Fund buying and other Christmas cheer

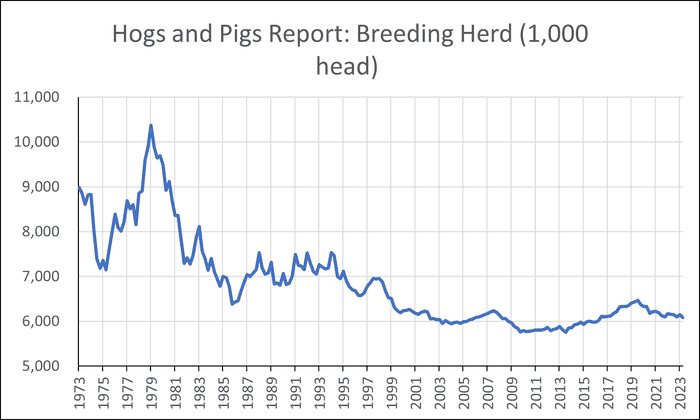

Possible to see a breeding herd of less than 6 million sows, not seen since 2014 PED, and approaching the fewest sows in report history.

December 18, 2023

The recent strength in the hog market has many folk welcoming the gift and wondering where in the world it came from. The fundamental picture is not changing much: plenty of market-ready hogs on queue and limited slots for marketing them. The answer is likely the result of fund buying after a forensic look at market action and changes in open interest.

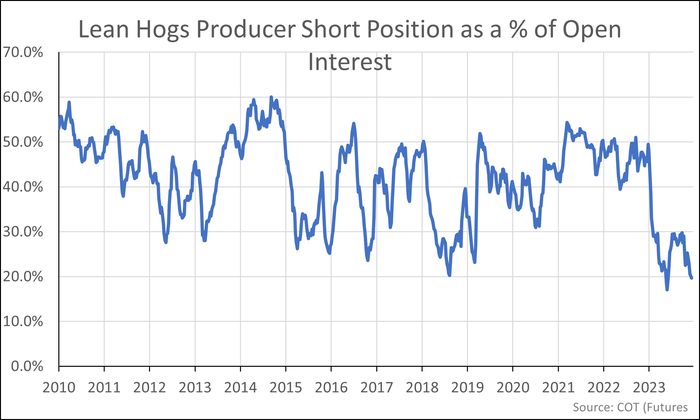

The funds are poised to have an oversized influence on the hog market given our current setup of skinny producer hedges. In fact, producer shorts are approaching the lowest levels since 2009 – not a big surprise in light of the lack of profitability availed to the pork producer for a sustained timeframe.

Kerns

We are awaiting the release of the December Hogs and Pigs report this Friday, Dec. 22 and I see little evidence of a Merry Christmas surprise. It is possible that we will post a breeding herd of less than 6 million sows, something we have not seen since the porcine epidemic diarrhea year of 2014 and approaching the fewest sows in the history of the report. And further reductions are likely forthcoming.

We are seemingly a victim of our own success. The pork industry is the poster child for efficiency, productivity and environmental stewardship. We consistently improve our utilization of resources (feed conversion, average daily gain) while advancing our productivity (pigs/sow/year). We produce more food with a lower sow base and fewer inputs on a consistent basis.

The missing part of “sustainability” is a critical component: profitability. We are currently in a transition to discover a balance in supply and demand at levels that allow us to make a living, it just can’t come fast enough to recover some financial stability.

Kerns

I was recently at producer meeting that had someone from the fertilizer industry on a panel discussion. There is good news on that front as the price declines we experienced from the 2022 crop input year to 2023 looks like it will extend into 2024. India, China and Europe all have fertilizer production facilities that are either being initiated or expanded.

At this time last year, a crop farmer was looking at corn futures in the $5.80 area compared to today’s $5.10 forward curve for both December of 2024 futures as well as December 2025 futures. Because of the drop in input prices, the profitability on an acre of corn is roughly the same. This is beneficial for the protein sector as the grain farmer has a financial incentive to plant every acre and maximize output. The agronomic world is in its own transition as slowing world demand is intersecting with increasing production.

Closer to home, the Biden administration is indicating that a change in the classification of ethanol to allow it to shine in a more favorable light when evaluated by the Department of Energy’s Greenhouse Gasses, Regulated Emissions and Energy Use matrix. Details are expected to be released by March 1.

This does at least a couple of things, in my opinion. The Biden administration has been a huge proponent of vehicle electrification which, on its own, would be the death knell to the ethanol industry. To counter this ethanol use decline, Sustainable Aviation Fuel almost had to be considered as an offset to the Tesla-favored vehicle policy. This ethanol reclassification is not a surprise.

What should also not be much of a surprise is the timing of the announcement in the spring of an election year. For those of us involved in animal agriculture, this likely means that the nemesis of the ethanol plant being able to move basis will be perpetuated. We are not increasing ethanol production, per se. We are just extending the shelf life of a process that was declared a transition fuel at its inception … and we still have not yet discovered the hand off to The Next Big Thing.

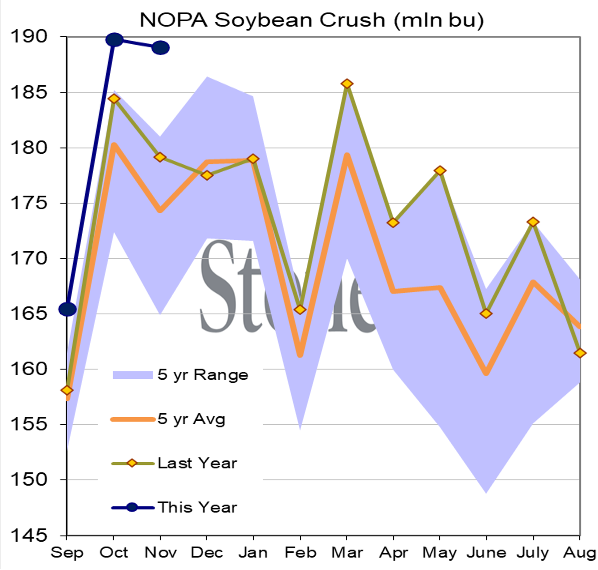

The long-awaited increase in soy crush that will result in more soybean meal production is finally starting to hit stride. Crush was a record for November, barely under the all-time record in October. We are going to be setting a multitude of crush volume records in the months to come as plants come online and add to the overall capacity of the soy processing industry.

This is welcome news for all of animal agriculture as we crush for soybean oil and it generates a relative surplus of soybean meal for us to feed. I anticipate this impact to really kick in gear in the March 1 or so timeframe when Argentina harvests their new crop soy and fires up processing capacity to satisfy the export market.

Kerns

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Kerns via email.

About the Author(s)

You May Also Like