- Pork Market News

- Hog Welfare

- Hog Health

- Farming Business Management

- Livestock Management

- Farm Policy News

The generational shift in may not be all bad for pork.

It is no secret that the ultimate boss for pig farmers is the global customer. However, deciphering what the true-blue customer really wants when it comes to pork can be a real mystery.

Antagonists often are planting false clues everywhere you turn — headlines, online or advertising — distracting the swine business from exactly the product that the average pork buyer wants. Listening to the small majority with loud voices, all pig farmers should raise hogs without antibiotics, feed non-genetically modified organism grain and raise hogs outdoors in large pens despite the science behind the modern pork production practices.

Still, adjusting to any one of these demands would cost more of the consumers’ hard-earned dollars. In general, the U.S. consumer spends 10% of the household income on food. Since, Americans’ incomes are not rising, the average consumer cannot afford to pay for an upgrade that actually does not change the taste, appearance or quality of the cut of pork. So, it really comes down to identifying the genuine pork buyer.

David Portalatin, vice president industry analyst of food consumption for The NPD Group, says the overall trend currently is that fresh meat or center-of-the-plate animal protein is becoming less frequently consumed. He further explains the drop in consumption is being somewhat offset by meat being used as an ingredient rather than the main dish. Therefore, the end result is flat or slightly declining meat consumption in the United States.

Looking closer at red meat and poultry, Portalatin says beef leads the decline, as the cost has driven consumers to select more reasonable meat options. Consequently, chicken is gaining steam whereas pork is holding its own. Interestingly, Portalatin says 51% of consumers tell The NPD Group that they want to add more protein to their diet, but unfortunately, often it is not poultry or red meat. Some popular choices as affordable options are eggs, cheese and peanut butter.

Five generations of consumers

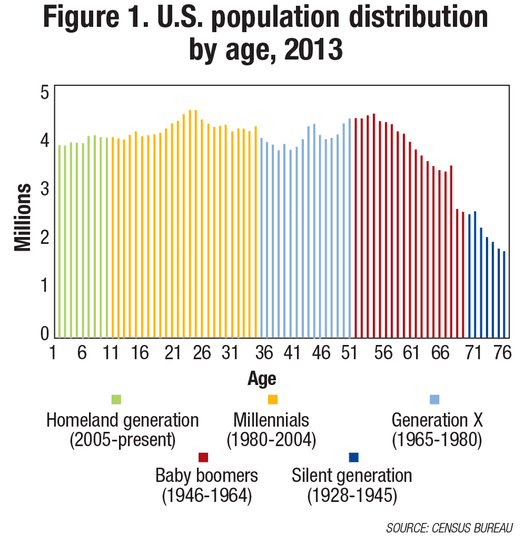

Today, four generations are regularly making purchase decisions when it comes to food. In fact, the most recent generation — the homeland generation (age 0 to 11) — has some influence on consumer purchases. In a few short years, the oldest of the youngest generation will be teenagers, making five generations of consumers.

Recently, the tech-savvy, instant-information generation — millennials — took the lead as the largest generation living, stealing the title from the baby boomers. Currently, the millennials — born between 1980 and 2004 — pencil in at 75.4 million, exceeding the 74.9 million baby boomers (refer to Figure 1). Plain and simple, this generational shift will shake up the marketplace. It will mean a whole new dynamic when it comes to pork demand.

Reviewing the fresh meat consumption pattern, Portalatin notes, “One of the things that we have been able to observe — which is pretty consistent decade after decade — is consumption of fresh meat increases as we age. It becomes a higher percent of the diet the older we get.”

Still, the two big consumer groups will be the millennials and the baby boomers, which sharply contrast. While the baby boomers are mostly old school when it comes to the food they eat, the millennials are not.

Millennials will drive the U.S. economy for decades to come, and the group stands out for being more diverse, with 42% identifying with a race or ethnicity other than non-Hispanic white, around twice the share of the baby boomer generation. To date, this generation is also the most educated, with 61% attending college, whereas only 46% of baby boomers did so, according to the Decennial Census and American Community Survey. Significantly, this is the first generation to have access to the internet during the formative years.

On the bright side, the generational shift may not be all bad for pork after all.

“What we are finding with this younger generation is today’s 20- to 30-year-olds have a much higher percent of meat consumption than did previous generations at the same life stage. That is potential good news for growing business with younger consumers. This group is way ahead of the curve,” Portalatin explains. “Unfortunately, we are also seeing the generational script being flipped on the other end of the spectrum, too. While consumption does typically rise as you age, today’s older consumers are the ones leading the decline in consumption.”

Putting it all together, The NPD Group research shows that these generational shifts account for about 83% of future trend in meat consumption, Portalatin explains. Fresh meat consumption based on meal occasion is anticipated to grow 5% through 2019 and 10% through 2024 according to NPD’s forecasts. Notably, he says, “That is a rate of growth that slightly outpaces the baseline for population growth. In a very mature industry, you look at that baseline of population as sort of your benchmark. We look at trends that are expected to grow faster than the benchmark as good opportunity for growth.”

While the projection of fresh meat consumption to slightly outpace population growth is good news, it is important to note that chicken is expected to be the growth driver of meat consumption. Yet, there is room to snatch the eggs from the marketplace basket.

Nevertheless, Ceci Snyder, dietitian and National Pork Board vice president of consumer marketing, says don’t count out the baby boomers. This generation has the ability to drive many food trends because they have more money and eat out more.

Largely, Snyder says, “Younger people are also more open to a wide variety of food. They have grown up with such ethnic cuisine. They do not think of it as ethnic. It is just how we eat food.”

Genuine pork customer

Repeatedly the Oklahoma State University research team led by Jayson Lusk has confirmed that consumers rank taste, safety and price as the most important values when purchasing food.

Today’s consumers want things that are natural, Portalatin says. It is the key driver. For instance, NPD research shows consumers are less interested in food that is labeled as reduced fat (not related to meat). If fat naturally occurs in a food item, then it is better for it to be present than have that food item processed to remove the fat.

Based on the research, only 5% of the population really considers themselves as “clean eaters.” Clean eating is about what is not in the food — nothing artificial, no preservatives and no chemicals. Basically, it is food in its natural state.

Although a small percentage of Americans are true clean eaters, many other consumers are using the same principles to form their food choices. Portalatin says, “The halo around it is much, much bigger. In fact, as much as 58% of consumers think that some of those principles are important when making grocery-store purchasing decisions.”

It really comes down to Americans today wanting fresh, natural food despite their age. For the millennials in particular, appealing to their desire for natural, minimally processed and fresh foods is a sweet spot for pork. “It is an easy, natural thing for pork to do. There is synergy already with momentum for the foods they are looking for,” Portalatin says.

Yet, no matter the term used on the food label or the sourcing standards established by food companies, it really comes down to economics, Portalatin stresses. He says, “We have 300 million people in this country, and you can’t feed 300 million people with boutique, organic and hand-raised pork. The modern food industry in this country has given us the most affordable, safest food supply in the history of the world. I think at some point, consumers are going to have to embrace the fact modern agriculture and food sciences on balance are a very good thing.”

Snyder confirms that price is the top factor in purchasing food. The NPB did a comprehensive look at pork consumers last year, identifying who eats pork and how they eat pork.

The NPB re-examination helped the organization to redefine its consumer target to focus on “creative cooks.” The creative cooks eat 62% of all fresh pork, but they are only in 29% of the households. Unlike beef or chicken, it is a small segment that drives the consumption for fresh pork, notes Snyder.

The creative cooks are comprised of individuals of all ages and ethnicity. As is obvious from the name, the creative cooks enjoy cooking for fun. They eat more meat and also like to try new meal ideas at home. So, the NPB marketing focus is on recipe development and fun ideas in the kitchen. Snyder says, “Inspiring recipes is really what drives them. It is not a health message like some groups.”

For this group, the recipe does not have to be fast and easy. Honestly, Snyder says recipes that are too simple won’t get creative cooks into the kitchen with pork. The creative cooks also follow food trends. Food companies invest millions and millions of dollars trying to predict the next big food trend in the quest to capture a bigger piece of the marketplace pie. Snyder says the food service segment can provide solid leads into the hot food trends. Consumers like to mimic trends in restaurants and in magazines. However, she says, “We want to hit that curve of where food trends are but not too far. There is a little bit of science and art in projecting where food trends will be.”

This group of consumers also likes to share their food experience online. They are very proud of what they cook and like to share on social media. More importantly, Snyder says peers will turn to the creative cook for advice about food.

Interestingly, Snyder says the creative cook consumer group is not overly concerned about anything on the farm. She adds, “Awareness of farm issues is very low. They really want recipes and ideas in the kitchen.”

In general, more than half of dinner meals prepared daily take less than 30 minutes to prepare. In addition, meal preparers are utilizing slow cookers more. Recipes that can be prepared in 15 minutes or less and placed in a crockpot before leaving for work are highly desirable across the board for consumers today.

Also, the pork industry is working to develop recipes that take pork beyond the center of the plate to be incorporated as an ingredient similar to ground beef or chopped chicken breast — burritos, tacos, pizza or sandwiches.

Breakfast is another chance to grow pork consumption. Eating breakfast anytime of the day is a growing meal occasion inside and outside the home. Consumers are eating more eggs as an inexpensive, natural and good source of protein. Portalatin says, “As consumers are cracking the egg in the skillet, they are putting in some bacon or some sausage. We are turning back the clock. We are going retro on breakfast.”

Openly, Portalatin says while consumers today are more aware about how food animals are raised, the consumers’ level of awareness is not necessarily tuned in to the finer details of pork production. He says, “They want to feel like that food is what they perceive to be natural. They are not necessarily trying to trace the entire food chain.”

Furthermore, he says, “We have a generation coming online that can handle a lot of information and will embrace information. There is an opportunity to have some honest conversation with consumers about food.”

The consumer is going to get the information from somewhere, and it is readily available instantly online, so Portalatin advises pig farmers to be engaged. Authentic and transparent discussions about pork are vital. He says, “Pork producers need to explain, ‘Here is how a pig is raised, here is the way it is done and this why it is good for you.’”

The millennials are not intimidated by information. Portalatin says you have to think of this younger generation as the generation that learned to jailbreak their iPhones. The average 14-year-old figured out how to change the operating system running on their iPhone. As a group, they have tremendous capacity to seek out information and absorb it. He says, “The key is because there is so much information, there is likely skepticism that has to be overcome to acknowledge ‘Is this information trustworthy? Do I want to embrace this?’”

Still, when communicating about pork, remember it is all about the food, Portalatin says. Buzz words are fads that will come and go. Whereas the terms will continue to evolve, the food is what really matters.

Pork eaters, by and large, are supportive of farmers and want to buy what they feel is high-quality pork. Snyder says, “There is no need to feel the least bit defensive. As a producer, you can be seen as the authority.”

She also says if pork producers encounter negativity online, it is probably not coming from a pork consumer. Snyder adds, “Many farmers feel like they are in a bunker of a war, but pork consumers mostly have neutral or positive images about the agriculture industry.”

Pork trends

Pork continues to be the fastest-growing protein in food service, holding the position since 2011, according to Technomic Inc. In 2015, pork sold in food service outlets reached a fresh new high at 9.8 billion pounds. Additionally, fresh pork also dominated the meat case sales at supermarkets. Finishing last year strong, retail pork was up 6.5% in pounds sold compared with chicken, up only 2.7%, and beef, down 1.5%. The NPB reports that “pork production climbed to a record 24.5 billion pounds, with per-capita pork consumption the highest in five years, according to USDA.”

Steve Meyer, vice president of pork analysis for Express Markets Inc., says this is great news for America’s pig farmers. He says, “Consumer pork demand was up 3% in 2015 from 2014, building on the healthy gains of 5.5% in 2013 and 7.5% in 2014. … In fact, 2015 marked the sixth of the last seven years in which demand has grown.”

The NPB identifies these top five pork trends in 2016:

Carnitas and other Latin pork dishes: Authentic Mexican cuisine, from food trucks to fine dining, is a hot menu item this year.

Carnitas and other Latin pork dishes: Authentic Mexican cuisine, from food trucks to fine dining, is a hot menu item this year.

Porchetta: This new food item, served as a slider or an entrée, is popping up in restaurants and retail.

Korean barbecue. According to the NPB, Korean barbecue is becoming a staple in most major U.S. cities.

Korean barbecue. According to the NPB, Korean barbecue is becoming a staple in most major U.S. cities.

Specialty and premium hams. Chefs are featuring meats cured in house or by domestic, artisan producers.

Specialty and premium hams. Chefs are featuring meats cured in house or by domestic, artisan producers.

High-quality cooked pork loins. Pork loins in many different flavor flairs will be the center-of-the-plate choice.

High-quality cooked pork loins. Pork loins in many different flavor flairs will be the center-of-the-plate choice.

The pork checkoff’s website, porkbeinspired.com, features more than 2,000 recipes and new recipes focusing on this year’s food trends.

Despite the communication effort, Snyder says the average consumer still struggles with properly cooking pork. Many are not aware of the new temperature guidelines revised by the USDA in 2011. Due to the advancement in food safety, the USDA lowered the cooking temperature to 145 degrees F for all pork whole cuts, followed by a three-minute rest time. Snyder says the only real complaint from consumers is from overcooking pork and not understanding why it gets dried out.

Putting price aside, consumers surveyed by the NPB say appearance is a big factor when selecting meat and poultry in the grocery store. Other selection factors are expiration dates, fat trim and leakage in the package. For pork eaters, way down on the list is issues on the farms (less than 5% answering open-based questions).

Snyder says the pork checkoff summer promotion program is a digital-focused campaign with a strong online presence, driven by digital and video. Since hog prices are lower, the checkoff consumer marketing budget is down 19%, so the NPB is being “scrappy” with its budget, Snyder notes.

The NPB launched the summer campaign “Grill For It!” in early May, featuring a talking grill. All season long, The Grill and its sassy sidekick Gloria will share their passion for all things grilling including travels to America’s favorite grilling joints and recipes that’ll put the sizzle in your summer. All the grilling action can be found at grillforit.com.

About the Author(s)

You May Also Like