Everyone must take ownership of their role in mitigating the spread of the disease.

August 4, 2021

When it comes to having the best pig production, health is king. Healthy pigs grow faster and more efficient with a high survivability rate while ultimately keeping pig costs low. Once disease is introduced into a sow herd or grow finishing group, the exact opposite happens. The extent of the severity and its impact on performance and economic outcome really comes down to two main factors: the health issues and the animal husbandry.

Porcine Reproductive and Respiratory Syndrome (PRRS) was first discovered in the United States in 1987-88 and quickly became one of the largest economic impacts on the swine industry. The latest PRRS breaks, identified as the 1-4-4 Lineage 1C, has been touted as the most challenging and costly of any previous strain.

In this article, analysis will be done to look at how severe the 2020/2021 PRRS positive breaks have been in nurseries compared to previous years. Nursery analysis was performed utilizing the MetaFarms Ag Platform with specific focus on United States (U.S.) customers only. In the calendar year 2020, the U.S. MetaFarms customers had slightly more than 9,000 closeouts (9,085) with total pigs started of nearly 17,000,000.

To minimize the spread of PRRS, every phase of production has been modified, sow farms seeing the biggest changes. Several sow farms have been modified through changing air flow by filtering, enhancing biosecurity measures at supply and people entry points and changing how animals are transported and moved. A main reason why so many changes have and will continue to occur on sow farms is the trickle-down effect to nursery and finishing performance and the resulting economic impact.

When PRRS is first introduced into a sow farm, the impact on the sows is much less than the impact it has on piglets. Typically, PRRS affects sows with lower piglet viability, abnormal amounts of abortions and higher than usual mortality. After a period of time, the effects on sows minimizes. However, the effects on the piglets weaned continues until sow health stabilizes.

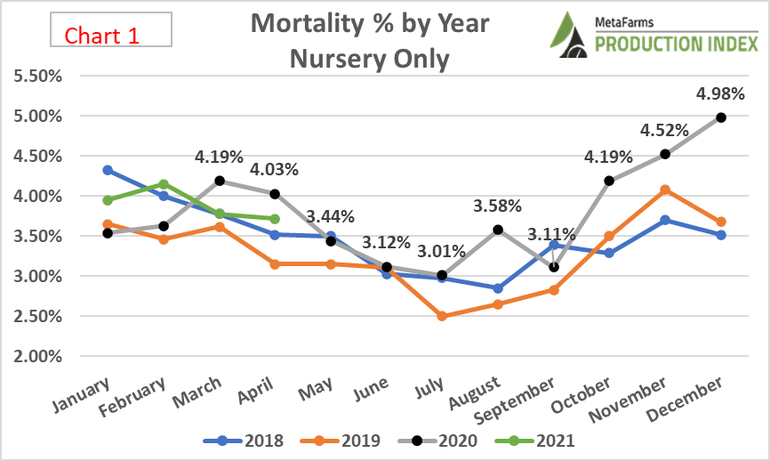

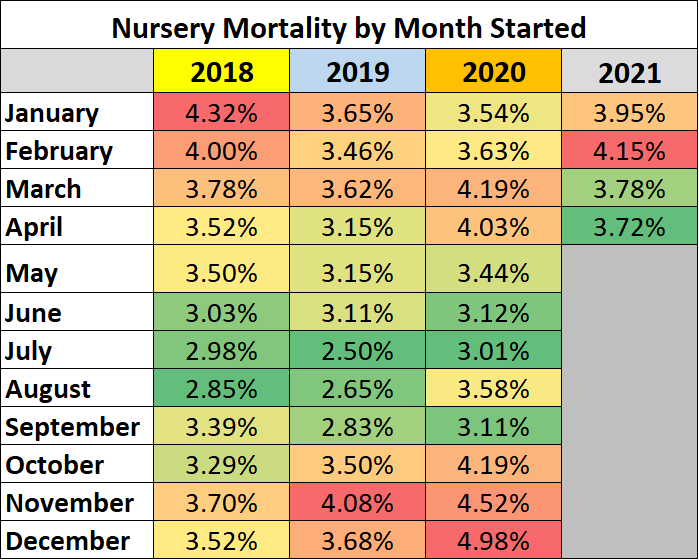

In this article, with as up-to-date closeout performance as available, we will look at how nursery groups performed by the starting month with heavy focus on, before, and after PRRS season. Chart 1 shows the average mortality percentage broken down by month. The grey line, indicating 2020, saw noticeable separation starting in October thru December, which shows us how bad the 1-4-4 strain has been. In this 40-month analysis, the December 2020 average of 4.98% was 0.66% (15.3% change) higher than the next highest month of January 2018. Historically, PRRS “season” starts in October with an increase in positive sow farm breaks and continues until the early months of the following year.

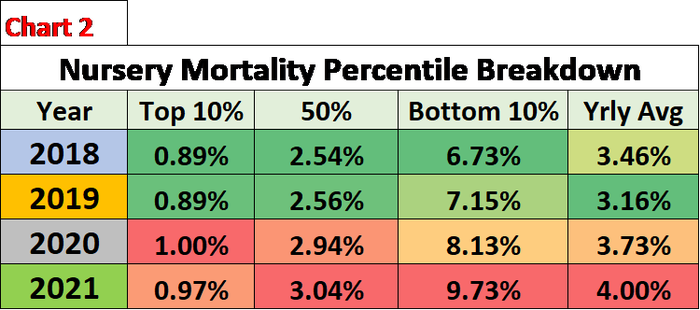

Chart 2 shows the yearly mortality average broken down into three different percentiles with a yearly average. The top 10% represents the best 10% of groups closed out during that timeframe whereas the bottom 10% shows how the worse groups closed out. This chart shows the severity of the PRRS breaks on nursery closeouts with all but the top 10% being higher than the previous three years. For 2021, the months involved were groups that started from January 1 to April 30.

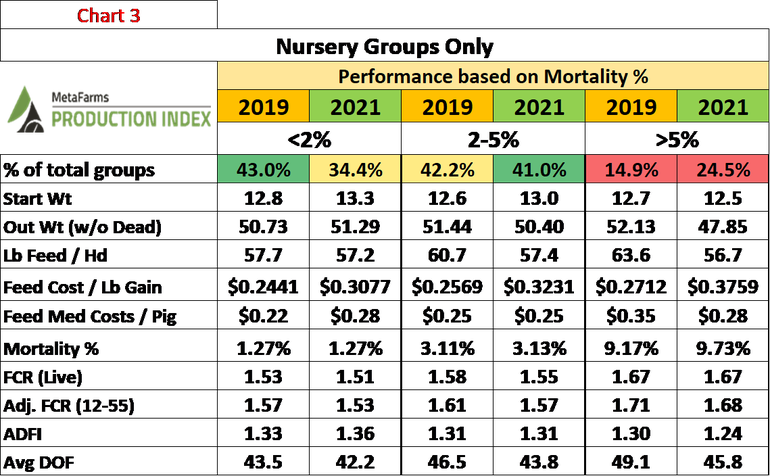

Digging deeper into the performance and economic difference of nursery mortality groups, Chart 3 shows three different mortality percentage breakdowns between 2019 and 2021. Nursery closeout groups with less than two percent mortality were combined together to provide analysis with the same logic for the other two brackets. 2021 has had 24.5% of its total groups close out with greater than 5% mortality while 2019 had only 14.9%. Notice the difference not only in the 2021 average mortality but also in the impact that it had feed cost per pound gain when compared to 2019. Feed costs have increased in 2021 when compared to 2019, but the difference of these groups by $0.1047, or 38% higher, cannot be overlooked as it shows how costly it is to raise these health challenged groups.

In July 2021, the National Pork Industry Conference (NPIC) had a session led by Dr. Chris Sievers and Dr. Ryan Strobel of Swine Vet Center that focused on some of the best ways to manage PRRS positive pigs in nurseries. The session had some very simple but valuable topics to help producers and caretakers on the core fundamentals of animal husbandry, which would be feed, water and air. Both veterinarians noted that keeping pigs warm and dry would, in turn, stimulate water consumption and feed intake, thus giving the pig a chance to survive.

An area that also can be overlooked is the impact that unhealthy pigs have on the caretakers. Receiving multiple shipments or groups of these health-challenged pigs can be demoralizing, so if you are a field supervisor, we recommend commending these growers on doing a good job during the challenges.

The mystery behind why the PRRS strain of 1-4-4 Linage 1C has had been so widespread and challenging remains unsolved, so what can be done by the pig caretakers on a daily basis? Everyone must take ownership of their role in mitigating the spread of the disease. Are you properly cleaning your vehicle, including places like the floor mats? Are all products coming into a farm properly cleaned and disinfected? With the possibility for a foreign animal disease outbreak in the U.S., now is the best time to tighten up biosecurity measures, and everyone needs to be involved.

MetaFarms Analytic Insights were used to provide the context and trends for this article. If you would like to see an analysis of how PRRS impacted your nursery performance, or if you have suggestions on production areas to write articles about, please contact Bradley Eckberg at or Ron Ketchem.

Source: Bradley Eckbergy, MetaFarms, who are solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like