Something to contemplate

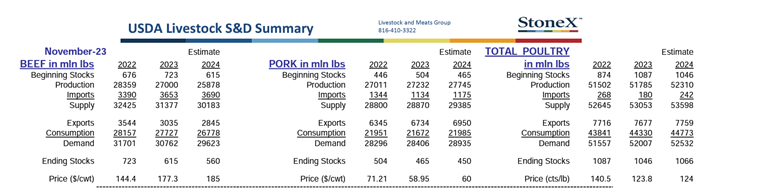

Feed demand was pushed higher, while same USDA release showed a decrease in protein production from the three major species.

November 20, 2023

Dr. Steve Meyer did an excellent job last week of identifying data points that are likely to direct the hog market, he also shared the inflection items that may alter the trajectory. Make no mistake, we are in a tough position as a pork production community given the dynamics he articulated. Let's take a look at some things that may allow us to turn a corner.

Corn price

I think the USDA may be just flat wrong with their November balance sheet and I do not write that lightly. The production side of their estimates went up nearly two bushels per acre, that seems consistent with the information we have witnessed both anecdotally as well as results off the combine. The disappearance side of the equation is the one that puzzles me.

The USDA increased utilization in all three of the major demand categories – feed, ethanol and exports – when the current evidence would point toward a lowering of all three if they are changed at all. Consider this: the EPA is estimating lower ethanol production in the same timeframe where corn used for ethanol was bumped up 50 million bushels. Hmm.

Exports were raised 50 million bushels while the pace of exports lags behind the pace necessary to hit the target even before the bump in export projections. As we sit right now, the clock is running out for the U.S. to ship to nearly anyone in the world aside from our somewhat captive market in Mexico. Double hmm.

Feed demand was pushed higher(also by 50 million bushels) while the same USDA release showed a DECREASE in protein production from the three major species. You can’t make this stuff up. (See chart below).

Kerns

As I studied the feed use tables, something did not seem right to me so I went back to the October report to compare values. Indeed, something was not right. Note on the table below that the USDA lowered its estimates of protein accretion for 2023 from October to November. What this means is that protein production was, apparently, overstated to begin with which would have artificially inflated the corn used in the balance sheet and then they lowered the protein production even further for 2024 while somehow raising corn utilization? This makes no sense.

Kerns

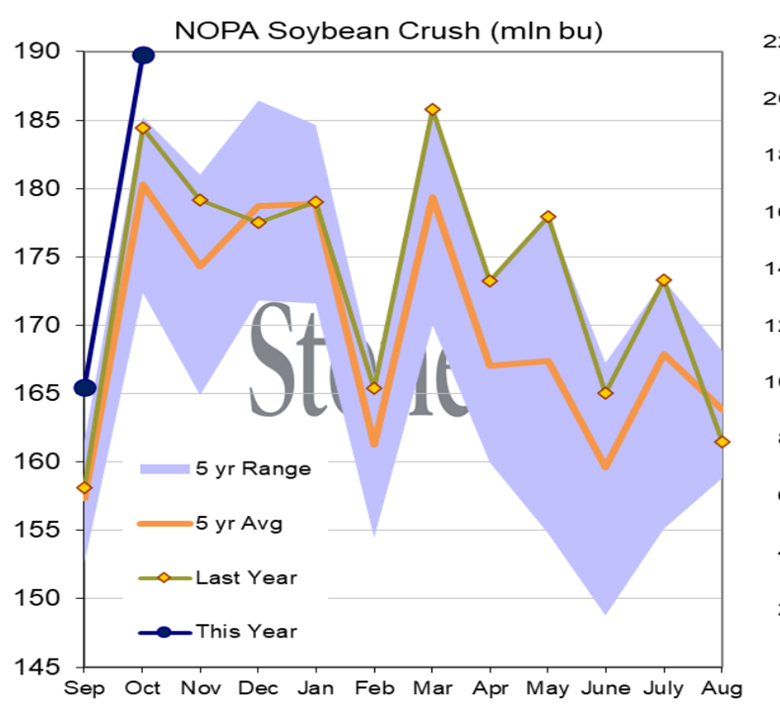

You could argue with a straight face one of two things: substitution or inclusion. There may be a plausible argument that corn looks attractive to the diet in relationship to the price of soybean meal, but the bump up in prices is a relatively recent phenomena – 30 days ago we were trading at roughly $100/ton less than today (chart below) and there is ample evidence that I will share later that crush rates are going nowhere but higher which should normalize the price relationship.

The substitution piece does not seem too plausible. That leaves us with inclusion. (Author’s note: I realize that substitution and inclusion are inexorably tied together in the formulation process, I am trying to isolate variables to better understand the changes in the balance sheet.) In order for this to be true, the USDA would have to substantially lower their price projections to something in the lower $4ish area and they did no such thing, conceding a mere 10 cents per bushel from the October report, moving from $4.95 to $4.85 per bushel.

The bottom line is that this report simply does not pass the smell test. It feels like there is a reluctance – for whatever reason – to keep the published corn balance sheet much more snug than the data would suggest. Our internal work would push a carryout number to closer to 2.4 million bushels which is decidedly not a tight situation.

Kerns

Soy complex

Soybean meal, in my opinion, has hit its apex and is on the cusp for a reality check to lower values. Three items support this bias. Unlike the corn balance sheet, the USDA seems to have the soy situation dialed in accurately. The goal of the market will be for the U.S. to limp into January with just enough beans in the pipeline to support domestic meal offtake.

If we are unable to hand off the leadership of exports to Brazil for reasons of production woes or logistical challenges in South America, thing will get dicey in a hurry. Brazilian weather has not been fantastic for the early part of the planting season but the two-plus week forecast was termed “ideal” by a well-respected market analyst and we have not seen anything close to the weather being praiseworthy so far this season. Reason for optimism that things will turn for the better in Brazil.

The second item of note is the economic woe of several of our export destinations. China’s economy is soft to say the least. During his recent visit to the U.S., Chinese President Xi (in a very surprising tone) was advocating peace and cooperation between his nation and the U.S. – something very un-Chinese like from a negotiating posture that normally projects strength whether it is justified or not. Soybean meal demand is soft in Asia and the path of least resistance is lower prices.

The third item to support my position was the recent NOPA crush report that was not just a record for October, it was an all-time in the life of the U.S. soy processing industry record. It is likely to stand for roughly 30 days. Given the crush capacity that has been built and is coming online in the U.S., we should not be surprised when production records are broken until the industry settles into a new norm. My best guess is that is about three years away. Until then, we will see more beans crushed domestically which means more soybean meal has to find a home. This is a good setup for the proteins sector.

Kerns

Pork complex

There is no sugar-coating the reality of the current situation as it relates to pig supply and producer profitability. We have been and are in a tough stretch with plenty of supply and demand that has not allowed for prosperity.

Do not look for help anytime soon in the form of Chinese imports, we had a great check-in recently with some folks with boots on the ground and the economic woes of the Chinese pork community mirror that of the U.S. The endemic nature of ASF takes no prisoners and the larger systems are seemingly less nimble at handling the disease. Producers of all sizes are losing money, the smaller producers are in better shape due mainly to their softer regulatory standards and availability of labor.

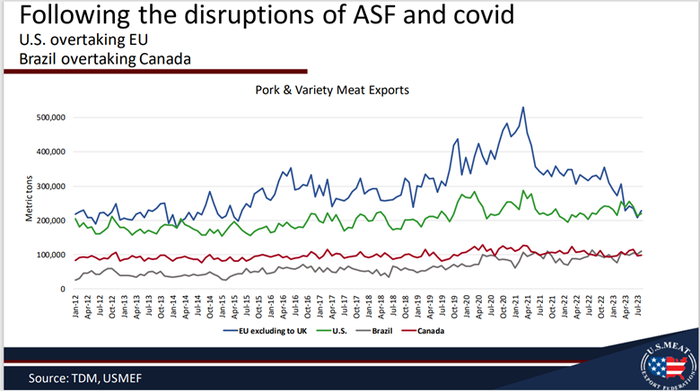

Even if China is not the savior, remember that the U.S. is quietly becoming the world’s #1 exporter of pork. Our year-over-year exports will be higher this year and we are looking for a modest increase in 2024, the big factor is the European Union’s contraction in output and shipments. Per the chart below (courtesy of Erin Borror and the U.S. Meat Export Federation) note that the U.S. overtaking the EU for the top spot in exports has less to do with our prowess, it has more to do with the collapse of EU participation. This is reason for optimism as the inelastic nature of pork demand could turn the tide of our fortunes in a hurry if/when it occurs.

My words of optimism are supported by data, it is more than just “hope.” We are simply going to need more time to wade through our current tough scenario to get to a positive financial position.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Kerns via email.

About the Author(s)

You May Also Like