The good news is that an opportunity exists to participate in this shift.

November 23, 2021

Society is in a state of continual transition. Our access to instant information undoubtedly accelerates both the actual pace and the perceived pace of change. Dominos Pizza set a record (at that time) for pizzas orders during the famous OJ Simpson slow-speed incident as a white Ford Bronco was thoroughly recorded in the news and we were glued to the television coverage.and then Dominos sold almost zero pizzas for a 5 minute period when the OJ verdict was unveiled. That may have been a sentinel moment in the food industry as we viscerally experienced the impact of consumer habits in the context of a societal incident. I believe we are on the cusp of another – albeit, less dramatic – shift in our societal relationship with food as our systems are caught up in a vortex of economic policy that may mark a transition as we enter what looks to be to insipid inflation.

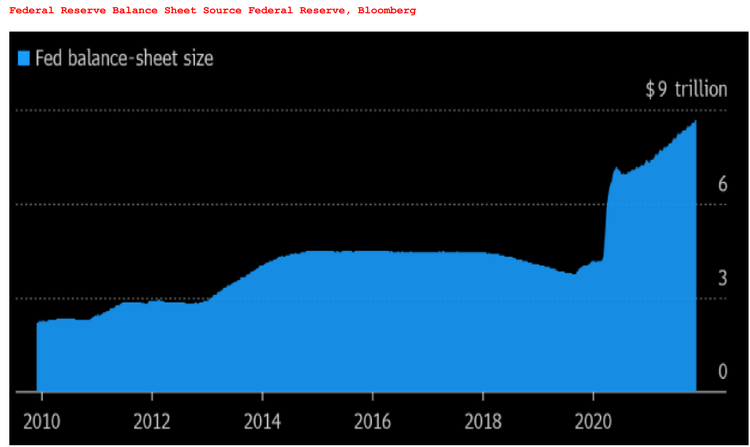

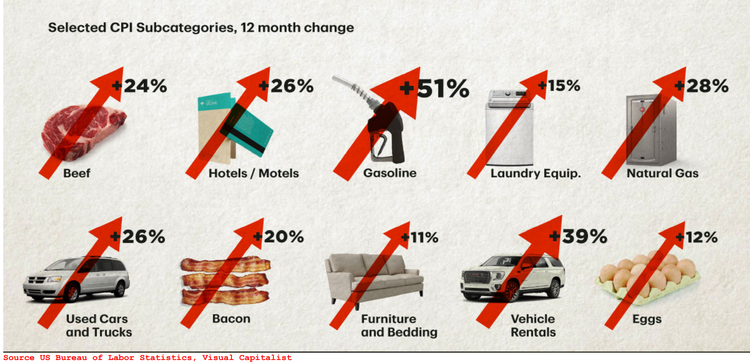

To be sure, food is not at the spearhead of inflation, we are just a participant in a rise as economic forces respond to a significant jump in the money supply (table below) as more dollars chase fewer goods. Throw in a myriad of disruptions to the supply chain for everything from computer chips to lysine in the context of a stubbornly soft economic rebound around the globe and the result is higher prices for nearly all consumable goods.

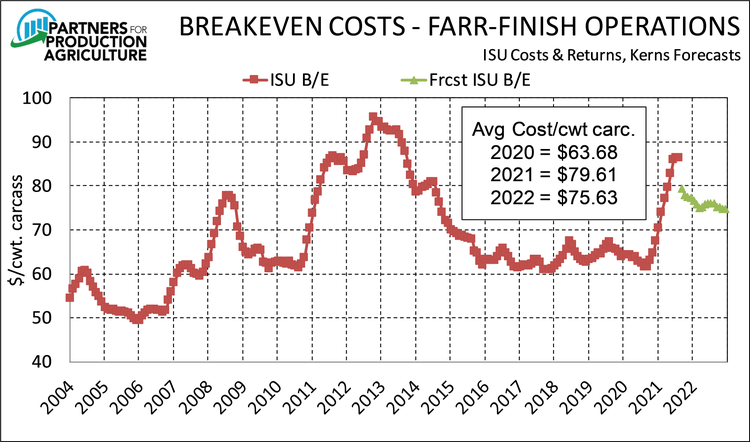

For our industry, this in not “bad” from a forward curve perspective. We tend to focus on how much more things cost and for good reason. Our forward look balance sheets show a jump in price of most non-commodity items that we generally shift into the formula at a static value. This is no longer reflective of reality. Things like propane, labor, maintenance materials and other non-feed items are also moving higher, it is not just a corn/soybean meal impact. Attached are Dr. Meyer’s projections in relationship to Iowa State’s historical cost of production, currently his estimates jump in value are inline with last year’s cost and are materially higher than our relatively stable experience over the past 5+ years. In fact, we are beginning to flirt with the all-time highs in cost of production that we experienced during the ethanol era. (chart attached)

The fortunate part is that our revenue is also higher and the future string of profitability looks favorable for 2022 as of this writing. As much as we like to wring our hands about inflation, consider this. If you are an established entity, your variable cost that is subject to inflationary pressures account for roughly 60% of your operation. This includes feed, energy and other consumables on the farm. The other 40% is made up of fixed assets that have an established cost at their time of origin and do not have a mark-to-market valuation that is moving higher and increasing your cost of production. In fact, your fixed asset base of land and buildings will probably help you in an inflationary environment. This past week, the opening bid on good farm ground in NW Iowa was $17,500. Any asset that you own, like land, that is subject to inflationary pressure will help ease the sting of what looks to be higher energy prices into the future. Your net worth may be moving higher as you experience more expensive pickups. I understand that buildings are not designed to last forever and replacement cost needs to enter the equation, the short-term impact is one of favorable economics with the decision to remodel or replace somewhere in the future. Not bad. Combine this with the fact that meat prices are nearly 100% a variable component that move with then-current market forces and suddenly inflation is not the boogey man in the closet that we were taught to fear in the rough economic times of the early 80s. I hasten to say that we invite inflation to a degree that creates an economic drag, but the circulation of money and the ability/willingness of the consumer to pay more for meat is a favorable outlook for those that produce protein.

To wrap up this topic, remember that economic events rarely happen in a vacuum. The price of compliance and operation in Europe is taking its toll with a projected contraction of their sow herd in addition to the tumultuous news coming out of China. The North American pork producer as a nice blue sky of opportunity in front of them, it is just not the one we would have wished upon ourselves.

My opening comment regarding society and the speed of information has deeper roots than the jury verdict of the latest calamity. We, too, have an opportunity to participate in this shift whether it is your farm’s emission profile or animal husbandry practice. Making blanket statements and rendering a change as “good” or “bad” is rarely successful. Understanding the underpinnings of the shift and anticipating the next move is where the action is located. Rather than bemoaning the yet-to-be-determined rules of Proposition 12 in California, it seems that our industry is better served by pausing for a moment to consider what is being said and framing our behavior to respond – not react – to that stimuli. I recently sat down with Bill Even from the National Pork Board to get an idea of that organization’s direction, I was impressed with their focus and understanding of the broader picture. Our future is in good hands when we have a combination of intellect and strategy working on our behalf.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns [email protected]

About the Author(s)

You May Also Like