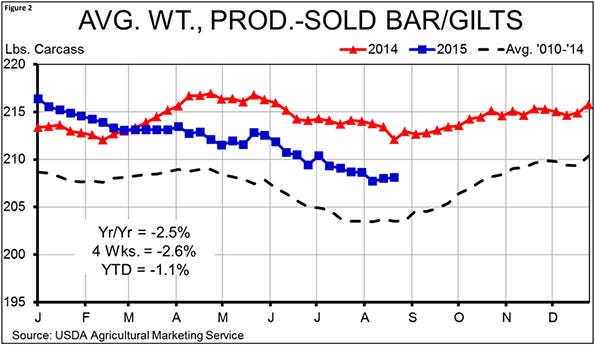

Weights have, in all likelihood, bottomed for the season. As can be seen in Figure 2, we have been near 208 pounds (the level we predicted weights would bottom at this summer) for the past four weeks and history suggests that the upward move will begin any time now. Cooler weather and fresh corn always encourage higher consumption and more rapid growth rates. While Eastern Corn Belt corn may have some quality issues, we don’t hear much concern in other parts of the feed producing regions and thus believe a pretty normal increase in weights is ahead.

Getting “ultra-current” going into September might blunt that increase but, while we think marketings will indeed be current as fall arrives, we doubt that enough hogs will be pulled ahead to flatten the seasonal increase in the size of hogs coming to market. We look for producer-sold barrows and gilts to average about 214 pounds in late-November and December.

The economic outlook of the whole world seems to be negative as I write on Monday morning with another big break on the Shanghai stock market, the Dow toughing out a 1,000 point loss in early trading before climbing back to “only” minus-237 points at present, and oil less than $40 per barrel.

None of those are positive news for the world economy. Just how that impacts the U.S. economy and consumer behavior remains to be seen but, given a choice, I would obviously rather not see these headlines.

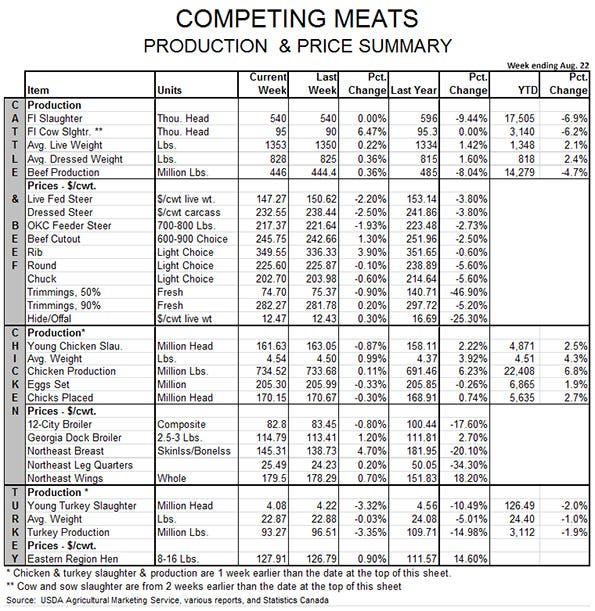

Bellies being bullish

Friday’s Cold Storage report was pretty much more of the same: Plenty of animal proteins in freezers with about the only bullish news being tight pork belly stocks. Total beef, pork and chicken in cold storage on July 31 was 2.352 billion pounds, 16.5% more than one year ago and nearly 11% higher than the average for July 31 over the past five years. The total was also 2.5% higher than on June 30. The report is likely bearish for all three species, but less so for beef.

Total pork in freezers on July 31 amounted to 635 million pounds, 19% higher than one year ago and 28.5% higher than the five-year average. Stocks climbed slightly in July – not a normal occurrence. There is some discussion that a larger-than-normal amount of product is being staged in freezers for export. I don’t know how much credence there is to that but the dollar fell to its lowest level (per dollar index futures) since January. That has to help a bit.

Ham challenge

The big challenge is still ham inventories which were 39% higher than both last year and the five-year average on July 31. It is possible that this summer’s low prices have encouraged some storage against future needs, thus pushing freezer stocks higher. I suppose that is a good thing but we are soon going to be producing 4.6 million to 4.8 million hams per week. There is plenty of ham supply ahead of us and anything being laid back now will still weigh on the market this fall.

Belly prices finally cooled last week with the primal composite losing $5.37 per hundredweight to finish the week at $162.14. Producers and packers still have to be thrilled with the run-up they have seen this summer – a run-up reflected in July 31 belly stocks that were the smallest in nearly two years and were only 37% as large as one year ago. Just as large ham stocks suggest continued pressure this fall, these tight belly stocks are encouraging even in the face of knowing that more bellies are on the way. If we have to handle a seasonal decline, it’s best to start it high, right?

Beef and chicken stocks were also large in last week’s report. Total chicken stocks (767.9 million pounds) were 22% larger than last year. Total beef stocks were up 16.5%.

About the Author(s)

You May Also Like