Pork exports to Mexico rebound in second half of 2016 to offset China's falloff.

January 10, 2017

By U.S. Meat Export Federation Staff

Faced with the challenge of record-large production and moderating demand in China, the U.S. pork industry needed its leading volume market — Mexico — to step up demand in the second half of 2016. And customers in Mexico did exactly that, in a big way.

After setting a new volume record for the fourth consecutive year in 2015, U.S. pork exports to Mexico slowed to some degree in the first half of last year. But exports to Mexico rebounded significantly in recent months, making a critical contribution to the U.S. industry’s effort to move its growing pork supplies.

November was the fifth consecutive month that exports to Mexico were higher year-over-year in value, and the fourth straight month that exports increased in volume. This second-half surge raises the possibility that U.S. pork could set yet another volume record in Mexico in 2016, as strong December results could push year-end volume beyond the 2015 mark of 718,819 metric tons. Export value will also exceed the previous year��’s total of $1.27 billion, though it will fall short of the full-year value record — $1.56 billion — set in 2014.

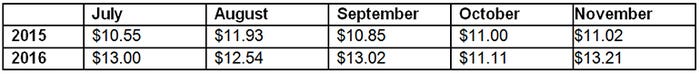

On a per-head-slaughtered basis, export value to Mexico is also trending higher year-over-year.

Trailing only Japan, Mexico is the second-largest contributor to per-head export value, averaging $11.16 in 2016. This accounts for 22% of the total export premium of $49.63.

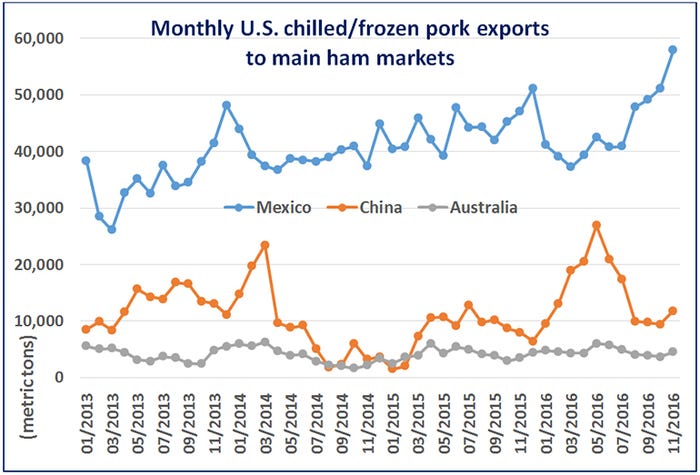

Mexico is an especially important destination for U.S. hams — even more so since the Russian market closed to most U.S. suppliers in 2013 and to all U.S. plants in mid-2014. China’s demand for U.S. hams was very strong in the first half of 2016 — but even at their peak, ham exports to China were still far below the volume shipped to Mexico.

“We really cannot overstate the importance of Mexico when it comes to utilization of U.S. hams,” explains U.S. Meat Export Federation Economist Erin Borror. “Closure of the Russian market — not only to pork from the U.S., but also from Canada and the European Union — was a big concern for the industry. The U.S. industry has successfully expanded demand for hams in some Latin American and Asian markets, but Mexico is still the go-to destination.”

Borror recently participated in a series of customer seminars in Mexico, providing processors, distributors and other key customers with an overview of the U.S. pork production and supply situation. Despite the persistent weakness of the peso versus the U.S. dollar — which contributed to a 24% average increase in the price paid for U.S. hams in 2016 — Mexican buyers continue to be enthusiastic about U.S. pork and showed strong interest in development and introduction of new products. Examples of these products include U.S. pork bacon made from ham, skirt derived from the brisket and “pork wings” — a new product made from pork shank to compete with chicken wings in sports bars and other casual venues.

In addition to being the mainstay international market for U.S. hams, Mexico also trails only China in purchases of U.S. pork variety meat. Facing competition from China, Mexican buyers paid more for variety meat items in 2016 with export value (through November) increasing 7% year-over-year to $191.9 million on a slightly lower volume of 127,856 mt.

The upward trend in Mexico’s per-capita pork consumption is also encouraging these buyers to explore expanded business opportunities utilizing U.S. pork. Since 2010, per-capita consumption has increased 17% to just under 39 pounds (carcass weight). With close proximity, a well-established customer base and duty-free access made possible through the North American Free Trade Agreement, U.S. pork exports have grown from just $145 million in 1994 to about $1.3 billion in 2016. Mexico’s purchases account for 8% of U.S. pork production, and the industry has benefited greatly from Mexico’s growing appetite for pork.

You May Also Like