Your tax dollars at work for you – I really mean it

For the pork producer selling his manure, the value of the product to the agronomic community via these credits just went up substantially.

April 15, 2024

.jpg?width=850&auto=webp&quality=95&format=jpg&disable=upscale)

In a politically charged environment where competition for resources runs at a fever pitch, it is not a big surprise that the chasm in opinions is probably at one of its widest points in memory. I recently had the opportunity to listen to Karl Rove contextualize this situation and he went deep into the history of the United States with its frequent raucous power struggles – the data would show that our current friction is nothing new.

What is different in this era is that we do not settle disputes in a Burr vs. Hamilton manner, instead we take to social media to make our side look rosy and the other side look oh-so terrible. The general approach from the agricultural community is to live within our means, make good on our obligations and generally operate as responsible financial stewards. We may be out of touch a bit with societal demands that are financed by our tax payments.

That whole scenario is about to make an abrupt shift under a provision called 45Z in the controversial Inflation Reduction Act. Proponents of the legislation see it as a modern-day New Deal with the goal of uplifting society via the addressing of carbon initiatives. Others see it as yet another boondoggle of wasteful spending with a marginal opportunity for meaningful impact. Regardless of your political views, the pork sector is on queue to be a huge beneficiary of the law, here is how.

The 45Z provision of the tax code provides credits to the ethanol industry (hang with me, this will turn back to pork) if they are able to reduce their carbon footprint via a model from the Department of Energy called GREET (Greenhouse gases, Regulated Emissions, and Energy use in Technologies). If they are able to meet the thresholds, they receive tax credits that could be used to offset federal tax liability. The biggest component of carbon index scoring for an ethanol plant is corn they grind followed by the energy used to run the facility.

One of the biggest components of carbon indexing for the corn producer is synthetic fertilizers – this is where the pork sector comes into play. There are a lot of moving parts and interplay between various agronomic practices, but in a recent example of farm ground in northeast Iowa, the carbon index was cut in half via the use of manure. If this makes sense to you – hog manure is more carbon friendly compared to commercial fertilizer -then you have the premise behind the subsequent math. And the math is impressive.

Each point of reduction in carbon intensity is worth about 5.5 cents per bushel to the ethanol plant. In my stated example, a hog farmer using his own manure raising 220 bushel/acre corn could be generating a value of an additional $.80/bu compared to not using manure. Remember, this is the value to the ethanol plant and there will be a water down effect by the time it gets to the row-crop producer, but we are talking about big enough values per acre (220 bpa x $.80 = $176/ac) that we can afford some slippage and still do quite well. For the pork producer selling his manure, the value of the product to the agronomic community via these credits just went up substantially.

The 45Z credits are scheduled to commence in January of 2025 and run for three years. Ergo, the crop that is currently going in the ground now will be the first production that is practically available to participate in this program. Many of you may remember the identity preservation efforts of high-lysine corn or high-oil corn that required physical segregation for a relatively paltry return. This program is significantly more lucrative without near the hassle, that is a win on both counts.

There are details for consideration for all producers as the GREET model does not treat all fields equally, there are several sites that offer an opportunity to discover your current carbon index score and learn more about the program – continuum.ag is my current favorite. (Note: the GREET model is scheduled to undergo a revision that had a self-imposed deadline of March 1 that has not been released as of this writing – oops, your government at work.) The main point of this article is to raise awareness of the program and identify how it will impact you.

I think there are at least two take-homes from this program. First, the value of the manure in your operation is about to take a marked shift higher whether you are using it yourself or it is being applied on neighboring fields. Second, this program is going to make the ethanol plant a fierce competitor for bushels should we ever hit a short crop. We in animal agriculture are likely going to have to ration because the ethanol plant is almost guaranteed profitability under this new operating scenario. I will share more information in subsequent articles as this one unfolds.

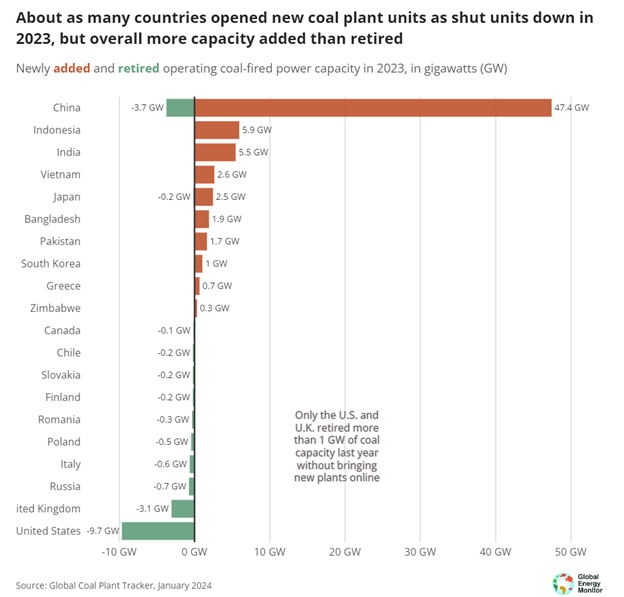

Finally, it may be important to keep everything in perspective. The U.S. sponsorship of a carbon solution may have a bit of folly associated with the effort when you consider that China continues to open more coal fired plants than the rest of the world can retire. Until we have a global solution to addressing carbon emissions, the U.S. taxpayer is putting a band-aid on (and paying for) a situation that requires surgery.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Kerns at [email protected].

About the Author(s)

You May Also Like