Subtle hints turn into sharp jabs

We should not be lulled to sleep given the quantity of market-ready hogs ready to move after snow is cleared in the Midwest.

January 15, 2024

The USDA was out this past week with its January report, one of the more anticipated publications as we shore up previous year production figures and get a marker on ending stocks. Markets have been hinting for several weeks that prices need to soften, and this report put an exclamation point on that sentiment. A few tidbits:

Corn

USDA adjusted corn yield higher to over 177 bushels per acre on over 94 million acres. Let’s think about that. Big acres means that we did not just plant the crop on black and level soil in the vicinity of Peoria. We stretched the Corn Belt a bit and still had record yields in a growing season that was nearly devoid of any moisture in the month of August This, in itself, is impressive.

But what happens to yields when we get a growing season that is actually conducive to good yields? Do not be surprised when USDA’s February forum initial balance sheets show the next yield estimate north of 182. Even if we lose a few acres (highly likely) we will have a supply/demand sheet that is heavy and portends lower prices. Both December 2024 and December 2025 corn futures pricing has slid below $5 per bushel and will likely continue to move lower. Given the heavy corn supplies, price has the responsibility of getting low enough to encourage more disappearance.

There is only one viable place for that to occur: you. The feeding sector is the only area that has enough flexibility to make a difference. We can tweak around the edges with ethanol, but they are already running full tilt and there is not much more demand to squeeze there. Our export channels are all clogged and South America is taking over world shipping.

If we are going to see any meaningful uptick in offtake, it has to be the livestock sector. However, you are only going to feed more corn if it is priced more competitively relative to alternatives. That’s a big reason why the overwhelming direction of the corn market is lower, even though we are currently trading at the lowest levels in almost four years.

Soy

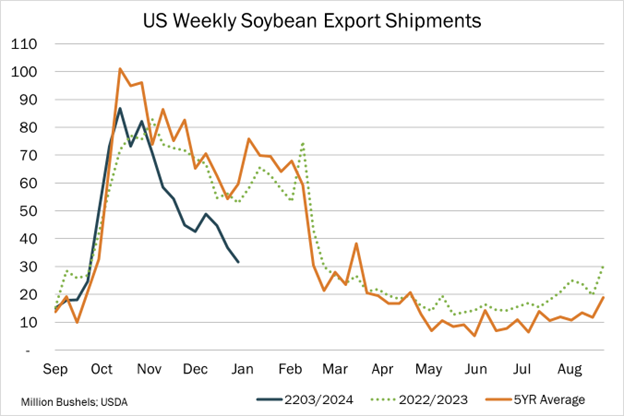

Soy yields increased a bit, as well, crossing over the psychologically important 50 bushels per acre threshold. The soy market has less to do with the United States right now and is a lot more about what is happening in South America. Issues here center around the dismal pace of export sales and shipments and the prospects for South America to completely dominate this sector in short order.

Kerns

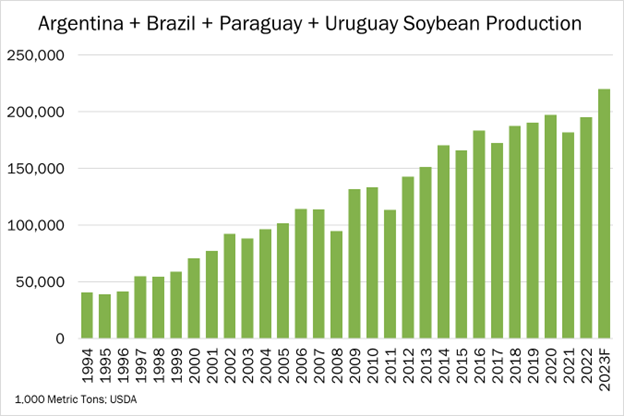

If the U.S. was going to flex any muscle in soy export arena, we needed to do it in the past several months. Now, the window of opportunity is quickly closing. South America is sitting on a record crop. You may hear the noisy gong about troubles in Brazil that are real and substantiated. What you may not hear is that Argentina, Paraguay and Uruguay are having very fine growing years and projected output from South America as a whole is on pace to reach record heights. And if the trend continues, South America will break this record next year and for years afterward. We (the United States) forfeited the title of the world’s #1 soybean producer in 2018 to the Brazilians — today they produce about 50% more beans than we do. This is not a trend that is going to reverse anytime soon.

Kerns

Use ratio and farm price

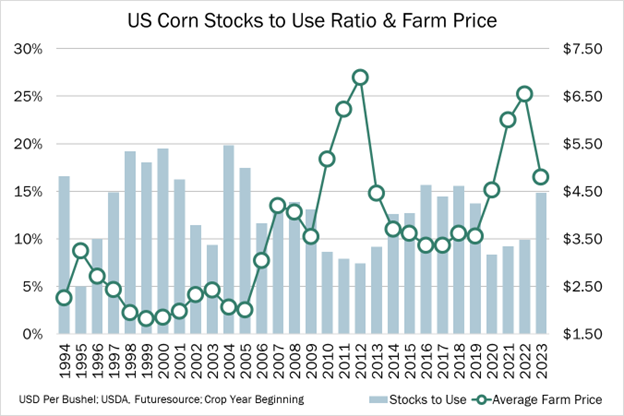

The last thing I want to address on the grain side is the future direction of the market using recent history as our guide. Take a look at the graph nearby. I’ve circled 2014 through 2019, years with an average stocks-to-use ratio of 14.1%, close to expectations for the 2023/2024 (14.8%). What might those six years teach us? The answer may surprise you a bit in a good way for animal agriculture (but it’s not so great for the grain guys).

Kerns

According to USDA data, farm prices in those years ranged from $3.36 to $3.70 per bushel, averaging $3.53. After the WASDE report, December 2024 futures closed near $4.80 per bushel, right where USDA forecasts farm pricing. But if history is any indication, we can take this corn market sharply lower — even though March corn was trading in excess of $6.00 per bushel during the summer growing season. The grain farmer has had a wonderful window to sell his crop at much higher levels and has largely passed on the opportunity. We are now in a definitive bear market where, as discussed earlier, the livestock sector will likely determine additional utilization and values will have to compress for you to bump up inclusions. You are in the driver’s seat.

Lean hog futures

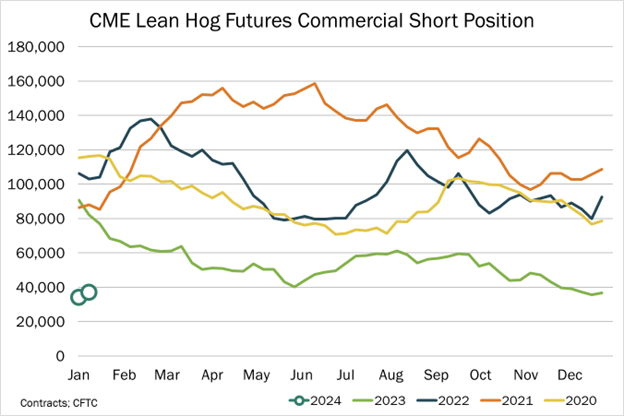

Switching gears, the revenue side of our business – the key driver of profits – has seen a nice little pop in recent weeks, thanks in large part to fund activity. The same commodity funds that have been pounding on the grain market are beginning to amass a long position in the hog market and have made their influence known with steadily higher values at the CME. The attached graph shows that producer participation has fallen to low numbers. This is not a surprise.

Kerns

The lack of profits on the forward curve are limiting short hedges. We are the natural seller in the market and our absence in conjunction with fund buy orders creates a bit of a vacuum to the upside. If the funds want to buy and there is nobody there to sell, what happens to price? It moves higher. And that is exactly what we have witnessed in the last several trading sessions.

I point this out so we, as market participants, can identify the difference between a fund-driven market and a fundamentally-driven market. They are two different things and we should not be lulled to sleep given the quantity of market-ready hogs ready to move after the snow is cleared in the Midwest. This is a welcome rally for certain, but it is fund-driven, not one that I think has the legs to bring us back to profitable levels without some change in the fundamental market.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Kerns via email.

About the Author(s)

You May Also Like