Pull your hat down tight — it could be a wild ride

Have we ever had so many balls in the air? I suppose so, but I can’t remember them being quite as explosive as some of these seem to be.

December 3, 2018

As the calendar winds down on 2018, we are not at a loss for things to consider in pork and hog markets. There is still a huge amount of risk at both ends of this market. The positive side is predicated almost completely on China. Its African swine fever situation and the ongoing but apparently paused trade war with the United States will be key to rallies in the U.S. market. The negative side would be predicated on ASF finding its way to the United States.

Those are the extremes, but there is a huge set of intermediate results that could still move the market significantly. Here are my thoughts about key factors in the next few months.

ASF — China

This is the single largest factor in world pork markets. The Chinese situation seems to get worse each week even though we don’t know many details at all. USDA’s publication of data showing small actual pork shipments last week and slightly larger booked pork shipments for next year was ballyhooed by many as the starting gun for a new export race. We think it was positive but are not ready to say things are changing yet. Our reticence is primarily due to the weekly data series not fitting well at all with the monthly (and more dependable) monthly data series from the Commerce Department and Foreign Ag Service.

This weekend’s announcement that the United States will not be escalating tariffs on Chinese goods puts a more positive spin on the situation and some are reading China’s willingness to resume importing U.S. agricultural goods as a clear sign that they need pork. That could be, but we probably need to wait for details.

ASF in Sichuan and the wild boar population in China are both quite foreboding developments. We still expect the big needs for pork to begin next summer when today’s breeding animal losses translate into missing market pigs.

ASF — European Union

We haven’t heard much lately out of Europe but, given ASF’s history, stopping it in the presence of a large wild boar population seems unlikely. The question is whether it gets into domestic pigs and whether the EU, with its high level of control and organization, can stamp it out if it does. Reports indicate that animal health officials have been very aggressive in removing wild boars in the area of Belgium where the disease was found. The wild card here is how the EU handles pigs and pork movements if Germany breaks.

U.S. hog supplies — Not as big as expected

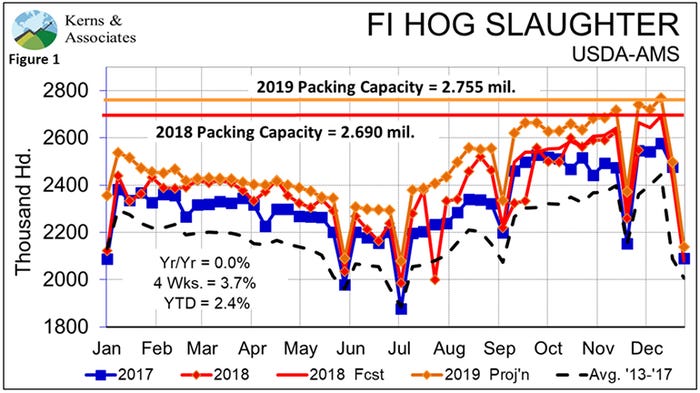

USDA’s September Hogs and Pigs report missed the 180-pound and over category by 2% or so to the high side. That figure allows for the hogs that were not harvested due to Hurricane Florence the weeks ending Sept. 14 and 21. Slaughter since mid-October (i.e. the 119-to-170-pound inventory) has been very close to our expected levels but numbers have been very short the past two weeks. (See Figure 1.) About 40,000 of the 100,000-head shortfall last week were due to winter weather on Nov. 26.

Packer margins have tightened, and they made little effort to catch up on those hogs last Saturday. Still, producer-sold barrow and gilt weights rose quite normally last week and are well below last year’s inflated level and even the five-year average.

Bottom line: We are current on marketings even with lower slaughter. At least for the moment, the hogs USDA expected are not out there.

Strong economy — But storm clouds are rising

While unemployment is low and wages are rising, the long-term prognosis for the U.S. economy is softening a bit. Why? Because things can’t stay good forever and this expansion is now 113 months old, second in length only to the 120-month expansion of 1991-01. Increases in short-term interest rates are “compressing” the yield curve. What was once a spread of 144 basis points between the Fed Funds Rate and the 10-year treasury note has now been less than 100 points in three of the last four months. This is not a yield curve “inversion” where short-term rates exceed long-term rates but we are moving toward such a condition. Recessions are frequently already in process when the rates actually invert. We aren’t there yet but the trend is that direction.

Big crops and great condition in South America

While USDA has been adjusting U.S. crops lower due to harvest difficulties, they remain very large and will result in large carryouts, especially for beans. Reports from both Brazil and Argentina are pretty much glowing suggesting that their second (i.e. “Soffrina”) crops will be planted on time and will likely be big.

World corn stocks are none too ample, but a good South American crop will likely ease what pressure there is. Another big southern hemisphere crop will just about bury us in soybeans. That becomes even more true if China loses significant numbers of pigs. U.S. production costs will remain low for the foreseeable futures.

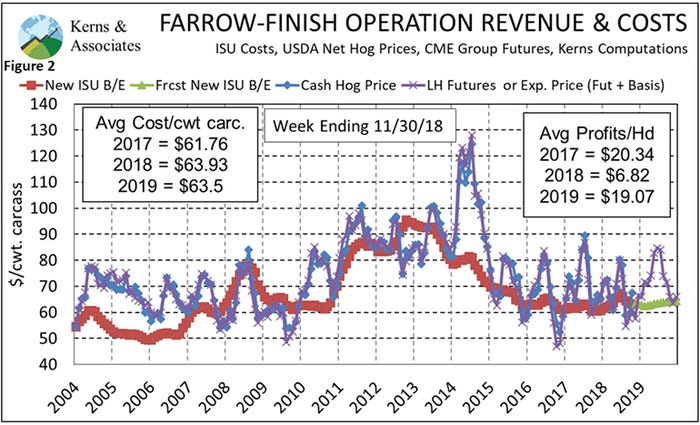

As can be seen in Figure 2, our model which represents the best 15-20% of producers, pegs 2019 average farrow-to-finish costs at $63.50 per hundredweight carcass based on corn and soybean meal futures prices last Friday. Today’s rally would push that estimate higher, of course, but still likely leave it below $64.

Optimistic futures versus fundamentals

When we put projected supplies in our price models, we still peak the 2019 hog market in the mid-$70s next summer. That is significantly lower than Lean Hogs futures and those futures prices last Friday imply profits of over $19 per head next year. “Yeah, but China could push prices much higher!” you might argue. And I would have to agree with that and reply “Yes, and a case of ASF here could push them down by as much as 75%.”

How much risk can you stand — both financially and emotionally? That is the question. There are strategies that would let you put a floor under prices and still participate in a rally. I think that sounds smart and would urge producers to discuss the possibilities with their marketing advisers.

Have we ever had so many balls in the air? I suppose so, but I can’t remember them being quite as explosive as some of these seem to be. Pull that hat down tight. It could be a wild ride.

About the Author(s)

You May Also Like