Smithfield plant closure, line speed reduction puts capacity below projected weekly runs for at least three weeks in Q4.

July 12, 2021

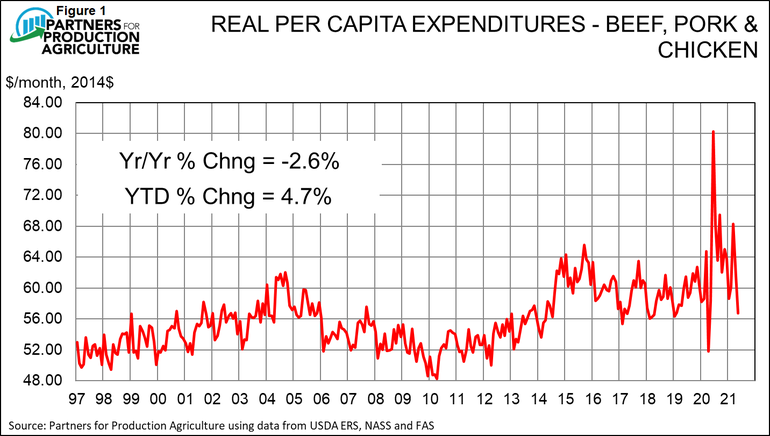

That screeching noise you may have detected back in May could have been a sharp slowdown in meat demand. May trade data released last week completed the information we needed to compute domestic per capita disappearance and thus real per capita expenditures (RPCE) for the month. Recall that RPCE is a useful measurement of the status of demand.

After more than a year of surprisingly strong numbers amid the coronavirus pandemic, domestic demand showed some weakness. Total RPCE for pork, beef, and chicken was down 2.5%, year on year, in May (Figure 1). The big drag was a 9.2% drop in chicken RPCE. “But chicken prices are high,” you might argue. True. But domestic chicken consumption was over 4% lower than one year ago due to a sharp increase in chicken exports. That lower consumption figure was not fully offset by higher prices – or at least not enough to conclude that chicken demand had kept pace with last year.

Pork and beef RPCEs were virtually unchanged from last year at +0.5% and -0.8%, respectively.

Year-to-date (YTD) figures remain very strong with total three-species RPCE standing 4.7% higher than last year. Pork is the leader in that group with YTD pork RPCE 8.5% higher. Beef RPCE is up 6.1% YTD while chicken RPCE is down 1.9% so far in 2021.

Some may find this slowdown surprising in light of the great pandemic re-opening. And I think stronger foodservice demand is certainly a positive. But remember my past warning that this re-opening would reverse the behaviors that drove strong demand last year. A given number of dollars doesn’t buy as much food in restaurants as in grocery stores. The restaurant buyer gets a serving of meat where the grocery store buyer gets a package. And finally, there are a lot more alternative uses for dollars now that people can get away from home and return to more normal activities. All of those were opposite – and supportive of meat demand – last year. This year they are actually a drag.

Look for RPCE levels to be lower than last year but not at all disastrous the rest of this year.

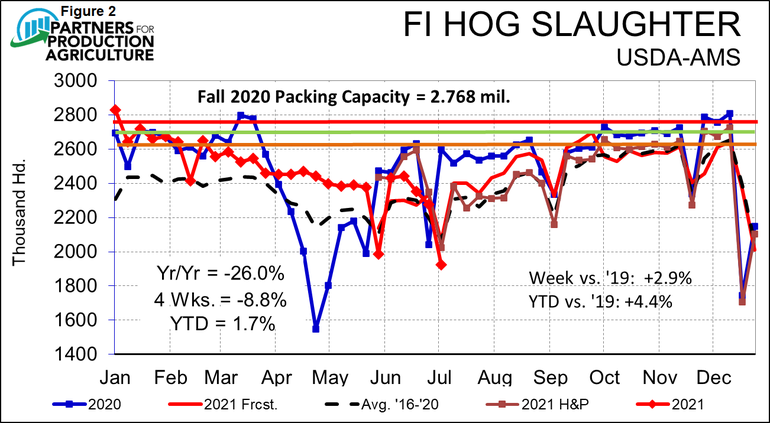

That’s the good news. The bad news is that we are once again dealing with a packing capacity reduction as Smithfield Foods announced last week that it would cease slaughter operations at it Gwaltney, Virginia plant. The plant once had a capacity of 10,400 head per day but has been operating at lower rates for some time. It has been converted to carcass production to serve Chinese customers and then back to wholesale cuts over the past three years.

This closure should come as no surprise. Changes (closure, convert to sow harvest, etc.) have been rumored for several years. By our count, roughly 100,000 sows have exited production along the eastern seaboard over the past two years, and the vast, vast majority of the pigs from those sows were processed in one of the three Smithfield plants in North Carolina and Virginia. Add in Smithfield’s refusal to alter pricing arrangements tied to Western Cornbelt or Iowa-Minnesota prices and it was pretty clear that at some time the company simply didn’t want as many pigs. Closing the Gwaltney plant is the logical result.

The closure takes out another 54,000 head per week of the packing capacity that I listed in my annual survey last July. That loss is in addition to the 85,000 head or so head reduction two weeks ago when USDA regulations forced five plants to slow their chain speeds.

Figure 2 illustrates the predicament. The red line is last summer’s 5.4-day capacity of 2.768 million head. This level was sufficient to handle our expected supply numbers this fall following the March “Hogs and Pigs” report. A few weeks were snug, but the capacity utilization situation looked much better for producers than in some recent Q4s.

That comfort disappeared when a Minnesota judge set aside the enhanced line speeds allowed by the New Swine Inspection System which was allowed to take effect last year by the Trump administration. Her decision took out about 85,000 head per week of capacity, pushing the total back to roughly 2.683 million head and putting 7 weeks or so of Q4 supplies at or above our 5.4-day capacity. The excess would not historically have been a problem, but today’s labor situation is vastly different from what we have been accustomed to. Tight labor suggested that the new lower capacity could be a problem.

Then came the June “Hogs and Pigs” report and a 3% lower, year on year, March-May pig crop. The implied lower Q4 slaughter totals brought some relief from the judge’s order and told us we would be okay this fall. That doesn’t mean there is “no harm, no foul” from this order. Remember that the order had nothing to do with worker health and safety issues from enhanced line speeds. It was made because USDA screwed up the procedures for publishing the final order. And now USDA is being wishy-washy at best as to whether it will defend the rule and practices that have been proven through a 20-year pilot project. That’s a lot of piloting down the drain it appears to me.

But I digress. The closure of the Gwaltney plant pulls another 54,000 head per week out of the total to push it down to 2.629 million head – the orange line. The reduction puts capacity utilization rates for Q4 much higher and leaves capacity below projected weekly runs in at least three weeks. We are back to the point of being very concerned about spot market prices – and thus a good number of formula prices – during those weeks.

Most of us long for the day when we could raise hogs and just haul them to the yards or one of a few local packing plants. There was a day when plants were plentiful. Those days are gone. It is important for any producer to know the situation he/she will face in years to come regarding harvest facilities. There is no guarantee that someone will operate the plant you are hauling to today. Most are solid but think this through as you make decisions about future output.

Source: Steve Meyer, Partners for Production Agriculture, who are solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like