Recent developments with China, including the Phase 1 trade deal (which includes $50 billion in agriculture products) will be huge for agriculture and it's hard to imagine $50 billion being approached without significant pork included.

Pork exports have increased by 6% through October of 2019, according to the U.S. Meat Export Federation. That growth has been primarily to China with exports up 142,260 metric tons, but offset by declines of 71,351 mt to Mexico, 20,119 mt to Japan and 16,863 mt to the Republic of Korea.

Pork supplies have been greater than anticipated by the last Quarterly USDA Hogs and Pigs report. The inventory over 50 pounds at that time indicated marketing would be 4.3% above year-ago numbers for September through December. Actual slaughter through that period has been up 6.2%. The U.S. industry will likely produce an additional 1.64 million head in the fourth quarter of 2019 compared to 2018, or another 350 million pounds of pork (158,900 mt).

As an industry we recognize much of that additional pork needs to be exported in order to have any reasonable market. In the period from September to December of 2018, the United States exported 664,650 mt of pork (excluding pork variety meat). To export all of the additional pork produced, exports would have to increase by 24%.

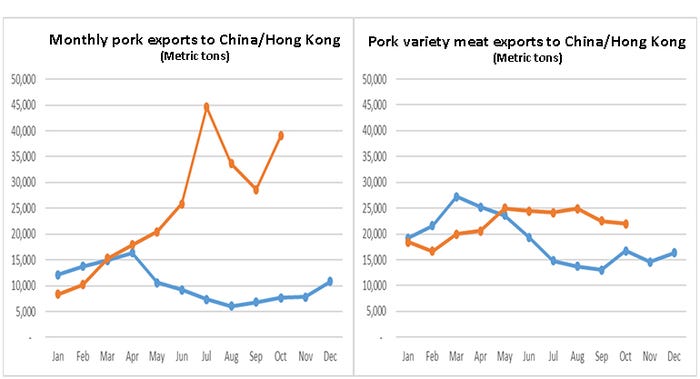

Recent developments with China, including the Phase 1 trade deal (which includes $50 billion in agriculture products), if finalized and executed, will be huge for agriculture and it's hard to imagine $50 billion being approached without significant (or mostly) pork included. As indicated in the charts below, pork exports to China have increased in 2019 as compared to 2018. The top line indicates 2019 to date, reaching a record month in July for U.S. pork to China which surpassed the previous high-water mark set in November of 2011.

With the Japanese agreement set to take effect on Jan. 1, nearing the finish line on the U.S.-Mexico-Canada Agreement, and the gestures being made on Phase 1 of the China trade deal, I anticipate much better export growth in the near future.

Source: Kent Bang, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like