What is going to happen to the hog market?

Suffice it to say that exports have been a drag on wholesale pork demand all year and will remain so – but to a lesser degree.

September 13, 2022

What has happened to the hog market? That question is on everyone's mind at the present. It leads quite logically to "what is going to happen to the hog market?" Let's try to unpack some fact to consider in answering both.

Recent large breaks in wholesale cut values and hog prices are not, in my opinion, supply related. The number of hogs coming to market and the amount of pork being produced has been quite close to the levels that I and, I believe, most analysts had expected. In fact, slaughter has been about 1.2% lower than I had forecast since June 1 based on my model usage of figures from the June Hogs and Pigs report. And using just USDA's year/year increase in market hog inventories and last year's actual weekly slaughter, that difference is just 0.3%. Kudos to the feds on very accurate market and weight class inventories!

So have exports been bad? Well, yes, but that too was about as expected and we actually don't have a clue what has happened since the week of Aug. 11 since USDA's Foreign Agricultural Service ran into a snafu with a new system and doesn't seem to really care about the fact that people need their information! They say they will have data this week but we are betting that it will be one big lump sum covering four weeks. How helpful is that? This agency just doesn't get it.

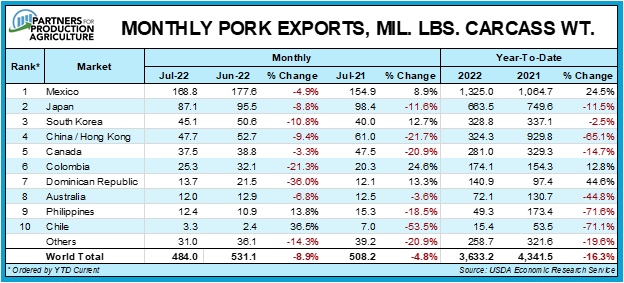

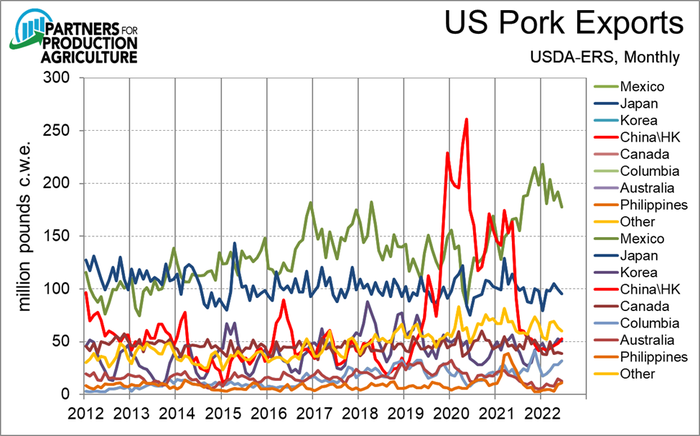

July exports were down "only" 4.8% from one year ago (Figure 1). I say "only" because that is the closest we have been to 2021 levels so far this year. These small year-on-year declines will likely continue since we are now comparing to significantly lower levels of shipments to China one year ago (Figure 2). U.S. pork exports are still down 16.3% from last year YTD. That means nearly 5% of production has been left on our shores for consumption this year. The YTD number will get closer to zero from now through December but it appears the industry will still be down 8 to 9% for the entire year. Suffice it to say that exports have been a drag on wholesale pork demand all year and will remain so – but to a lesser degree.

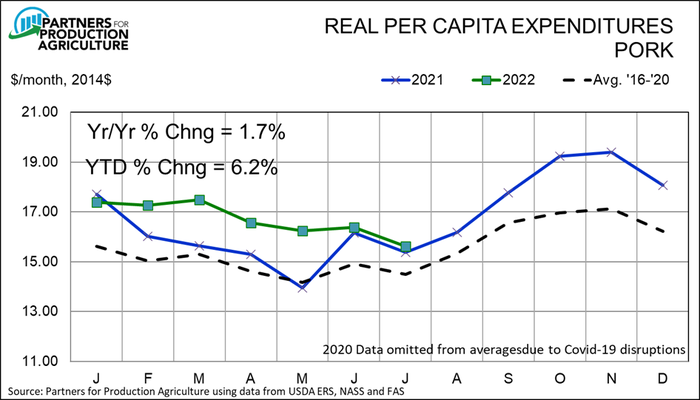

Domestic demand is a different story. Consumer level demand was record high last year and has been even stronger virtually every month in 2022. Real per capita expenditures for pork were 1.4% higher yr/yr in July and that level brought YTD pork RPCE to +6.2% . Figure 3 shows clearly that the best demand months of the year are likely ahead of us. The reason? U.S. pork production rises in the fourth quarter and U.S. consumers typically consume much more pork and do no force retail prices to decline. Steady prices and more volume mean demand is strong!

So why have the wholesale and pig price cratered? In a nutshell: Because consumer-level demand is not the relevant demand for those two markets. Wholesale demand and pig demand are "derived" from consumer-level pork demand. Retailing costs, packer costs, profit margins and market position all cause the differences between the demands to change. Think of the three as an accordion with consumer demand at one end, hog demand at the other and wholesale demand in the middle.

Sometimes the accordion gets compressed and hog demand moves closer to retail demand. Such was the case this summer. Supplies were seasonally tight and it was a seller's market – for both pork and hogs.

Sometimes the accordion gets stretched out and hog demand gets further from retail demand. This usually happens when hogs and pork are plentiful and buyers are in control. That has not been the supply situation this past few weeks but wholesale buyers backed off on purchases, putting downward pressure on prices of bellies, hams and butts. The middle of the accordion got farther from the retail end.

And the same happened for hogs as packer margins declined sharply. The demand for hogs has fallen relative to consumer level demand – for the moment.

I say for the moment because there is good news: The information we have suggests that the consumer demand end of the accordion has not moved. That's important as demands at the other market levels can increase more easily if they don't have to "lift" consumer level demand at the same time. The space in the accordion can be reduced. That does not frequently happen in the fourth quarter but this recent expansion of the distance between farm and consumer demand has been much larger than usual.

Are we going back to $120 hogs? Absolutely not but I think we could see some strength between now and November and, with sufficient packing capacity, the market could improve this fall. That's unusual, I know, but my models say that per capita pork availability will be low enough to support stronger prices than we seen now.

CME LH futures obviously do not agree with my position and I admit that bucking the futures market is not a comfortable position. I'll stay out on that limb for now. Demand is still record high and that, to me, is a sufficient reason for optimism.

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like