Many are wondering where will the “black swan” might from that could burst what many see as a bubble?

November 22, 2021

Agriculture Prices Exploded to Upside

For those of us who have been around long enough to remember, the current economic climate in agriculture is reminiscent of the mid-1970s. After being in the doldrums for a while, grain prices and farmland prices all exploded to the upside.

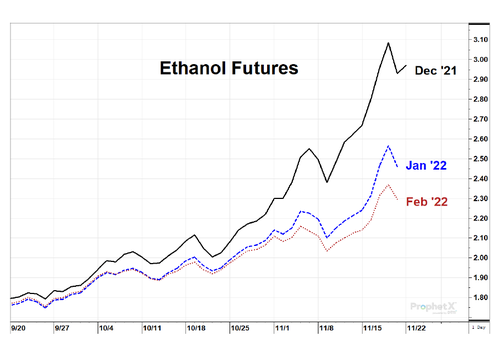

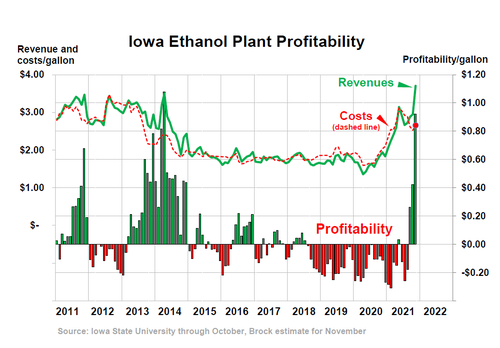

Since September, December ethanol futures have risen from $1.80 per gallon to $3.00 per gallon. The profitability of ethanol plants is now back to the levels of 2014 (see chart below). Many in the industry thought it was not possible to get there. This has resulted in the strongest corn basis in recent memory throughout the Midwest as ethanol plants scramble to buy corn during a slow harvest amid farmers who are unwilling to sell.

Land Prices Explode

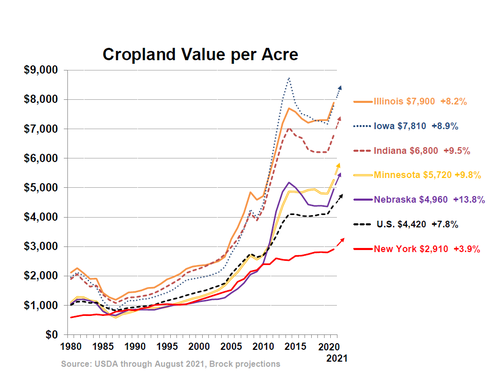

The sharp rise in commodity prices, cheap money/credit and lots of it has resulted in the biggest increase in farmland values since the mid-1970s as well. The chart below does not do the market justice as USDA data is only up to date through August. Starting in September productive farmland throughout the Midwest has soared into new highs. Productive land in Illinois, for example, is selling consistently from $16,000 - $17,000 an acre. Some sales where three people start bidding against one another in several states in the Midwest have exceeded $20,000 per acre. It takes crazy to a new level. But combine cheap credit, very profitable farming, and farmers with ample cash, and all of a sudden we have tulip mania.

How Long Can This Last?

Many are wondering where will the “black swan” might from that could burst what many see as a bubble? There can always be some type of a natural disaster. War. Political upheaval. In today’s political climate, literally anything can happen, but nothing is all that visible between here and the nearby horizon.

Protein demand worldwide remains extremely strong. Because of rampant inflation, which has impacted food prices at the retail level as well, consumers are still shelling out the money. As long as beef, pork and poultry are moving in the marketplace at incredibly high prices, expansion in livestock will be encouraged which will increase the demand for grain, and the domino effect continues.

Historically, with this type of a scenario one can assume that these trends can continue, with some severe corrections along the way, for at least another two to three years. The long-term cycle in cash corn prices since 2012 has indicated that a major top could occur in 2023/24. That could well still be on target and the high established in 2021 was just a temporary stalling point.

One thing for sure, the trends in all ag commodities are well established to the upside. It is never healthy to stand in front of a freight train.

About the Author(s)

You May Also Like