Industry has grappled with tariff wars, African swine fever, the COVID-19 pandemic as well as numerous other factors.

It’s hard to believe three years have already gone by since the last World Pork Expo. So much has transpired in the past 36 months, and it will be good to finally catch up in person with friends, colleagues, and industry professionals to take stock of where we are at as an industry at this critical juncture in time. As we gather again, hog and pork markets are very strong and despite rising feed costs, profit margins are favorable looking out on the forward futures curve. As most readers are aware though, this has not always been the case and wasn't when we last gathered in Des Moines.

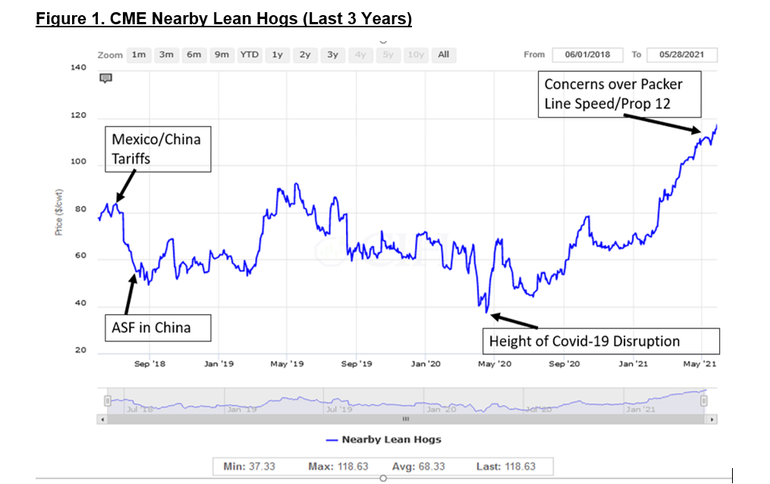

We have experienced tariff wars with China, watched an ongoing global struggle with African swine fever, experienced a massive global market disruption resulting from the COVID-19 pandemic and continue to deal with issues impacting trade (Figure 1). Compounding this, the global feed market has been equally upended with a quick and unexpected tightening in the supply/demand balance that has driven prices to multi-year highs.

Since we last gathered, there has also been the introduction of a new risk management tool in the CME’s Pork Cutout contract as well as improvements in the Livestock Risk Protection (LRP) insurance program from the Risk Management Agency (RMA) of USDA (revisions from June 2020, September 2020), and January 2021).

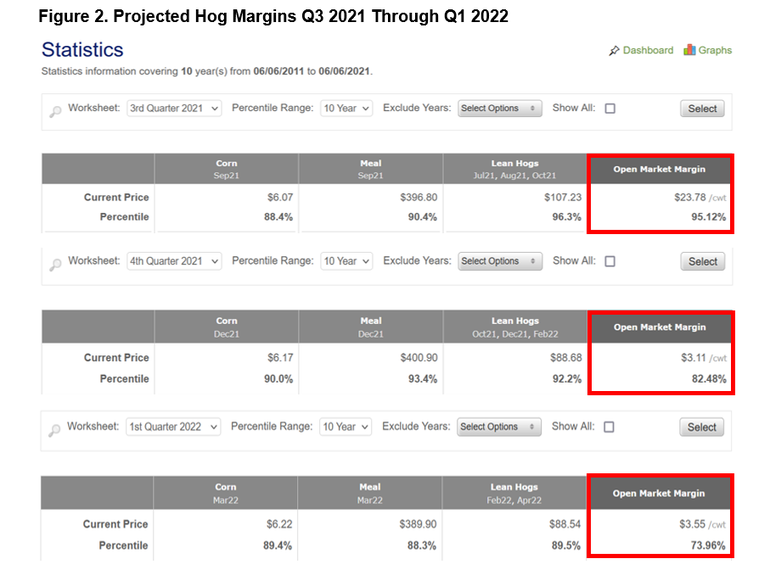

Despite all the chaos and market disruption of the past 3 years with these significant market events, projected margins when looking out on the forward futures curve are both positive and historically strong – above the 90th percentile of the past decade in Q3, the 80th percentile in Q4, and over the 70th percentile in Q1 2022 (Figure 2).

At the same time, there is uncertainty over the impact from other factors yet to be determined like the packer line speed decision and Proposition 12 in California. Adding to these concerns, a major set of reports from USDA will be released at the end of the month, including the “Quarterly Hogs & Pigs,” a revised “Crop Acreage," and the quarterly "Grain Stocks,” all of which will provide additional risk.

Meanwhile, the normal seasonal weather considerations affecting crop progress and conditions are augmented this season due to tightened domestic and global S&D.

Looking specifically at the three-year margin history for Q4 in Figure 3, you will notice that profitability has only been stronger during the initial surge of pork imports from China in 2019 resulting from their ASF-related domestic supply shortage prior to the COVID-19 pandemic last year. You will also notice that fourth-quarter margins have been quite volatile over the past three years, ranging from an over $20.00/cwt. positive margin during that time to a loss of nearly $25.00/cwt. just ahead of Q4 2018.

Q4 pigs are already on the ground and the upcoming USDA “Hogs & Pigs” report at the end of the month will hopefully provide some more clarity on that supply later this year. While domestic demand has been robust, there are some concerns of a slowdown in shipments to China along with lower price trends there. In the meantime, reduced packer line speeds will begin July 1 and there is still quite a bit of time left in the growing season with significant risk exposure for producers who buy most or all of their feed needs on the open market.

While it is impossible to know what will happen over the remainder of this year into 2022, it is possible to protect strong forward margins today. Fortunately, there are many tools available to producers from LRP to futures and options on the CME to manage these margins. Both the hog and feed sides of the margin equation should be carefully considered in the strategy selection process however given the high historical prices we are currently trading at.

LRP could be an excellent tool for someone who is looking to establish cash flow-friendly, cost effective coverage on their hogs. Options might be a sound approach to managing feed costs in the current market environment by providing upside protection against further price spikes while maintaining opportunity to the downside should the market move lower into harvest. Futures may also play a role for those who would like to lock-in margin opportunities on at least a portion of their forward production.

Despite the strategies you choose, there are many contracting alternatives available and we look forward to seeing everyone this week in Des Moines. Please stop by our booth at V361 in the Varied Industries Building to review specific strategy ideas for your operation. In addition, you can always contact us with any questions about how LRP or futures and options may fit into your risk management approach.

Source: Chip Walen, CIH, who are solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.

About the Author(s)

You May Also Like