When you talk about world pork production, you have to talk about China. After all, they have half of the hogs. By far, China is the world’s largest producer, and largest consumer of pork. Because of the Chinese affinity for pork, it is the most consumed meat in the world. Last year people ate 24% more pork than chicken and 89% more pork than beef.

Twice each year, USDA’s Foreign Ag Service releases a publication they call Livestock and Poultry: World Markets and Trade. It includes data on production, consumption and trade of pork, beef and broilers. It also includes the USDA’s best estimates of what the year ahead holds for these meats.

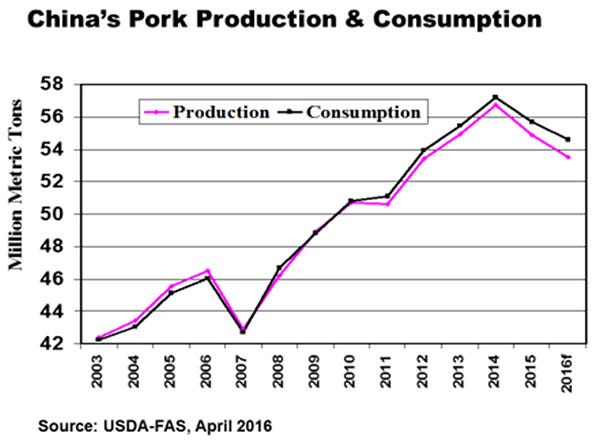

USDA expects 2016 Chinese pork production and consumption to be down for the second year in a row. Chinese pork production is declining faster than Chinese pork consumption. USDA-FAS predicts that this year China will consume a million metric tons more pork than they produce. The growing difference between consumption and production means China’s pork imports are increasing rapidly.

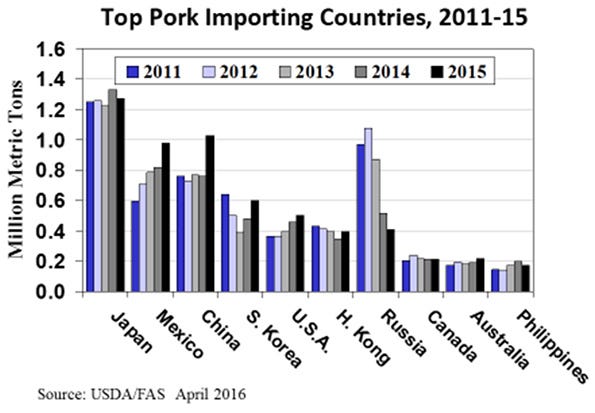

FAS expects China to import 1.3 million metric tons of pork this year. That is 26% more than last year, 78% more than five years ago, and more than any other country except Japan. Japan has been the world’s top pork importer for more than 20 years. USDA thinks they will hold on to that rank again this year.

FAS expects China to import 1.3 million metric tons of pork this year. That is 26% more than last year, 78% more than five years ago, and more than any other country except Japan. Japan has been the world’s top pork importer for more than 20 years. USDA thinks they will hold on to that rank again this year.

Mexico and China are the two fastest growth markets for pork imports. South Korea is the fourth largest pork importing nation. USDA expects South Korea will import 1.8% more pork this year than last. The United States is the fourth biggest pork importer and is forecast to import 6% more pork than in 2015. Russia was consistently the second largest pork buyer during the first part of this century but has dropped off. The intentional decline in Russian pork imports is in response to political disputes with western nations. World pork imports are expected to increase 8% this year. China, Mexico and Japan are expected to see the biggest increases in pork imports.

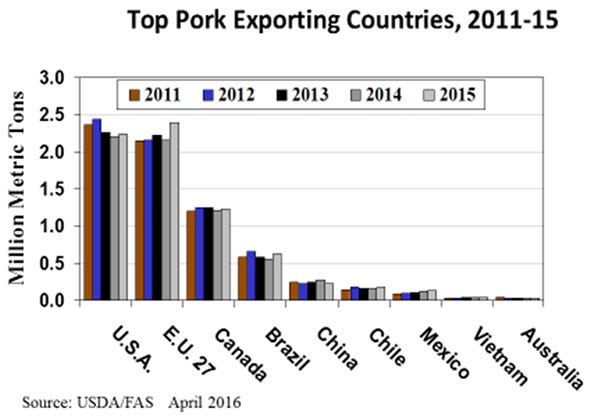

The United States was the largest pork exporting country from 2005 to 2014. Last year, the European Union exported 6.6% more pork than we did. USDA expects the EU to export more pork again this year. USDA is forecasting EU pork exports will be up 8.9% this year while U.S. exports increase by 5.3%. Combined, the EU and U.S. account for 64% of world pork exports.

The European Union has been very successful at expanding pork sales to East Asia. Last year 56% of EU pork exports went to China, Japan or South Korea. Two years earlier only 38% went to one of those three countries. The weakening of the euro relative to the dollar is a big reason for the growth in EU exports. USDA expects world pork exports to increase by 526,000 metric tons this year.

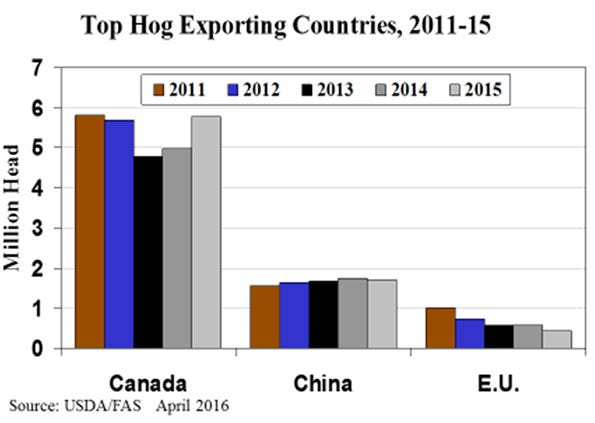

The United States is by far the largest importer of live hogs and Canada is the largest hog exporting country. Last year 5.741 million hogs were shipped from Canada to the United States. After declining for several years, the number of hogs imported from Canada was up by 16% last year. USDA expects the U.S. to import 359,000 (6%) more hogs from Canada this year than we did last year. In 2015 China exported 1.696 million hogs and the EU exported 436,000 hogs.

Three countries — Canada, China and the EU accounted for over 90% of the hogs exported in 2015.

World pork trade is growing faster than world pork production. Declining trade barriers are allowing pork to move to the people who like it and have money to buy it. This is good for consumers. It is also good for pork producers who can produce quality pork at a competitive price. Japan consumes twice as much pork as it produces. U.S. hog farms produce 20% more pork than Americans eat.

Currently, the biggest obstacle to increased U.S. pork exports is the value of the dollar. Compared to the euro, the dollar costs 17% more than it did two years ago and 21% more than five year ago. Relative to the Brazilian real, the dollar is 62% more valuable than it was two years ago.

About the Author(s)

You May Also Like