Tyson Foods to close Perry, Iowa pork processing plant

Reduction in capacity will make conditions very snug again this fall, putting pressure on spot purchase prices for hogs.

March 11, 2024

Tyson Foods announced today that it is closing its Perry, Iowa slaughter plant, effective June 28. The plant had a capacity of 9,000 head per day. It was strictly a single-shift plant and reportedly employed 1,200 workers.

This announcement is not a huge surprise as it has been rumored for some time that Tyson was considering this change. The Perry plant originally belonged to Oscar Mayer and was, I believe, built in the 1950s or early 1960s. It has been modernized several times over the years and has been involved for several years in supplying specified products to Japanese importing firms.

Tyson will likely absorb some of these pigs at its other Iowa plants. Storm Lake and Waterloo are reportedly among the most cost-efficient plants in the country. Those plants have capacities of 17,250 per day and 19,500 per day, respectively. Tyson’s other Iowa plant at Columbus Junction can process 10,350 head per day.

The closure will put national weekly slaughter capacity at roughly 2.65 million head assuming a 5.4 day workweek. My forecasts have slaughter per kill day up 0.6% this fall. This reduction in capacity will make conditions very snug again this fall if those slaughter levels occur, putting some pressure on spot purchase prices for hogs.

That same situation happened this past fall with negotiated prices falling into the $40s. Based on current supply forecasts, I can’t rule that out again this year with lower slaughter capacity. Much will depend on how well wholesale demand can hold during the fall months and thus keep product values high.

Readers should note that I and everyone else will get an updated view of those potential supplies on March 28 when USDA releases its next quarterly Hogs and Pigs report.

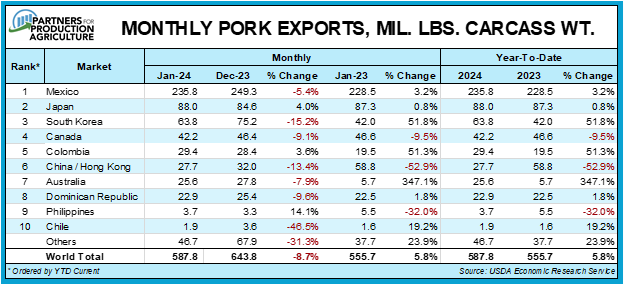

U.S. pork exports began 2024 right where they left off 2023—on a good note! See Figure 1. January exports totaled 587.8 million pounds, carcass weight. That figure is 5.8% higher than last year. It was led, of course, by shipments to Mexico which were 3.2% larger, year-on-year, and accounted for just over 40% of total U.S. shipment. South Korea jumped past both Canada and China/Hong Kong to claim the number three spot just behind Japan. South Korea shipments were 51.8% larger than last year and are likely the result of opportunities that have been created by the reduction of EU pork output.

Figure 1

U.S. pork imports were up 3.9% from last year in January. Imports totaled 98 million pounds, less than one-fifth as large as our exports.

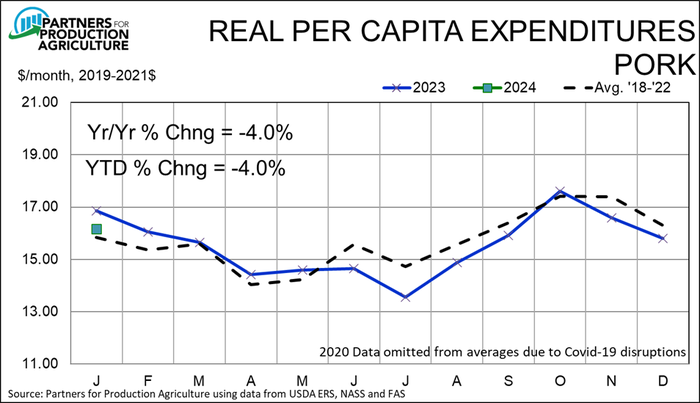

January real per capita expenditures for beef, pork and chicken were up 3.4% from one year ago and marked the fourth highest non-Covid month on record. The charge upward was led by beef RPCE which was 9% higher than last year. Chicken RPCE was down -0.6% year-on-year while pork RPCE was 4% lower versus January 2023 (see Figure 2).

Figure 2

Is this a cause for concern? Yes it is. Is it a cause to get one’s hair on fire? I don’t think so. January’s observation is still above the five-year average for January. The five-year average data in Figure 2 omit 2020 due to the wild impacts of Covid-related plant shutdowns but they include 2021 and 2022 when pork RPCE was at record highs. That “average” line is by no means “average” when viewed in a longer historical context.

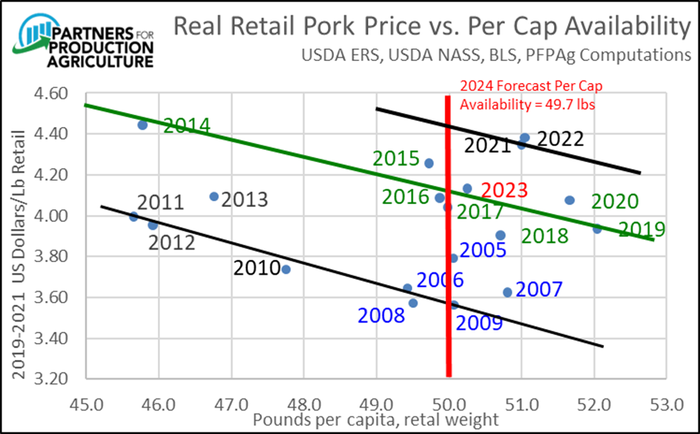

The next few months will be critical in assessing the true condition of pork demand. RPCE figures should be higher than last year since demand struggled mightily in the first half of the year. Note in Figure 3 that the scatter plot location for last year was still among the pre-2021 family of annual price-quantity pairs. That is certainly short of ’21 and ’22 but those years were largely driven by stimulus payments in consumer’ pockets, something that did not happen in ’23.

Figure 3

Domestic per capita availability is currently forecast to be slightly lower than in 2023 due to slight output growth and another 5% or so growth for exports. The question is where deflated retail prices will go this year. Will consumers be willing to pay more for these slightly smaller offerings and, if so, how much more?

Demand is not consumption! Price is a key part of the demand situation.

About the Author(s)

You May Also Like