It looks like March slaughter may come in slightly above the 4.5% increase implied by the December Hogs and Pigs report. It doesn’t appear there will be any large revisions in the market hog inventory when USDA releases the next Hogs and Pigs report on March 30.

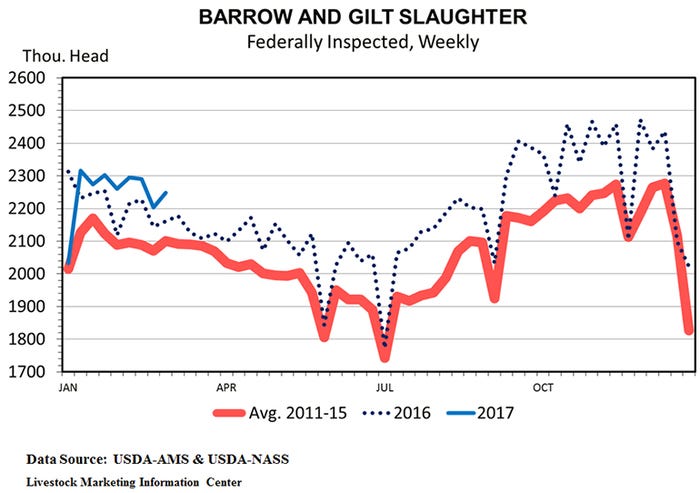

Hog slaughter has been close to what was implied by the USDA’s December hog inventory survey. Average daily slaughter of U.S. raised barrows and gilts was up 3.2% during December-to-February. The Dec. 1 market hog inventory indicated winter market hog slaughter would be up 3.3%. It looks like March slaughter may come in slightly above the 4.5% increase implied by the December Hogs and Pigs report. It doesn’t appear there will be any large revisions in the market hog inventory when USDA releases the next Hogs and Pigs report on March 30.

Last year’s commercial hog slaughter was a record 118.2 million head, up 2.4% from the year before and up 1.5% from the old record set in 2008. Indications are that this year’s hog slaughter total will easily exceed 121 million hogs and may exceed 123 million head.

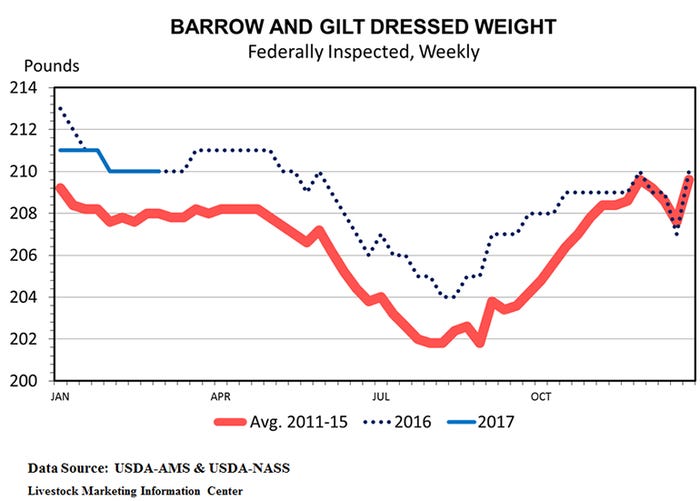

USDA’s latest forecast is that 2017 pork production will total 26.105 billion pounds, up 4.7% from last year’s record. The increase in pork production must either come from increased hog slaughter, heavier carcass weights, or both. Given that daily hog slaughter is up roughly 3.7% thus far in 2017, USDA’s forecast requires hog slaughter to average close to up 5% for the rest of the year, assuming slaughter weights stay close to last year’s level.

Hog weights peaked with the record hog prices of 2014 and have trended lower since. Carcass weight averaged 213.7 pounds in 2014, 212.3 pounds in 2015, and 211.0 pounds in 2016. Thus far in 2017, average weights are down 0.5 pound. The long-term trend is for carcass weights to increase 1.3 pounds per year, so a weight increase is certainly due. Summer weather and hog prices will likely determine if 2017 weights average above or below last year’s level. Hot weather and red ink usually push weights down.

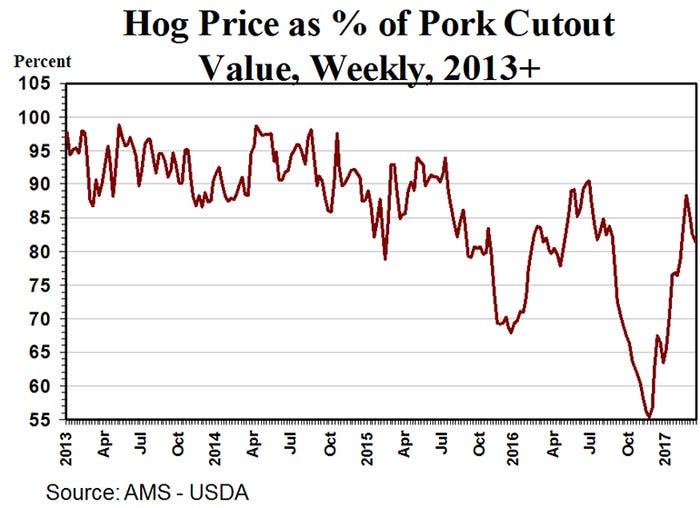

Of course, what matters most to producers is the price they get for their hogs. Prices have rebounded from the lows of last fall. In part, this is due to less pork on the market. Pork production was down 2.7% in the first 11 weeks of 2017 compared to the last 11 weeks of 2016. Cutout value is up nearly $10 per hundredweight from mid-October. Equally important is the flip side of that production coin – reduced hog slaughter. Packer margins have tightened causing hog prices to climb even faster than the cutout value. In late November, hog prices dropped to nearly 55% of cutout. Now hog carcass prices are back above 80% of cutout value.

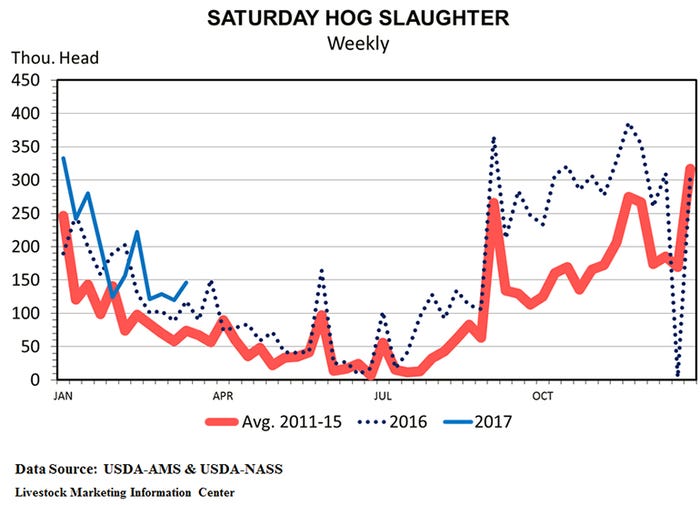

If USDA’s prediction of 4.7% more pork this year than last turns out to be accurate, producers better hope that slaughter weights take a big jump. If weights hold steady, 4.7% more pork will necessitate 4.7% more slaughter hogs. That would be a major challenge for packers. Hog slaughter plants were running at capacity last fall. Since then two old plants are being remodeled and brought back on line (Windom, Minn., and Pleasant Hope, Mo.) and two large new slaughter plants (Coldwater, Mich., and Sioux City, Iowa) are expected to start operations this summer. These four plants are likely to add about 20,000 head per day to this fall’s slaughter capacity. That is an increase of 4.5% on the 442,000 daily slaughter of last fall. If fall 2017 slaughter is up 4.5% or more, packers will once again struggle to process hogs in a timely manner which means packer margins will expand and hog prices will drop faster than the pork cutout value.

Saturday hog slaughter is the best indicator of how close packers are to slaughter capacity. Currently, the number of hogs slaughtered on Saturdays is trending down as it always does at this time of year. Saturday slaughter numbers will come back up in the fall. Even with additional slaughter capacity coming on line this summer, Saturday slaughter this fall could exceed last year’s record levels.

A case can be made that hog slaughter will not reach 123 million head this year. The December Hogs and Pigs report said winter and spring farrowing intentions were up 1.4% and 1.0%, respectively. If pigs per litter increase by 1.5%, which is in line with the long-term trend, then the December-to-May pig crop should be about 2.7% larger than last year and June-to-November hog slaughter would be expected to be up 2.7%. That would leave 2017 hog slaughter at roughly 122.2 million head which is 3.4% more than last year. If the number of litters farrowed fall short of intentions or if pigs per litter increases more slowly, then packer margins are likely to be much tighter than last year.

As always, producers will want to look closely at the numbers in the March Hogs and Pigs Report. Especially check out litters farrowed and pigs per litter. These surveys are not perfect, but they are the best available indication of future production.

About the Author(s)

You May Also Like