Chinese Academy of Agricultural Sciences recently projected that production will continue to decline in 2020, dropping 8% year-over-year.

May 13, 2020

While COVID-19 currently dominates all news headlines, including those regarding meat production and supplies, African swine fever is still having an enormous impact on global pork trade. This is especially true in China, where ASF was first confirmed in August 2018.

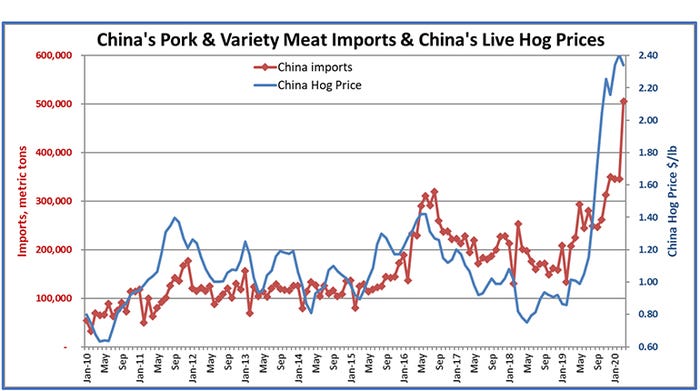

China typically produces and consumes about half the world's pork, so even small interruptions in its domestic production can create significant swings in global pork trade patterns. But ASF's impact in the country has been unprecedented, causing a decline in world pork supplies of more than 10% last year. In 2020, global production is expected to fall more than 16% compared to 2018. While the virus spread to all of China's provinces by June 2019 and caused significant mortalities, producers — fearing greater spread — rushed to cull their herds before being infected. Thus, the decrease in China's production and surge in imports didn't fully materialize until late-2019.

China's Ministry of Agriculture and Rural Affairs data point to a slow rebound in sow and total hog inventory numbers after bottoming in the fall of 2019. But ASF remains a danger throughout China and COVID-19 has added even greater uncertainty to the swine and pork marketplace. China's first quarter live hog slaughter was 131.29 million head, a decline of 30% (or more than 57 million head) from the first quarter of 2019. First quarter pork production of 10.38 million tons was down 29% year-over-year.

The pace of China's recovery in pork production is difficult to predict, but the Chinese Academy of Agricultural Sciences recently projected that production will continue to decline in 2020, dropping 8% year-over-year to about 39 million metric tons. Pork production is expected to begin rising in 2021, but it will be at least 2022 before output returns to the pre-ASF level seen in the first half of 2018. USDA has issued an even less rosy forecast, estimating that 2020 Chinese pork production will drop 20% (to 34 million mt) this year, which means a drop of 37% compared to 2018, when production reached 54 million mt. Full details are in this USDA GAIN Report.

While pork production edges slowly toward recovery, China's demand for imported meat continues to soar. Despite COVID-19-related lockdowns, China's meat and poultry imports reached a staggering $7.8 billion in the first quarter, up 137% from last year, while volume totaled 2.18 million mt, an increase of 85%. This total includes pork and pork variety meat imports of nearly 1.2 million mt, up 118% from a year ago. The European Union — mainly Spain, Germany, Denmark and the Netherlands — accounted for 61% of these imports. The United States captured 18% market share, followed by Brazil (7%), Canada (6%) and Chile (3%). The United States is the least "China-dependent" of these suppliers, as China accounted for one-third of U.S. export volume in the first quarter, compared to 42% for Canada, 48% for Brazil and 67% for Chile. European Union export data is only available through February, but China accounted for 60% of the EU's January-February volume, up from 54% in calendar year 2019. EU exports decreased sharply to all other main destinations. China bid product away from other customers as EU hog slaughter decreased by 3% in the first two months of the year.

As a reminder, despite the favorable U.S.-China Phase One Economic and Trade Agreement, U.S. pork still faces a 25% tariff disadvantage, due to China's continued retaliation on the Section 232 metal tariffs. Since early March the Section 301 retaliatory tariffs, which added another 35%, have been waived for most imports of U.S. pork.

U.S. export data show that nearly 100,000 mt of carcasses (boxed primals) were exported to China in the first quarter (up from zero a year ago), accounting for 46% of the total U.S. cut volume shipped to China. Bone-in hams totaled 20,000 mt and other frozen cuts amounted to 96,500 mt. China's demand for less labor-intensive boxed carcasses makes the market especially attractive in these challenging times.

As noted in the U.S. Meat Export Federation's first quarter export summary, strong demand from China has driven U.S. pork and pork variety meat exports to record levels in 2020, but the U.S. industry also achieved strong growth in key markets such as Japan, Mexico, Canada, Central America and Oceania.

"This is a very important point when examining current export trends," notes USMEF Economist Erin Borror. "The surge in China's demand for imported pork is not going to end anytime soon, but we also know that it will not last forever. It's therefore very important that the U.S. industry continues to expand exports to both well-established and emerging markets, and that is the trend we are seeing so far this year."

China's live hog prices have eased modestly in recent weeks but are still up about 115% from a year ago, averaging 31.18 renminbi per kilogram (about $2 per pound) on May 7. Pork prices also eased into late-April, averaging 52.11 renminbi per kilogram, up 112% year-over-year but down from the mid-February peak of nearly 60 renminbi per kilogram. Piglet prices are record-high at U.S. 6.35 per pound live weight, up 170% year-over-year, as supplies remain tight and buyer interest in piglets — especially from large-scale operations — continues to rise. Depending on the production model, per-head profits are estimated at $150 to $300, which continues to fuel rebuilding efforts.

China has leaned heavily on its central pork reserves to keep prices down this year, with 17 releases through April totaling 330,000 mt. Although this volume is small relative to total supplies, releases from the pork reserve have helped dampen wholesale prices of all pork, fresh and frozen. In the meantime, COVID-19 has resulted in greater acceptance of frozen pork by consumers as imported frozen supplies have been more visible in the marketplace, including both supermarkets and e-commerce food platforms.

"In addition to private expansion efforts, the Chinese government is taking extraordinary measures to bolster pork supplies and support expanded production," notes Joel Haggard, USMEF senior vice president for the Asia Pacific, who is based in Hong Kong. "But that was no easy task even before the COVID-19 pandemic and could prove to be even more difficult now."

Entering April, Chinese farmers intensively tried to sell heavy hogs to market due to declining prices, and slaughterhouses seized the opportunity to try to push prices lower by pulling back on purchases, citing weak demand. With the increased costs of raising hogs and transportation risks related to ASF and COVID-19, farmers became reluctant to sell hogs at lower prices. Moreover, producers believe hog prices may rise slightly in the weeks ahead as economic activity increases and schools reopen. Foodservice outlets are also seeing improved traffic and revenues, though a long recovery is expected as a subset of the population remains reluctant to resume sit-down dining.

ASF's Asian presence isn't limited to China. It has also had a dramatic impact on pork production in Vietnam and the Philippines, and has spread to smaller markets as far south as Indonesia and Papua New Guinea. India also recently reported its first confirmed case.

"ASF's entry into Asia and especially to the Greater China region has had global implications for production, consumption and trade of all proteins," Haggard says. "Though somewhat overshadowed by COVID-19, ASF continues to command the global pork industry's full attention."

Source: U.S. Meat Export Federation, which is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like