Finishing mortality closeouts in 2021 have statistically been the worst year over the last ten years.

October 6, 2021

Has porcine reproductive and respiratory syndrome (PRRS) really been that bad? Each year PRRS gets introduced into every productive phase, with the heaviest impact on mortality in younger pigs. But what does the impact look like for finishing pigs? The latest and most widely talked about PRRS breaks, identified as the 144 Lineage 1C, has been touted as the most challenging and costly of any previous strain. In this month’s article, an analytic analysis will be done by looking at various mortality analytic comparisons spanning across multiple years for finishing group closeouts between the months of January through August.

All closeouts are based on a standardized set of business logic and calculation algorithms which allows our analysts and users to make apples-to-apples comparisons of performance across and within companies using MetaFarms Ag Platform.

Finishing closed group analysis was performed utilizing the MetaFarms Ag Platform with specific focus on the United States customers only. In the first eight months of 2021, the U.S. MetaFarms customers had slightly more than 5,900 closeouts (5,951) with total pigs started over 10,000,000. Characteristics of a finishing group would be a starting average weight around 45 pounds with an ending average weight out of 285 pounds. Pigs are normally on feed for around 120 days, have an average daily gain (ADG) of a 1.90 and have a feed efficiency (FCR) of 2.87. As previously stated, finishing groups are generally on feed for 120 days, or four months. Groups starting in starting in November 2020 would not close out until February or March of 2021.

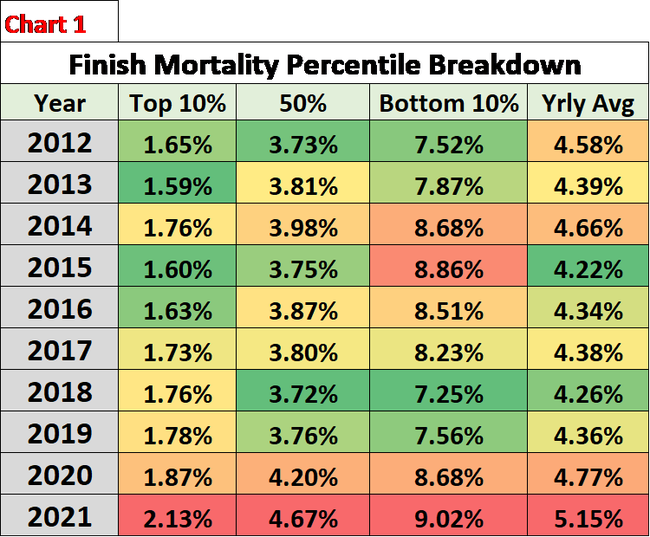

Chart 1 analyzes the last ten years of finishing closeouts broken down into three different percentiles ranges from the best (Top 10%) to the worst (bottom 10%) along with the yearly average. This year had the distinction of having each its percentile, along with the average, of being the highest across all years. Each 2021 percentile and average were 0.16-0.47% higher than the next closest month. This is a clear indication that 2021 year has been an above average mortality year but one that has also seen severe mortality closeouts.

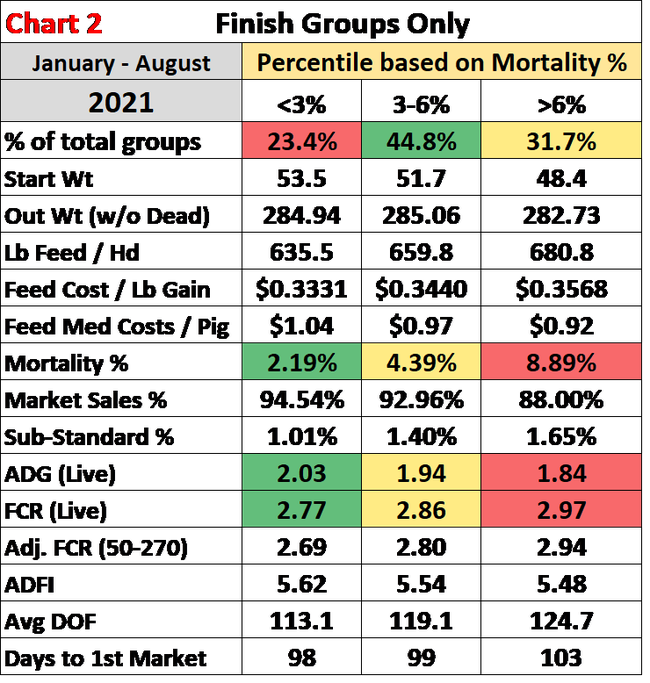

Chart 2 analyzes finishing closeout data that separates 2021 closeout finishing groups across three different mortality percentage ranges. Closeouts that fell within the mortality ranges will have their performance and financial metrics as part of that range. Focusing on key performance indicators (KPIs) in the >6% range, the closeout average mortality is more than doubled the median range of 3-6%. Pigs are on feed over 11 days longer, which correlates with pig growth (ADG) being 0.19 less than the <3% range of closeouts. When pigs eat feed and later die, their feed pounds and cost are lost, thus when looking at feed conversion rate (FCR), a large reason for the 0.20 difference between the >6% range and <3% range is in large part to the higher mortality.

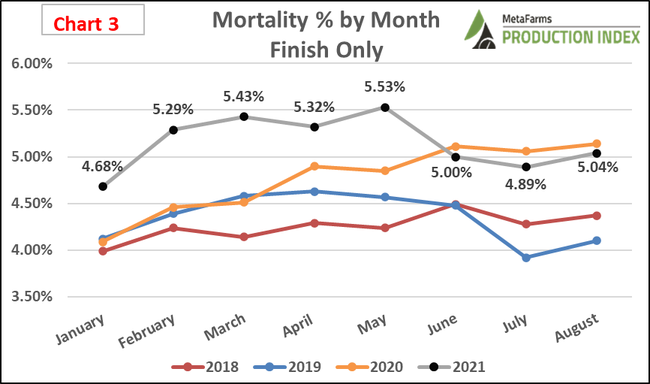

Chart 3 looks at the last four years of finishing closeout mortality rate by month where the first five months of 2021 having above average closeouts by a half percent or higher when comparing to the previous three years. 2021 stayed atop until June when closeouts became similar to 2020, the COVID-19 year’s average. However, they were still noticeably higher than 2018 and 2019. As a reminder, finishing groups that closed out in February 2021 were placed into nurseries back in September/October of 2020.

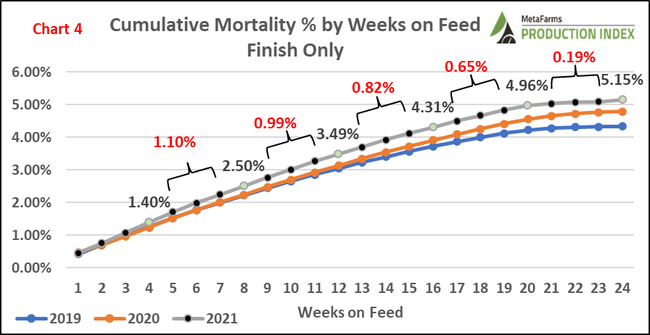

Chart 4 focuses on finishing mortality by weeks on feed for groups closed out in 2019, 2020 and 2021. As a reminder, these closed groups occurred between January-August each year. When analyzing mortalities, it is important to not only look at why mortalities occurred, but when. Late term mortalities should be analyzed on every closeout to determine if these deads are coming from transporting losses, late term lameness or bottom end pigs. Assuming marketing starts at day 100, or week 14 on feed, 2021 data shows that 1.23% of the overall deads occurred between week 14 and 24. For a 1,000 head finishing barn that 1.23% mortality represents nearly 12 pigs. Twelve pigs may not seem like a lot but considering the amount of feed fed to those pigs or the medication and/or vaccines given, the financial losses begin to add up quickly. There never is a good time to lose a pig, but the financial impact of mortality is felt the longer pigs are on feed.

2021 finishing mortality closeouts have statistically been the worst year over the last ten years. The cause could be attributed to many different things, but it mainly must be attributed to PRRS, specifically the 144 Linage 1C strain.

The severity and longevity of this past year’s PRRS season has baffled everyone in the pork industry. Closeout performance also indicated lower growth rates, poorer feed conversion and along with a higher feed cost per pound gain.

With the weather turning from summer to fall, cooler temperatures are upon us. Farmers are and have been harvesting in the fields, which brings pit and lagoon pumping season as well as PRRS and flu season. For many producers, preparation to minimize disease outbreaks are a daily focus point; now is the time to ensure proper biosecurity measures are in place. Let us all hope that the 2020/2021 PRRS season does not repeat itself this year.

MetaFarms Analytic Insights were used to provide the context and trends for this article. If you would like to see an analysis of how PRRS impacted your finishing performance, or if you have suggestions on production areas to write articles about, please e-mail or call us.

If you have questions or comments about these columns, or if you have a specific performance measurement that you would like us to write about, please contact Bradley Eckberg.

Sources: Bradley Eckberg, MetaFarms, who are solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like