Uptick in futures, markets provides breathing room

Producers have opportunity to repair some of the financial wounds inflicted by COVID-19.

February 15, 2021

Pork producers that have survived the throes of COVID-19 and the subsequent upheaval in the markets are finally able to print black numbers with the uptick in the futures and cash markets. This breathe of fresh air was long awaited, and if we are anywhere close to right, could allow us some decent profits for 2021 and set the stage for opportunities in 2022. When was the last time we could say that?

The backlog of animals that has plagued the supply side has finally subsided to a degree that resembles something closer to a normal balance of shackle space relative to market-ready inventory. There are a couple things at play from our in-barn management when things were really backed up to the recent spate of farrowing house disease that have impacted production. The transition from a few too many to not enough is on the horizon and markets are responding accordingly.

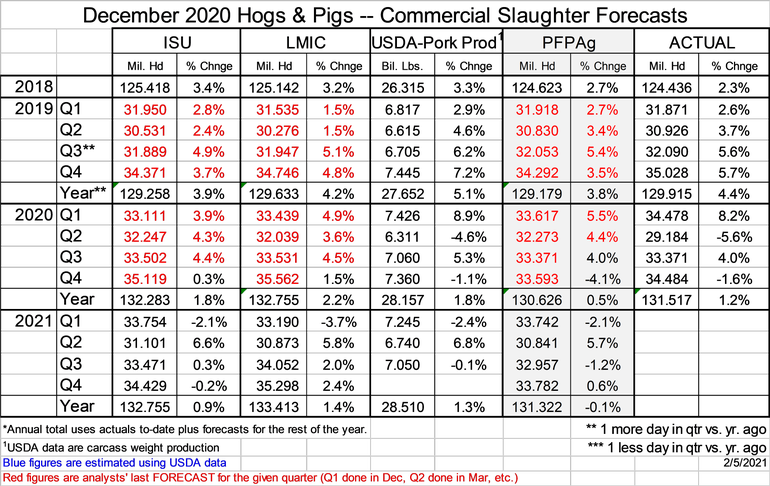

Per the table below, as derived from the most recent USDA “Hogs and Pigs” report, total production in 2021 is not scheduled to move the needle much relative to last year, but the feel of the market as well as demand (more on that later) is one of shorter supplies than implied by the report. This scenario is setting up nicely for the pork production community to post profits and make decisions about their operation’s future in a more positive economic light.

(Note: the 2021 percentage changes are derived from the 2020 actual. The aberrations of last year make for some potentially unexpected values presented. When we get in these gyrations, it is helpful to compare actual numbers for mental comparison.)

The recent behavior of the April contract and the uptick leading to the February settlement should cause you to pay attention – something is up. It could be a squeeze coming into the expiration; we will see if that was the case this week if product and cash bids fall out of bed. I suspect it is something a bit larger that just coincided with the April contract taking over as lead month this week. I believe we have a genuine shortage of both product and pigs that is just beginning to evidence itself after months of brewing quietly in the background. We have heard several reports of bellies being in high demand, and we know that USDA’s “Cold Storage” report has been indicating reduced inventory for quite some time. The prospects for a reduced run of animals in an overarching environment of economic stability is turning the tide. As we know, as goes the belly, goes the cutout. We have a positive trajectory.

The economic stability I am referencing is not confined to the borders of the United States. We have had some opportunity to travel recently and the level of activity at airports, the pricing and availability of rental cars, the cost and availability of hotels and the timing of dinner reservations at the preferred restaurant all indicate that we are domestically trending back to the new normal in our country.

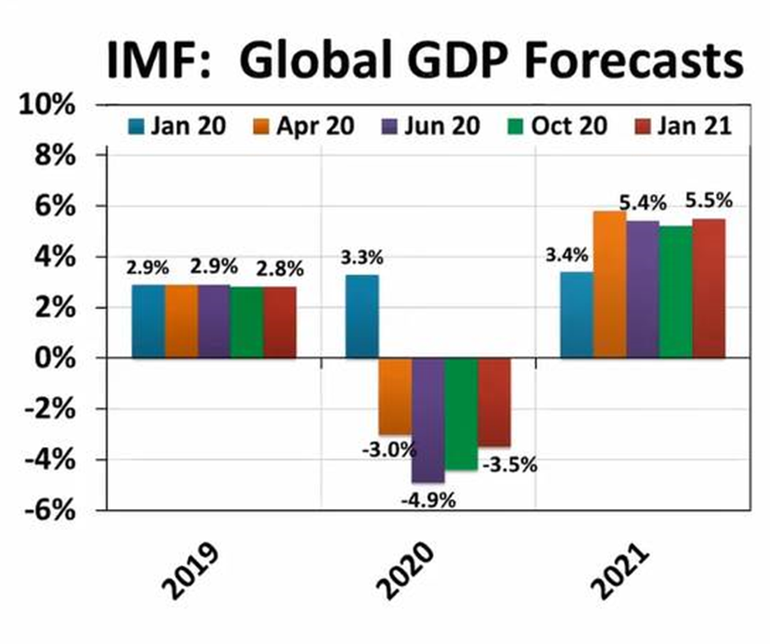

Attached is a chart, courtesy of Brett Stuart, that depicts the global picture as projected by data from the International Monetary Fund. Note the 2021 forecast shows a nice rebound. If you dig a little deeper in the numbers, the world economy is anticipated to be led by recovery in Asia in the first half of the year before the western countries participate fully in the last half of the year. This brings me back to the demand side of the equation. Not only do we have a pronounced decrease in available supply of pork and pigs, demand is robust as well. I am a bit tired of experiencing the “perfect storm” of factors that have led to our struggles, it is nice to be on the other side of the wave.

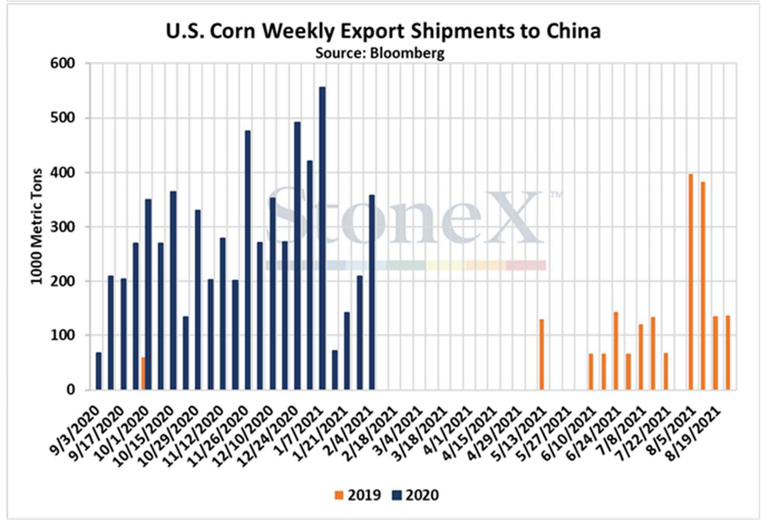

This uptick in world economic activity has taken no prisoners. Our input markets, primarily corn and soybean meal, have also been swept up in the movement and were out in front of the livestock markets for a couple of reasons. Chinese demand and South American production woes are probably the biggest factors.

The South American production issues are likely more of timing rather than crisis. Their crop was planted a bit late, the needed rains during the early production season were sparce, the commencement of harvest of the first beans in South America was met with heavy rains and there was a long line of empty ships waiting to load. This has brought additional demand to the U.S. until the situation straightens itself out. But make no mistake, Brazil is on queue for a record harvest if/when they can get to the maturing crop. It is an issue of timing.

World demand for soybeans is record high this year and will likely be surpassed next year with the growing appetite from China. Between a rebuild of their hog herd, the suspension of swill feeding that has resulted in a more western style corn/soy diet, and production shortfall of corn relative to their use by a tune of roughly 90 mmt/year, this one looks to be more than just a flash in the pan.

The first chart below depicts the movement of corn from the U.S. to China this year relative to last. In fact, you could take almost any year from the past and it would look the same since China has been a casual player in the importation of corn for quite some time. The pronounced shift to becoming a major importer of corn is being felt in the market, and in my humble opinion, is the key impetus to what should set up as a dynamic acreage battle if the snow ever thaws in the Midwest and we start to think about planting a crop.

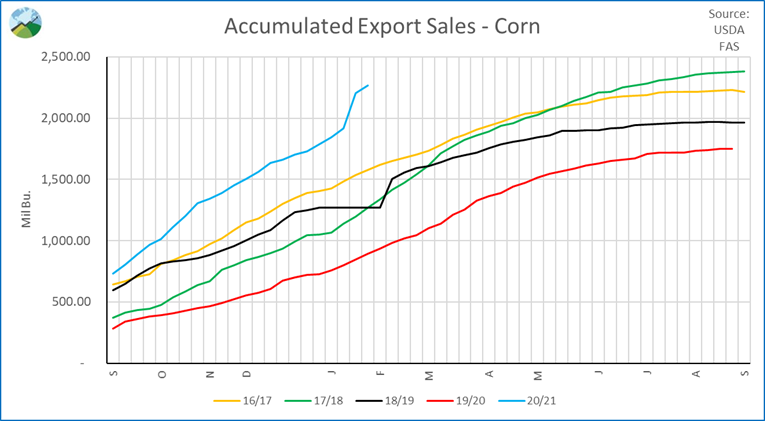

The second chart is the cumulative sales of corn from the U.S. to all destinations. We are in a nice demand market, and these conditions tend to have a bit more staying power than a supply disruption that can be solved with the next crop.

Here is the bottom line: after several months of proverbial artillery shells exploding all around us, we are in a period of quiet and calm, with a lot of blue sky on the horizon. We have an opportunity to repair some of the financial wounds inflicted, and dare I say, even prosper in 2021. Forward margins are attractive and the risk-management tools available to the pork producer are getting better. We have an opportunity to negotiate the environment with optimism and hope. This could be fun again.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

You May Also Like