What's the plus-minus outlook for the current U.S. pork industry?

Things shaky enough to take a defensive mindset in your risk management decisions for 2023.

March 13, 2023

For a guy who grew up in Oklahoma in the '60s and '70s, I'm a pretty big ice hockey fan. No, I never played much. There were very few ice rinks and pond hockey in Oklahoma is fraught with dangers, drowning be foremost.

But I had the good fortune of rooming with a Canadian and the goalie on the Iowa State club team so I learned a bit about the game and I enjoy it greatly. There are lots of good athletes in the world but the fact that hockey players do what they do on skates still amazes me. But I digress.

One of the stats observed by hockey fans is "plus-minus." It's a gross measure of a player's effectiveness that is simply the number of goals his team scores minus the number the other team scores while he is on the ice. Yes, there are other players out there but everyone is expected to play both offense and defense so this is, to me, still a reasonable measure. It has even caught on in basketball.

So, what's the plus-minus outlook for the current U.S. pork industry. In it's purest form, I suppose that would simply be the profit outlook: Plus for revenue, minus for costs. But that would make for a very short column this week so I'm going to expand today's discussion to address the "plus-minus" factors as I see them for the remainder of this year. I will draw some information from last week's outlook session at the Annual Meat Conference put on by the Food Marketing Institute and North American Meat Institute. I once again shared the stage for the outlook session with Randy Blach, CEO of CattleFAX and Paul Aho, president of Poultry Perspectives.

Profits

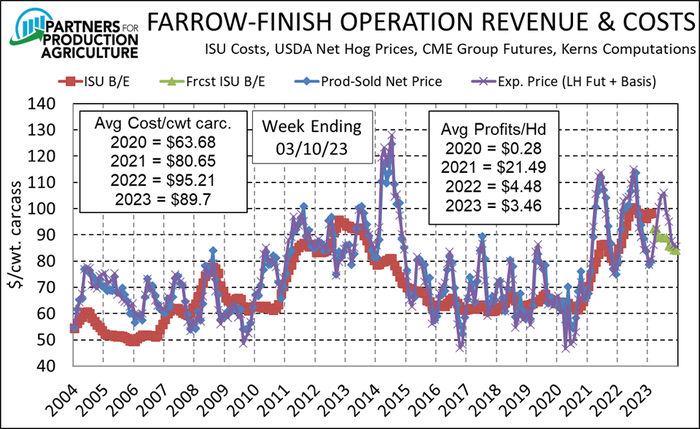

Let's start with that grossest of measures and I mean gross as "over-arching" not "yuck" though right now the word works for both! This is a big minus at the moment. Figure 1 shows historical data for Iowa State University's Estimated Costs and Returns, my forecast for costs based on that historical data and CME corn and bean meal futures as of last Friday, and hog price based on CME hog futures as of last Friday and historical national barrow/gilt net price basis.

The ISU costs and these returns best represent the low-cost 25% or so of U.S. hog operations and, even for those very good producers, 2022 and, it appears, 2023 are nothing to be pleased with. What's more, the 2023 costs are understated (and profit overstated) because my cost model uses only corn and soybean meal futures values and thus omits the unusually positive basis levels which have been witnessed in recent months. The omission of basis is the reason for the clear discontinuity between the ISU costs (red line) and my cost forecasts (green line). It amounts about $5 to $7/cwt. carcass or $10-$14 per head, thus putting the 2023 profit forecast well into the "minus" column. Adjust these to represent the average producer ($10-$12 per head higher on costs) and things get even uglier.

Demand

Wholesale pork and hog demand have been soft since last fall and our lagged data for consumer-level demand are showing that it, too, has waned in recent months. The good thing is that these reductions are occurring from record high levels in 2021 and 2022. The bad thing is that none are showing much sign of recovery. Significant demand improvement was the case in January and February of 2022 so I continue to hold hope that some improvement might be seen this year but that limb gets shakier by the moment. Put this in the "minus" column at least for now.

Prices of competing products

This is a plus for beef and a minus for chicken with some changes in the offing. The Choice beef cutout is pushing $290 and is poised to set new non-COVID records later this year. That's a positive now, that could be a big positive later.

Chicken prices have struggled under the weight of an output surge last summer and fall when the sector apparently solved their "ineffective rooster" problem but simply adding more roosters. I think the resulting "minus" chicken price swoon is a major factor in soft wholesale demand for pork as retailers and restaurants featured profitable chicken products. But chicken companies are moderating production and Aho expects some significant improvement in chicken prices later this year. Another potential "plus" factor.

Hog supplies

It has been difficult to track these amidst a number of weather disruptions this winter. But after catching up from the pre-Christmas storm that backed up 650,000 head or so, hog supplies have continued to run ahead of the number implied by USDA's December report. After two remarkably accurate reports in June and September, the statisticians at NASS appear to have undershot the inventories of pigs over 120 pounds by about 2%.

I expect a revision of the June-August pig crop in the next report due out on March 30. The question is "Why did they miss?" Is death loss lower than last year and all of the anecdotal chatter of state pork producer meeting season? Are litter sizes finally increasing at 1%-plus again? Are there more sows out there? We'll get the answers eventually but for now this is a "minus." I hope we get more clarity in the March report.

Economy

What was concerning about some things while other things seem hunky-dory tuned decidedly ominous last week with the failure of Silicon Valley Bank and, now, the closure of Signature Bank over the weekend. SVB is no small deal as it was the 16th largest bank in the United States. I'm no banker or bank watcher but I'm a bit surprised that such a large bank could end up with a portfolio de-valued so much that it fails quite this quickly.

Higher interest rates always cause bond values to fall so this is one of the unintended (though surely not unexpected?) consequences of Federal Reserve rate hikes. News reports say that U.S. banks have $620 billion with a B in unrealized bond losses at the moment. The question is whether enough of those losses are concentrated in a few banks to cause more failures. The key work there is "unrealized" since they won't be actual losses unless a bank or banks is forced to try to liquidate them. This doesn't seem quite as scary as the 2008 meltdown but . . . a "minus" for sure.

World grain and oilseed supplies

Argentina continues to be a big "minus" here as estimates of both its soybean and corn crops decline. Brazil has been a "plus" for its anticipated record soybean crop but is still a bit shaky on corn as moisture has delayed planting of the Safrinha corn crop which is primarily destined for export. Ukraine will be a "minus" relative to history regardless what happens with the Black Sea corridor negotiations – and could be a big "minus" if those are not fruitful.

USDA predicts a big increase in U.S. corn acres but it is mid-March and who knows how this planting season might go. U.S. soybean supplies will remain tight but the cavalry is on the way in the form of new crushing plants – a "plus" but one that won't be manifested much until 2024.

How the plusses and minuses balance out will be quite interesting. I still think things are shaky enough to take a defensive mindset in your risk management decisions for 2023.

About the Author(s)

You May Also Like