Will Shrinking Consumer Disposable Income Threaten Pork Demand?

A look at how decreasing personal disposable income could affect the pork industry.

February 17, 2014

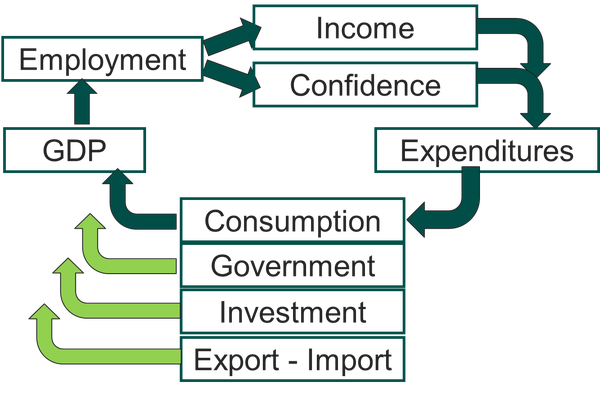

Several years ago I put together the model depicted in Figure 1 to illustrate how “The Great Recession” was impacting the meat and poultry business. A recession has been defined in a number of ways, of course, but the most commonly cited one is two successive quarters of lower gross domestic product (GDP). Thank goodness we are no longer in a recession but revisiting the graphic put the question of just where we do stand in terms of the “business cycle” to top of mind. Thus, you are reading about it this week.

Figure 1

First, let’s review the simple model. GDP can be looked at from either the supply or demand side. The supply view says that GDP is the total value of goods and services produced for use within a specific country. The demand side says that GDP is the spending for the total goods and services used in the country. The two must be equal since the value of production must be the same as expenditures for those goods and services.

Producing GDP drives employment which in turn impacts two factors, income and confidence, that in my model drive total expenditures. Those expenditures flow through four spending streams: Consumption, government spending, investment and net exports (ie. exports less imports). Increase spending and you increase GDP which increases the value of goods and services in the economy, which drives employment, etc., etc. You see the circular picture.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Wrap Up newsletter and get the latest news delivered right to your inbox every week!

None of these factors speak directly to the meat business but we know that meat demand is driven by income, the prices of substitute and complement goods and consumers’ tastes and preferences. So, at least the income aspect of meat demand is impacted by this macro-economy. More realistically, it also affects demand through consumer confidence (or lack thereof) and, more broadly, the relative value of currencies which affect trade flows.

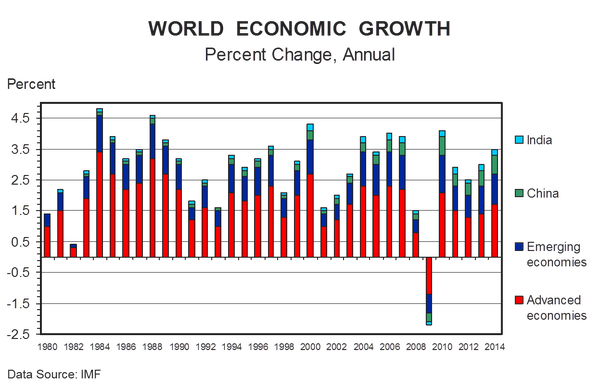

So where do we stand on these various macroeconomic factors? Figure 2 shows historical data for world GDP. The recession is quite clear, as is the recovery that reached a robust 4% in 2010 before faltering in 2011 and 2012. Growth increased to 3% in 2013 and is forecast by the International Monetary Fund to hit 3.5% in 2014. That rate is lower than the boom years of the ’80s and late ‘00s but better than several years just after the dawn of this century. Note also that emerging economies, China and India, continue to comprise a larger share of world GDP growth than they did before the recession.

Figure 2

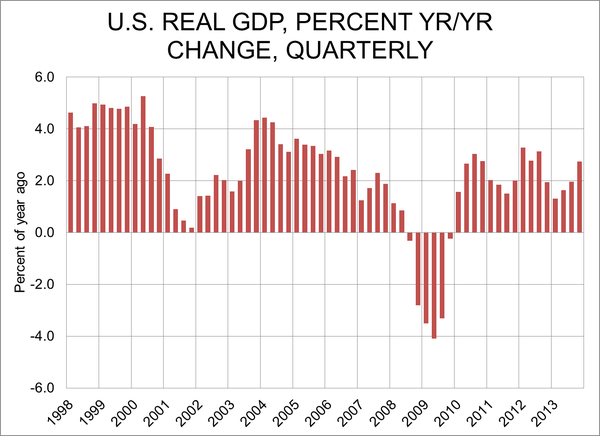

U.S. GDP (Figure 3) continues to recover as well. While the average growth rate for 2013 will be only about 2%, fourth quarter (Q4) GDP grew at an annual rate of 2.7% and the short-term trend is positive. The fact that Q4 growth was that high in spite of a two-week government shutdown is encouraging, especially now that a budget deal is apparently done.

Figure 3

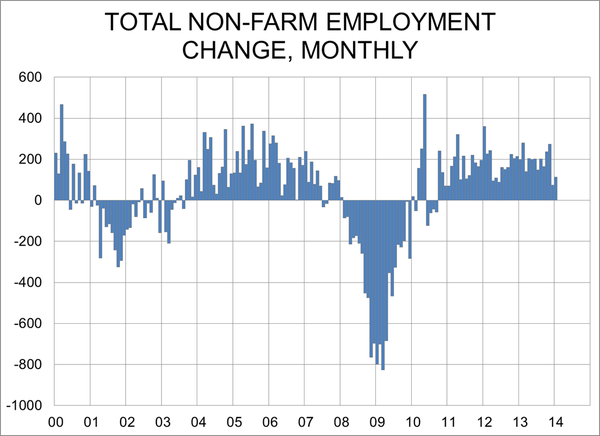

There are, to me, still two major flies in the macroeconomic ointment. The first is employment, which still lags its pre-recession level by 866,000 jobs. As can be seen in Figure 4, the economy was adding jobs at a clip of nearly 200,000 per month for much of 2013, until only 75,000 jobs and 113,000 jobs were added in December and January. That pace needs to rebound quickly if Q4-2014 GDP growth is to be sustained.

Figure 4

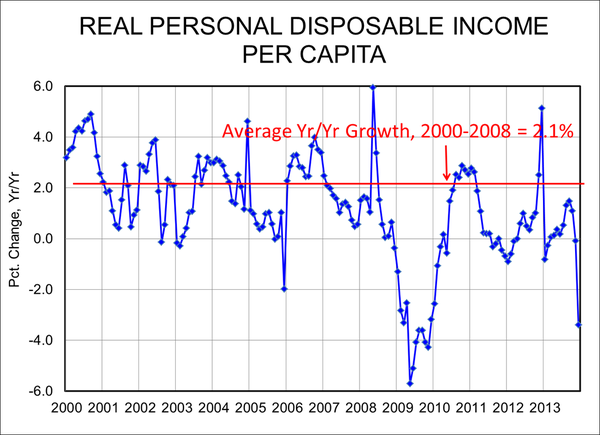

The second one is familiar to many readers as I have been concerned about it for some time: Personal disposable income. This is the amount of personal earnings that citizens have left over after they pay taxes, pretty much an aggregate “take-home pay.” Dividing total personal disposable income by the population and deflating it to represent constant dollars give us real personal disposable income per capita, an important measure of consumers’ buying power.

And the picture for that measure over the past few years is not at all pretty. As can be seen in Figure 5, real per-capita disposable income has averaged a growth rate of just 0.1% since 2008. It averaged 2.1% prior to that time, and I believe it must move back into consistent positive growth rates if the demand increases we witnessed in 2013 are to be maintained. With no income growth, consumers are again dropping their savings rate to support purchases. That is not healthy in the long-run, especially when U.S. savings rates were only in the 5-6% range.

Figure 5

So the macroeconomic picture is muddy. Output is growing, but at a rather slow rate. World GDP continues to recover, but at a slow rate as well. Job gains are undependable and “take-home pay” appears to be stagnant. It’s pretty remarkable that pork demand had such a good year in 2013, but it will be difficult to sustain without some strengthening of these broad economic variables.

You might also like:

Many Factors are Working Together to Impact Pork Supply

You May Also Like