USMEF report estimates the economic cost of Mexican tariffs to the U.S. pork industry.

June 19, 2018

The U.S. pork industry could lose more than $300 million for the remainder of 2018 and $600 million over the next 12 months in plummeting ham prices alone due to the Mexican tariffs placed on U.S. pork products, the U.S. Meat Export Federation estimates.

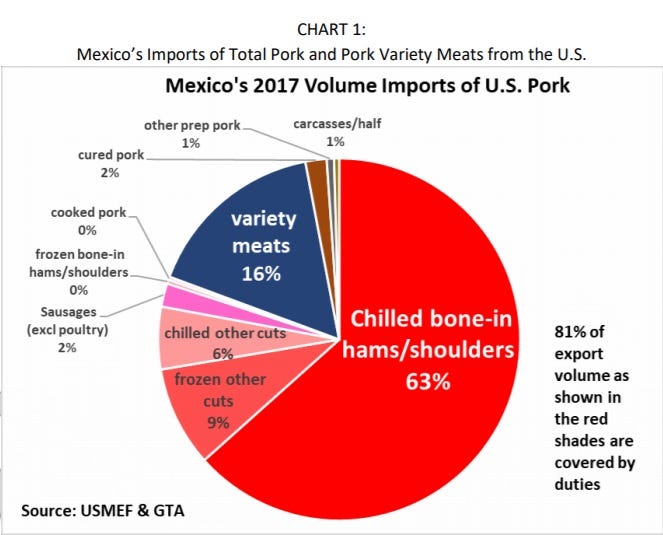

In response to President Trump’s announcement that tariffs will now be placed on steel and aluminum imports from Mexico, the country implemented new duties on U.S. pork imports, effective June 5. Tariffs on chilled/frozen pork were increased from 0% to 10% until July 5, after which they will increase to 20%. The tariffs are not expected to be lifted until the United States rescinds the metal tariffs. Essentially, the USMEF states in its report, “Mexico has effectively eliminated the NAFTA (North American Free Trade Agreement) benefit.”

Since the United States accounts for at least 40% of Mexico’s pork consumption, Mexican consumers and U.S. hog farmers are both negatively impacted by the current trade tiff between NAFTA partners. Mexico is the largest volume market for U.S. pork, accounting for one-third of total U.S. pork and variety meat exports in 2017. Export value to Mexico averaged nearly $12.50 for every hog processed in the United States last year, an increase of $1 per head even with the 2.6% increase in U.S. hog slaughter, reports the USMEF.

Who comes out a winner?

Canada and the European Union are most likely to increase their market footprint in Mexico, given a price advantage over the United States. However, in the short-term there are constraints. The USMEF confirms that Canada already exports most of its hams to Mexico. In order to supply more pork to Mexico, it will most likely decrease exports to other destinations.

European exporters are optimistic about opportunities there, especially considering the upgraded EU-Mexico Free Trade Agreement expected to be implemented as soon as 2020. Presently, nearly 60 EU slaughter plants are approved to export to Mexico, with more pending approval.

Currently, the United States is the more ideal supplier for Mexican large processors on the transportation and logistical cost advantages alone. It is not easy for Mexican processors to convert from chilled U.S. pork to frozen boxes of EU pork, however it may be more appealing to have options in pork suppliers.

Bottom line, the USMEF forecasts and increase Canadian and EU supplies in Mexico could result in a fall of U.S. market share from 90% registered during the first quarter of 2018 to 75% for the second half of this year. Overall, this would result in a decline in U.S. pork exports of roughly 10,000 metric tons per month or more than 60,000 mt. for the rest of 2018. Given value holds at first quarter 2018 levels, the drop in export value to Mexico would be more the $100 million over the next six months.

Shrinking U.S. prices

The growth of U.S. pork production means any extra product not purchased by Mexico must be absorbed domestically or in other export markets at a much lower price. The USMEF estimates looking only at ham prices, the drop in the primal value could translate into losses to the industry of more than $300 million for the remainder of this year which would be roughly $600 million over the next year. Picnics are the other primal most likely to be impacted. As a result of additional negative price pressure from picnics and hams is likely to result in $425 million for July-to-December 2018 and $835 million over the next year for the U.S. pork industry.

Switching to bird

Since the duty-free quota is specifically aimed at Mexico’s processing industry, retailers do not have opportunities to purchase pork at zero duty beyond Canada and Chile. In those countries, pork supplies will become squeezed. Therefore, Mexican retailers are most likely to feature turkey and chicken more, giving it more space on the retail shelf.

USMEF estimates that roughly 70% of U.S. pork exports to Mexico are bound for processing and 25% to retail with the remaining 5% to the food service sector. For the processor alone, U.S. pork may still be the most affordable option. However, if Mexico were to quickly lift the foot-and-mouth disease-related restrictions and approve Brazilian pork plants, the loss in U.S. market share could be more significant. Although Mexico’s approval of Brazilian pork would likely have longer-term implications, at this time duty-free access through the quota only lasts to the end of 2018, after which all non-free trade agreement suppliers will again pay the 20% duty. This should somewhat limit Brazil’s future competitiveness, clarifies USMEF.

Source: USMEF

You May Also Like