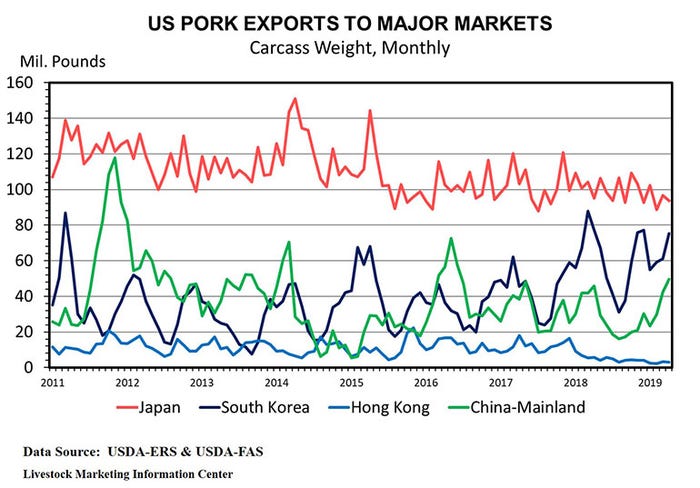

The export decline of 93 million pounds was led by a drop of 133 million pounds (20.8%) in shipments to Mexico. South Korea, Japan, Hong Kong and China also cut their purchases by more than 10 million pounds each.

Domestic meat demand has been strong this year. For January through April, U.S. meat demand was up 1.7% year-over-year. Among the meats, pork demand was the strongest during the first third of 2019, up nearly 4%. Domestic beef demand was up 2.2%, turkey demand up 1.7%, and broiler demand down 0.7% compared to January-April 2018.

Strong domestic pork demand has translated into strong retail meat prices. The average retail price of pork in grocery stores during May was $3.883 per pound, up 9.6 cents from the month before, up 14.2 cents from a year ago, and the highest for any month since October 2017. Packer margins during May were the tightest since October 2017.

Export demand has not done nearly as well. Export demand for each of the four major meats were lower than during the first third of 2018 with export demand for pork dropping the most. The strong U.S. economy is likely the main contributor to strong domestic meat demand. International trade disputes likely have contributed to the weakness of export demand.

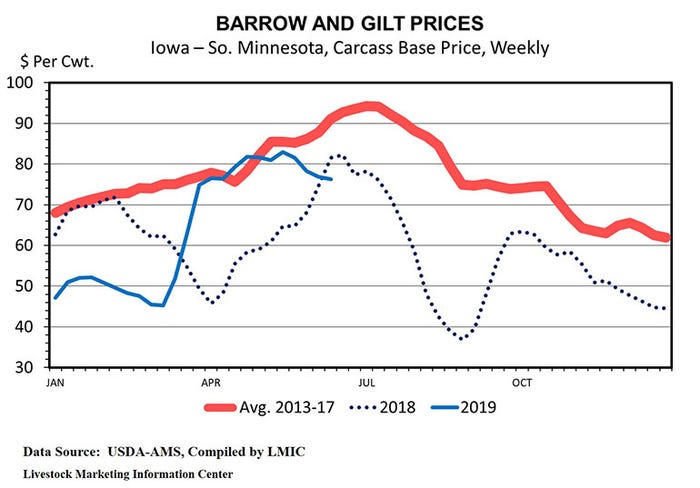

Most everyone expects U.S. pork production to set another record this year. Normally, that would imply low hog prices and red ink. Yet, this spring, the outlook for hog profits was outstanding. The optimism about hog profits came from the assumption that feed prices will continue to be low and pork exports to China will be record high due to their production shortfall caused by African swine fever. Both assumptions look questionable today.

On April 15, the December lean hog futures contract closed at $87.25 per hundredweight. Last Friday that contract closed at $74.15 per hundredweight. On April 15, the December corn futures contract closed at $3.9075 per bushel. Last Friday it closed at $4.635 per bushel. The hog/corn ratio for December calculated using futures prices has dropped from a very profitable 22.3 in mid-April to only 16.0 today.

Last year, U.S. pork exports set a record at 5.87 million pounds. That record was driven by increased pork shipments to South Korea, Australia, Taiwan, Colombia and other Latin American countries. U.S. pork shipments to China in 2018 were down for the second consecutive year.

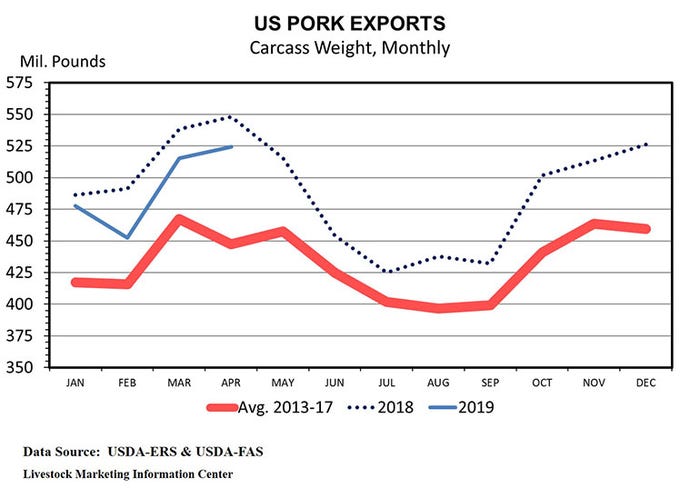

During the first third of 2019, U.S. pork exports were down 4.5%. The export decline of 93 million pounds was led by a drop of 133 million pounds (20.8%) in shipments to Mexico. South Korea, Japan, Hong Kong and China also cut their purchases by more than 10 million pounds each. On the flip side, Australia, Colombia, Canada and Chile each bought at least 18 million pounds more U.S. pork in the first third of 2019 than they did last year.

USDA’s WASDE report is predicting 2019 pork exports will be 596 million pounds (10.2%) higher this year than last year’s record level. They are forecasting 2020 pork exports up an additional 7.4% from this year. During January-April, U.S. pork exports were down 4.5%. If USDA is right about a 10.2% increase for the year, then May-December pork exports will need to be 18.1% higher than a year earlier. If all of the forecasted 596 million pound increase in pork exports goes to China, then May-December shipments to China will be up 347% bringing the annual total to 931 million pounds. That is a lot of pork, but less than is annually purchased by either Japan or Mexico.

China buys a large portion of U.S. pork variety meats and byproducts. They are much smaller player in muscle meats trade. In 2018, Mexico, Japan, South Korea and Canada each bought far more U.S. pork than did China. Last year’s pork exports to China, 335 million pounds, were only the seventh largest ever. The record for U.S. pork shipments to China is 668 million pounds shipped in 2011. In 2011, 2.9% of U.S. pork production was shipped to China. Last year 1.3% of production went to China. During the first third of this year 1.6% of U.S. pork production went to China.

Despite ASF in China, U.S. pork exports to China have not yet matched last year’s pace. During January-April U.S. exports to China were down 14 million pounds (9.0%) year-over-year. On the brighter side, U.S. pork shipments to China have increased each month since January and were larger in both March and April than a year ago.

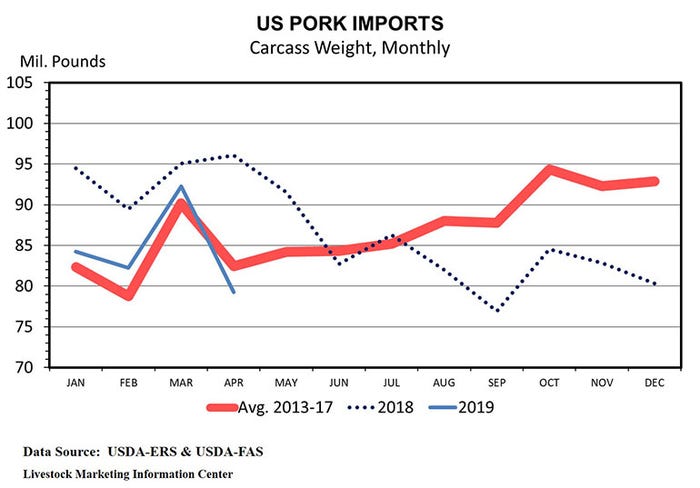

U.S. pork imports during January-April was down 9.9% due to big declines in shipments from Canada and Denmark. If, as appears likely, Canada ships more pork to China this year, then they are likely to ship less to the U.S.

The futures market is predicting that hog prices will be steady to slightly higher through mid-July then decline to a December low, roughly $5 under current prices. Futures contracts for next spring are trading about $2 per hundredweight higher than where the April and May 2019 contracts expired.

Last week Tyson announced the debut of their “Raised and Rooted” brand plant-based and blended meat-plant protein products. Initial products include plant-based nuggets and blended beef-plant burgers. Tyson stressed their commitment to continue to expand their traditional meat and poultry business. They see these new products as an additional market opportunity. Tyson is certainly not alone in their effort to produce and sell plant sourced protein as a substitute for red meat and poultry. Long term, the success of these new products could have a big impact on meat demand.

The quarterly Hogs and Pigs report will come out on Thursday of next week. I expect it to have larger farrowing intentions than the March report which forecast March-May farrowing intentions at up 0.6% and June-August intentions at down 0.1%. The March survey was conducted following seven consecutive months of red ink for producers. The June survey was conducted following three months with very solid profits.

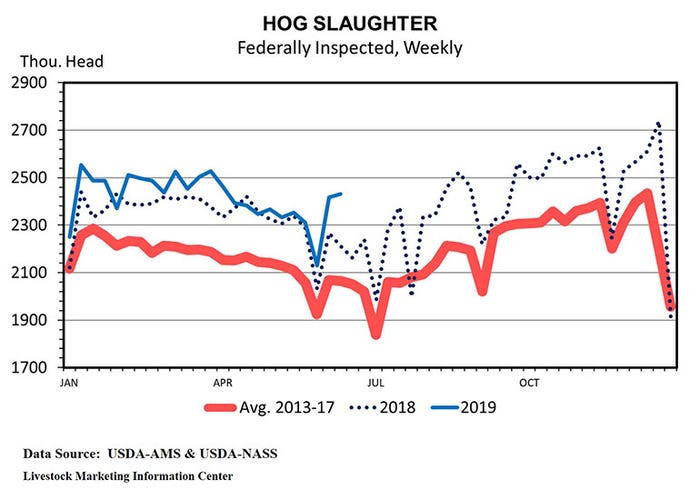

This afternoon, USDA will release their weekly crop progress report. Because of excessive rains in the Midwest, plantings have been delayed and crop condition is poor. The monthly Livestock Slaughter report will be released Thursday. Preliminary data indicate May hog slaughter was up 1.4% year-over-year, with the same number of slaughter days this May as last. Daily hog slaughter appears to have been 0.5% less than implied by the March Hogs & Pigs report. The monthly Cold Storage report comes out on Friday afternoon. Also, USDA will release the June Cattle on Feed report on Friday afternoon.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like