February exports below year-ago levels for U.S. pork, beef

The United States is still Mexico’s primary pork supplier but Canada, Chile and the European Union have all gained market share in 2019.

April 19, 2019

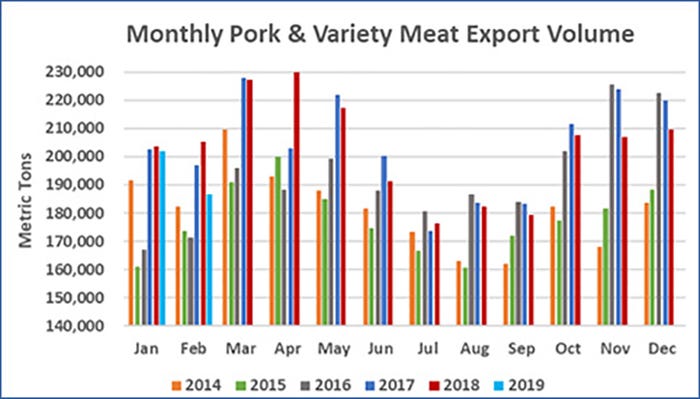

February exports of U.S. pork and beef fell below last year’s levels while lamb exports trended higher, according to statistics released by the USDA and compiled by the U.S. Meat Export Federation.

Pork export volume was down 9% from a year ago in February to 186,745 metric tons, while export value dropped 17% to $455.9 million — the lowest monthly value total since February 2016. For January through February, pork exports were 5% below last year’s pace in volume (388,580 mt) and 13% lower in value ($950 million).

Pork export value averaged $45.12 per head slaughtered in February, up slightly from January, but 21% lower year-over-year. The January-February average was $44.93, down 16%. Exports accounted for 24% of total February pork production and 21% for muscle cuts only, down from 27.8% and 24%, respectively, a year ago. For January-February, the ratio of total production exported was 23.8% (down from 26.1% a year ago) and 20.6% for muscle cuts only (down from 22.7%).

February beef exports declined 6% year-over-year to 94,885 mt while value was down 3% to $581.6 million. January-February, exports were 3% below last year’s record pace in volume (199,651 mt) but steady in value at $1.22 billion. The volume decline is mainly due to lower exports to Hong Kong and Canada, as shipments to most other major beef markets have trended higher in 2019.

Beef export value per head of fed slaughter averaged $309.39 in February, down 4% from a year ago, while the January-February average was down 3% to $296.19. February exports accounted for 12.8% of total beef production and 10.1% for muscle cuts only, down from 13.6% and 10.8%, respectively, in February 2018. For January-February these ratios were 12.5% and 9.9%, each down one-half percentage point from the first two months of 2018.

“The stiff headwinds trade disputes have created for U.S. pork exports have certainly not subsided,” says USMEF President and CEO Dan Halstrom. “USMEF is encouraged by reports of progress toward resolution of these disputes, but in the meantime missed opportunities for export growth are mounting. On the beef side there is still much to be excited about, especially with the launch of U.S.-Japan trade agreement talks. A great deal is at stake for both U.S. beef and U.S. pork in those negotiations, as exports to Japan deliver remarkable returns for the entire U.S. supply chain and it is essential that we get back on a level playing field with our competitors.”

Notes

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton equals 2,204.622 pounds.

U.S. pork currently faces retaliatory duties in China and Mexico. China’s duty rate on frozen pork muscle cuts and variety meat increased from 12 to 37% in April and from 37 to 62% in July. Mexico’s duty rate on pork muscle cuts increased from zero to 10% in June and jumped to 20% in July. Beginning in June, Mexico also imposed a 15% duty on sausages and a 20% duty on some prepared hams.

U.S. beef faces retaliatory duties in China and Canada. China’s duty rate on beef muscle cuts and variety meats increased from 12 to 37% in July. Canada’s 10% duty, which also took effect in July, applies to HS 160250 cooked/prepared beef products.

Pork export value to Mexico down nearly one-third; competition heightens in Japan

Retaliatory duties continue to pressure U.S. pork exports to Mexico, with volume through February down 13% from a year ago to 119,430 mt and export value dropping 32% to $171.3 million. The United States is still Mexico’s primary pork supplier but Canada, Chile and the European Union have all gained market share in 2019.

Demand for imported pork may now be on the upswing in China/Hong Kong due to African swine fever as buyers prepare for a looming pork shortage, but China’s retaliatory duties make it difficult for the U.S. industry to capitalize. The duty rate on U.S. pork is 62%, compared to 12% for other suppliers. Through February, exports to China/Hong Kong were down 22% from a year ago to 54,383 mt, with value dropping 34% to $108.2 million.

In the leading value market for U.S. pork, exports are feeling the pinch from Japan’s lower duties on imports from the European Union, Canada and Mexico. Through February, U.S. pork exports to Japan were down 9% from a year ago in volume (61,464 mt) and 12% lower in value ($248.7 million). Chilled pork exports to Japan were down 6% in both volume (34,685 mt) and value ($166 million).

January-February highlights for U.S. pork include:

Exports to South America continued to shine behind strong performances in Colombia and Peru and a surge in exports to Chile. Export volume to the region increased 44% from a year ago to 25,772 mt while value jumped 49% to $64.1 million.

Strong growth in both Australia and New Zealand pushed exports to Oceania 31% ahead of last year’s pace in volume (20,117 mt) and 18% higher in value ($53.7 million).

Despite lower exports to leading market Honduras, Central America continued to be a strong performer for U.S. pork as growth in Costa Rica, Panama and Guatemala moved export volume to the region 16% higher year-over-year to 14,201 mt, while value climbed 12% to $32.4 million. A safeguard measure in the U.S.-Panama Trade Promotion Agreement triggered April 1, raising tariff rates on U.S. pork through the end of this year, but USMEF still anticipates strong demand for U.S. pork in Panama.

Pork exports to the Dominican Republic remained on a record pace and variety meat exports to Trinidad and Tobago surged, pushing exports to the Caribbean significantly higher in both volume (9,331 mt, up 18%) and value ($22.1 million, up 16%).

Fueled by strong growth in the Philippines and Singapore, exports to the ASEAN region were up 29% year-over-year in volume (7,982 mt) and 21% higher in value ($20.4 million).

Taiwan has emerged as a strong growth market for U.S. pork, with exports climbing 85% in volume to 4,200 mt and value up 50% to $8.6 million. After slumping in 2016, pork exports to Taiwan have trended higher over the past two years.

High inventories and lower domestic prices caused pork demand in South Korea to pull back from last year’s record-breaking pace, but exports to Korea remained relatively strong in both volume (38,209 mt, down 6%) and value ($102.1 million, down 14%). Korea’s hog prices gained momentum in March and were at or above last year’s levels from mid-March to mid-April, suggesting Korea’s pork demand remains strong and the industry is preparing for ASF’s potential impact on global pork supplies.

Impressive growth for beef exports to Japan, Korea; Hong Kong trends lower

Beef exports to leading market Japan remained strong in February, pushing January-February exports 8% above last year’s pace in volume (47,695 mt) and 10% higher in value ($309.3 million). Frozen beef exports to Japan, primarily short plate and cuts in the clod/round category, rebounded from last year when frozen U.S. beef was still subject to Japan’s 50% snapback duty rate.

Variety meat exports (mainly tongues and skirts) have also performed especially well in 2019, soaring 35% in volume (8,707 mt) and 29% in value ($58.9 million). The competitive landscape continues to intensify in Japan, as major competitors enjoyed another decrease in import duties on April 1. The duty rate for beef cuts from Australia, Canada, New Zealand and Mexico dropped from 27.5% to 26.6%, while the U.S. rate remains at 38.5%. The duty rate for beef tongues and skirt meat from these competitors is now 5.7%, while the U.S. rate remains at 12.8%.

Following a record-shattering 2018, beef exports to Korea continue to push higher, though at a more moderate pace. January-February exports to Korea increased 7% in volume to 35,529 mt while value was up 11% to $261.7 million. U.S. beef continues to make strides in the Korean supermarket and foodservice sectors, driven by red-hot demand for U.S. steaks. Prepared U.S. beef products are also increasingly popular in a wide range of home meal replacement items.

Other January-February highlights for U.S. beef include:

While beef exports to Mexico were steady with last year in volume (40,048 mt), value climbed 13% to $197.9 million. Beef muscle cuts achieved strong growth in both volume (24,434 mt, up 15%) and value ($155.5 million, up 19%).

Exports to Taiwan were 3% ahead of last year’s record volume pace at 8,342 mt, but value slipped 6% to $73.7 million.

Beef exports to Central America cooled in February but January-February exports to the region were still up 17% year-over-year in volume (2,357 mt) and increased 14% in value ($13.2 million), with growth driven mainly by Costa Rica and Honduras. Beef exports to the Dominican Republic have surged in 2019, climbing 87% in volume (1,470 mt) and 78% in value ($11.5 million).

Africa has been a promising source of beef variety meat growth this year, with variety meat exports to South Africa (mainly livers) increasing 80% in volume (1,179 mt) and more than doubling in value ($1.1 million, up 113%). Variety meat exports were also sharply higher to Gabon, increasing 311% in volume (739 mt) and 157% in value ($529,000).

As noted above, a slow start to 2019 in Hong Kong and Canada partially offset solid growth in other markets. Exports to Hong Kong fell 40% to 13,712 mt, valued at $110.4 million (down 35%). Exports to Canada were down 15% in volume (15,908 mt) and dropped 13% in value to just under $100 million.

Lamb exports continue to gain momentum

U.S. lamb exports continued to trend higher in February, driven by muscle cut growth to the Caribbean, Mexico, Panama and Saudi Arabia and strong variety meat demand in Mexico and Canada. February exports of U.S. lamb totaled 1,361 mt, up 51% from a year ago. Export value was $2.43 million, up 31%.

For muscle cuts only, exports climbed 17% from a year ago in volume (244 mt) and 31% in value ($1.55 million).

Through February, lamb exports were 67% ahead of last year’s pace in volume (2,745 mt) and 37% higher in value ($4.57 million). Muscle cut exports were up 46% in volume (488 mt) and 38% in value ($2.72 million).

Source: U.S. Meat Export Federation, which is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like