The item that has probably been a larger sticking point is not the price component, it is the ability for Chinese importers to execute.

September 16, 2019

The recent rally in hog futures on the back of optimism of the U.S.-Chinese relationship may feel like another round of Lucy promising not to pull the ball out as Charlie Brown attempts a kick. We have been here before only to be disappointed on the backside of a rally to “The Promised Land.” I believe there is a reason to embrace the hope and also remain aware of the current reality.

Let’s first consider what is in front of us. The October contract is under pressure, trading at a plus-$3 discount to the December — an abnormal situation as October usually trades at a premium to the December contract. This is reflective of the heavy economics on the front end in relationship to the hope for the deferred contracts. This scenario — reality in the moment and anticipation of the future — is going to be a common theme; the question for pork producers is “what do I do?” We are likely going to have to slog through the next few weeks of heavy markets as animal flow and productivity appear to be stellar. I suspect we will get confirmation of the good production on the Hogs and Pigs Report at the end of this month, 2 p.m. Chicago time on Sept. 27. Packer margins are healthy, to say the least, which will keep animals moving even if we are not thrilled with the values received. The hope is largely structured into the 2020 contracts with our models indicating a plus-$30 margin for pork producers. Is it too good to be true? In my opinion, the forward curve is “properly” valued given the considerations:

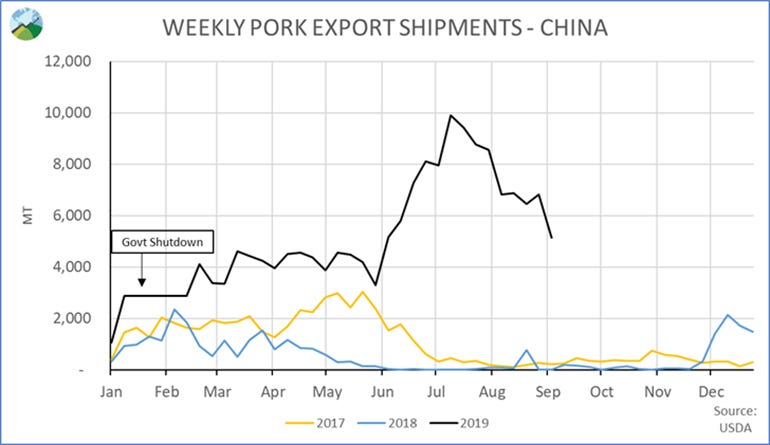

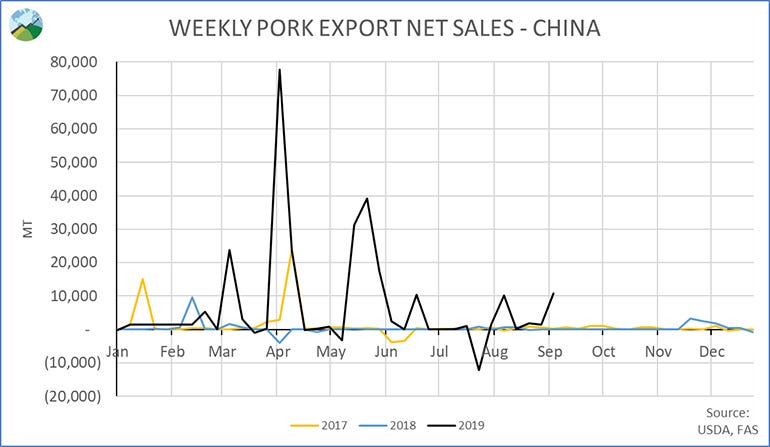

China has been both booking and taking delivery of product in a relatively steady fashion since the first of the year. The market is pricing in both the current shipments continuing and increasing as we roll forward — this appears to be a sane assumption. Steve Meyer’s economic work would indicate each 1% diversion of available supply equates to roughly $6 per carcass per hundredweight of price change. China taking 2% extrapolates into about $12 of price premium, Steve’s model indicates a mid-$70s summer market in the absence of China — the math works in the $90 summer of 2020 price point. Bottom Line — we are not too far out in front of our skis given these data.

Prices in China are approaching $30 RMB/Ki. That number needs some context given that we generally do not relate to those values or easily convert them in our head. To put it in perspective, this is the equivalent of roughly $2.40 per pound carcass in U.S. terms. Do you think there may be some financial incentive here? Yep.

There is a difference between a tariff and an embargo. We have largely been focused on the application of ever-increasing tariff levels and how pork has been caught as a bargaining chip in international negotiations. That is probably the wrong metric in this market as evidenced by the previous bullet point that shows a massive economic incentive, even with the tariffs in place. The item that has probably been a larger sticking point is not the price component, it is the ability for Chinese importers to execute. This is where the log jam appears to be moving and will allow the monetary calculations to manifest. Please watch this item as your harbinger of product movement, not the tariff level.

The USDA released a grain supply and demand report last week that contained few surprises and, in my opinion, a huge statement that did not show up on the balance sheet as published. The USDA backed off both corn and soybean yields marginally, very much in line with market expectations. What I believe may be the most important component for animal agriculture is the resiliency of the crop given the aberrant growing season. If we are able to come out of this year with a relatively small ding in yields, what does that mean if we get back to something that resembles normal or even good growing conditions? We saw 2014 as a watershed year in grain production given the leap forward in yields that have largely been sustained since, 2019 will go down as the year where we tried to kill the crop in a number of ways and were unable to do so. Any anxiety that we may experience regarding the forward curve of expenses has got to be quelled given this observation.

In conclusion, I believe it is appropriate for pork producers to internalize some optimism in the face of the recent price action. We like the utilization of option strategies to protect margins while still offering the market movement to move higher.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like