It has been a better 2017 than I had expected. Large hog numbers have been handled with relative ease and better-than-expected exports have limited domestic availability and helped push retail values higher.

June 5, 2017

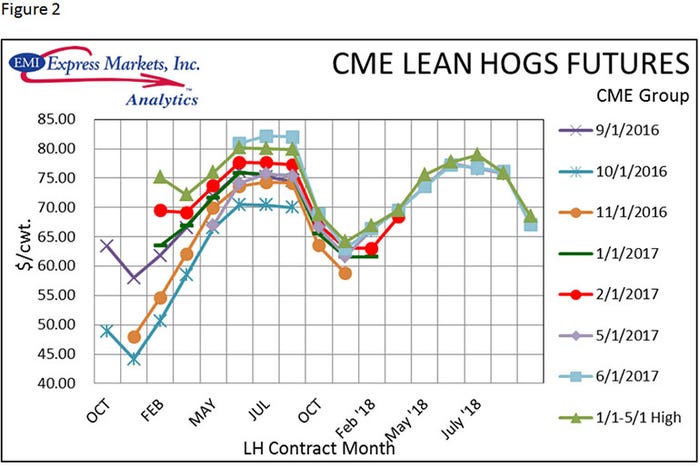

It has been a great run for hog and pork markets the past three weeks. I thought in April that we had likely seen the high for lean hog futures for the year. The February peaks were beyond what I expected to be the summer highs for cash markets, and the March-April selloff was so abrupt and so large that I simply doubted the ability of the futures market to climb out of that hole when hog supplies have been almost exactly as I expected them to be.

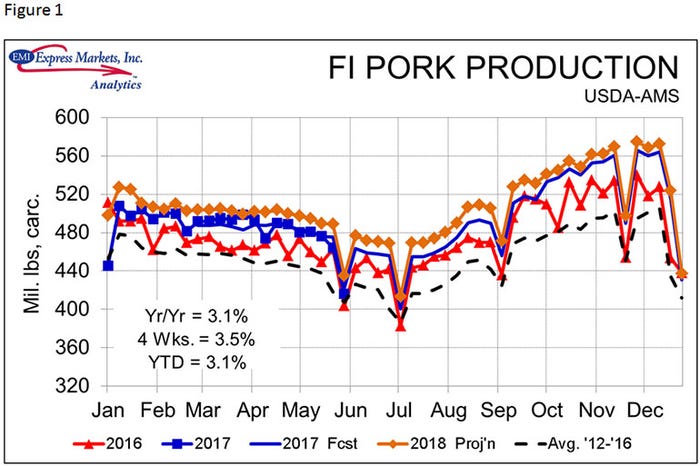

In fact, our forecasts of federally inspected pork production are, so far in 2017, within 0.1% of actual production. See Figure 1.

Well so much for the “high of the year” prediction for futures. Figure 2 clearly demonstrates the huge rally we have witnessed in recent weeks. Today’s (June 5) selloff puts a bit of a damper on this rocket of a market, but producers once again have a great opportunity to sell summer hogs. And the rally is keeping the deferred contracts at or near their highs so far this year.

To me, that suggests more opportunity to lock-in hog prices. Whether you do so depends on your financial and emotional abilities to incur (or endure!) risk. Most producers are in pretty good shape on the financial side and all of you should by now know how your personality and emotions handle risk. Make decisions accordingly.

Cash hog markets have been very late to the party. While both the negotiated and all methods weighted average prices have rallied by about the same amount, the negotiated price was more than $7 lower than June lean hog futures on Friday. That is a painful basis to swallow when one lists their short hedge on hogs. The all-hog price is much higher ($77 versus $73 as of June 2), but the component that is pushing the all-hog average is Other Purchase Arrangements, a price that is not included in the CME Lean Hog Index and so should not be much of a factor in lean hog basis.

So is either market right? I always put my bets on the cash market in these situations. “Cash is king” did not become an adage by accident, and while there are a lot of smart people who trade futures and make that market, they are betting in the price of hogs on the last two days of trading on each contract. They are not necessarily factoring current conditions into their bids and, even if they were, I believe the people involved in the cash trade have a much better picture of the true supply and demand situation. Or at least their seats are a lot closer to the action than any on LaSalle Street in Chicago.

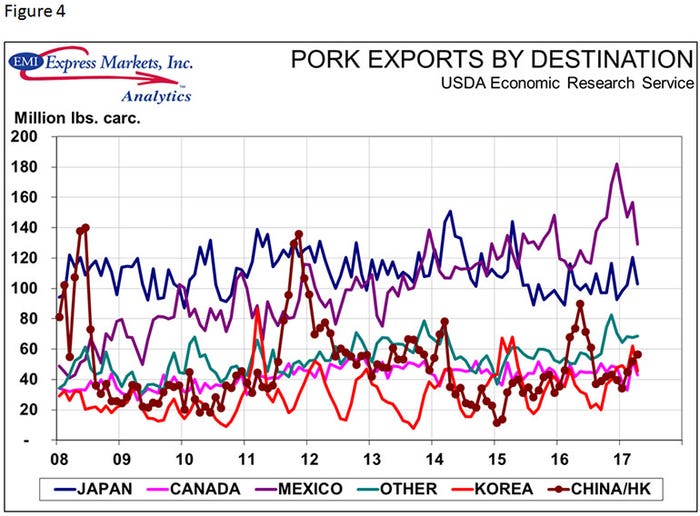

Cash markets are slightly higher than I expected at this time, and the reason is clear: Exports. April export data were released this week and they showed a continuation of year-on-year growth. While the April total was 12% lower than that of February, it was still 7.9% larger than last year’s April figure. The April total kept year-to-date exports well above one year ago, but the percentage increase did drop from the +18% and +17% levels of February and March, respectively, to 14.6% in April. I’d still say the year-to-date April figure is a huge win for the U.S. pork industry. Exports to Mexico and Japan slowed down a bit in April but Mexico is still on pace to set another record. See Figure 3. Shipments to Korea and “Other” markets (Australia, Colombia, Honduras, Dominican Republic and Philippines are the key members of that group) continue to grow rapidly. Exports to China/Hong Kong grew from March but are still 23% lower than one year ago.

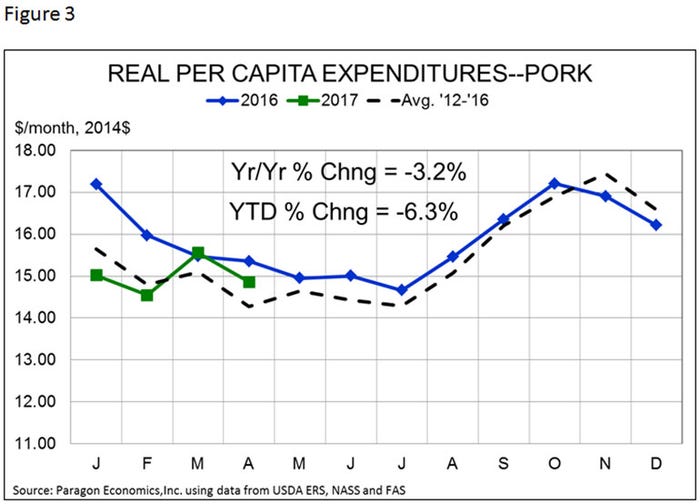

Domestic demand (or at least our measure of domestic demand) continues to struggle. April real per capita expenditures on pork amounted to $14.88 (2014 dollars), down 3.2% from one year ago but still 4.1% larger than the five-year average for April. See Figure 4. March and April have shown marked improvement from January and February, and we look for May to show more improvement yet given the rally we’ve seen in loins, butts and ribs. Those higher wholesale costs will push retail prices higher and higher retail prices demonstrate strong consumer-level demand. Continued strength in the beef market will help as well.

It has been a better 2017 than I had expected. Large hog numbers have been handled with relative ease and better-than-expected exports have limited domestic availability and helped push retail values higher. None of this, in my opinion, justifies the level of Lean Hog futures but even those are positive because of the pricing opportunity they offer producers. Add in the beginnings of yet another huge crop – and thus reasonable production costs – and this looks to be a good year for producers. Oh, and did I mention the new packing plants? We’ll save that for another time.

About the Author(s)

You May Also Like