Pork cutout futures start trading later this month. For many producers, this can be a significant addition to their margin management strategy.

November 2, 2020

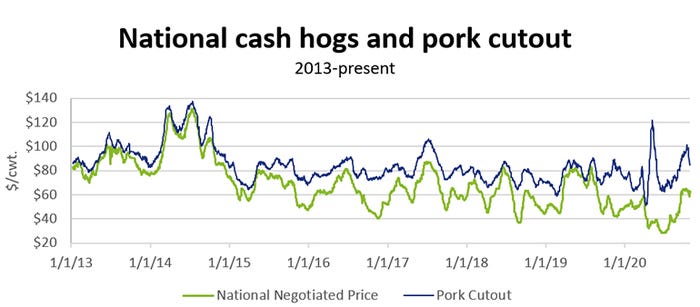

Pork producers often price their animals using cash hogs, the pork cutout or some combination of the two. The CME Lean Hog Index is calculated from a weighted average of the daily price and volume for producer-sold negotiated, swine or pork market formula, and negotiated formula transactions as reported by the USDA.

The CME's Pork Cutout Index will offer a new opportunity to customize a producer's risk management approach to their unique circumstances. With cutout futures set to begin trading Nov. 9, it is important to understand how buying or selling these derivatives can better align your hedges with your actual price discovery process and improve your basis risk.

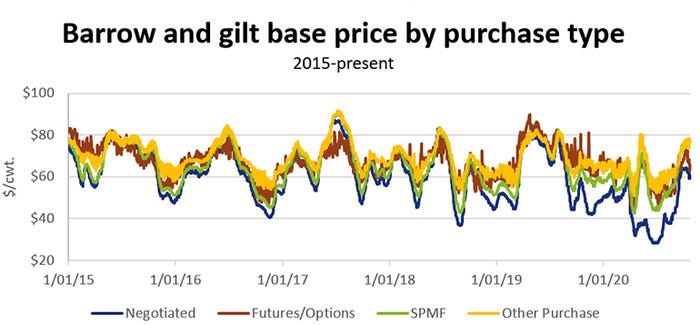

Pricing methods have evolved over time and so, too, have producers' risk profiles. Cash hog volumes negotiated directly between buyers and sellers in the spot market have slowly diminished and now represent about 2-3% of total barrow and gilt slaughter. At the same time, an increasing number of hogs under the swine and pork market formula purchase type have been referencing the pork cutout value in their base price calculations. The weighted average price can significantly vary between the different purchase types. It is now estimated that approximately 35% to 40% of the Lean Hog Index is based off the pork cutout, with the remainder tied to the swine market.

The correlation between the Lean Hog Index and base price formulas that use exclusively cash market hog values has weakened in extreme periods. This was especially evident during the supply chain disruptions we experienced this past spring. While the bottleneck at packing plants temporarily restricted packing capacity and lowered demand for cash hogs and the ability to process the animals, the pork carcass cutout value increased dramatically as end-users attempted to secure physical product. Because of the influence of the pork carcass cutout on the Lean Hog Index, futures increased in late-April and early May despite the swine market remaining at historically low levels.

No two pig farmers are the same and their price discovery methods are equally diverse. We know there are many different manners of cash hog price discovery and some producers have multiple formulas upon which they get paid. With the introduction of pork cutout futures as a tool to manage risk, it is crucial that both the optimal quantity and type of hedging instrument(s) to be used is determined. Regression analysis can be used to determine the optimal mix of lean hog and cutout futures to improve your hedge's correlation to cash and reduce basis risk.

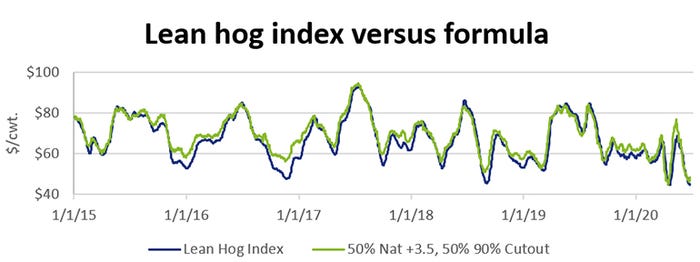

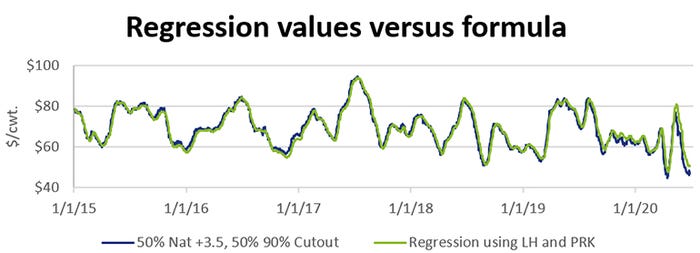

Consider a producer who has a formula pricing agreement with a packer that is half the national negotiated cash price plus $3.50 and half of 90% of pork cutout value. Since 2015, the performance of the lean hog index against this formula (the producer's cash contract) is displayed below.

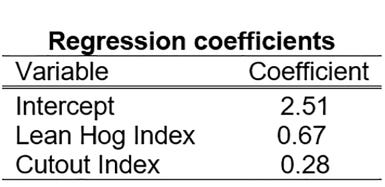

While the two series moved together, deviation can be seen in extreme periods. To reduce this deviation, we can use a regression to determine whether it makes sense to include Pork Cutout Index as part of our hedging strategy. The results of the regression are summarized below.

The coefficients above of 0.67 and 0.28 imply that to hedge 1 million pounds of production, the market participant would need 670,000 pounds of lean hog futures and 280,000 pounds of cutout futures. Utilizing this strategy would have tightened the range of outcomes much closer to this producer's actual cash price, as displayed below.

Over the past five years, the Lean Hog Index and the pricing formula described above exhibited a correlation of 96%. Utilizing the hedge ratios described above, the correlation improves to 98%. The deviation between cash and futures would also have been reduced by using a mix of lean hog and pork cutout futures.

For producers whose hogs are entirely priced on cash markets, he or she may need to be short lean hog futures and be long the cutout. On the other hand, a producer priced exclusively on the cutout could simply avoid engaging in lean hog futures at all and instead be short cutout futures.

It is important you understand what this new hedging tool means to you and how it relates to your particular price discovery. Reach out to us or your market adviser to run the math on your pricing agreements to provide a better idea on the optimal hedge ratio for you and your operation to improve your hedge's correlation, reduce basis risk and take control of your bottom line.

There is a risk of loss in futures trading. Past performance is not indicative of future results.

Source: Dustin Baker, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like