Hog Welfare

thumbnail

Livestock Management

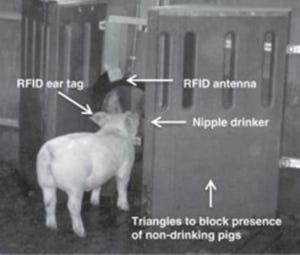

A step towards smart swine barnsA step towards smart swine barns

Evaluating the suitability of emerging technologies.

Subscribe to Our Newsletters

National Hog Farmer is the source for hog production, management and market news

.jpg?width=300&auto=webp&quality=80&disable=upscale)