Don't be blinded by the recent rally, and use put options to protect the revenue side of our business. Just let the line run a little more if we have a Big Fish on the hook.

March 13, 2017

I have recently had the opportunity to address a few groups in the agricultural sector. Some of them have been pork-oriented; others are from other walks of Agriculture (with a capital “A”). One thing that strikes me at nearly every gathering is the disconnect between the “old way” of evaluating markets and what we have been experiencing over the last six months or so.

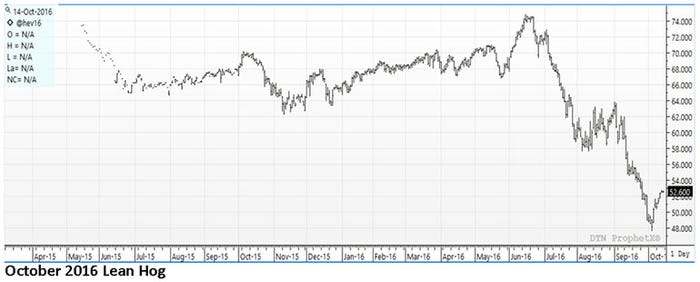

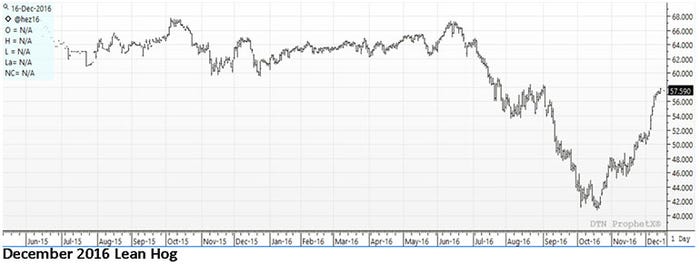

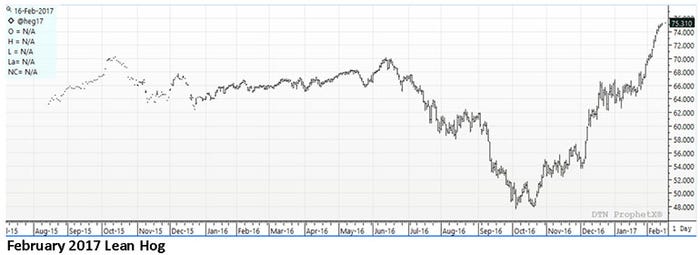

To wit, how many faithful readers of this column were feeling more than a little trepidation as we approached the fourth quarter of 2016 as it had all the markings to repeat 1998? I know I was in that camp. Call me Chicken Little, but I really did think the sky had an opportunity to fall. Until it didn’t. At that point you had a choice – keep on believing what you had been believing, or re-evaluate the whole scenario and try to put rationale around the rebound in hog prices. If you were a politician, you may be accused of flip-flopping if your position shifted. To me, you are a learned individual if you change your mind when you are presented with new information that runs counter to your prior beliefs. Maybe that is one reason why I will never hold political office? I think it is healthy to change your mind when the facts warrant it. Take a look at the three graphs below; they are, respectively, of the Lean Hog market for October 2016, December 2016 and February 2017.

Our first hint that something had shifted occurred just before the expiration of the October 2016 contract. Notice the sharp low was followed by a tail that trended higher. Not a big tail, but a mini-rally at the conclusion of this contract. Remember, too, that cash was trading at a $7 premium to futures. Hmmm. That is odd. But this was an odd time so you are forgiven if you missed this subtle queue. One observation is a point.

Then came the December expiration. The rally that started just before the October went off the board continued into this futures market with almost no setbacks from October through the middle of December. We were probably still holding our breath at this point, but the potential disaster of a packing capacity crunch never came. Packer margins were handsome in this period and they took advantage by running hard, making a busload of money, and averting a crisis. You are forgiven if you were still skeptical of the rally at the end of the December contract, as we were still not out of the woods. But two observations make a line.

The streak remained intact with February that was keeping the rally alive and going off the board at life-of-contract highs. Very impressive. Three observations make a trend.

From here on out, it is time to change your tune if you are still a bear and have all of the “facts” on your side of the ledger. Reality was and is different. Here we sit with the April contract as the lead month that is exhibiting a bit of uncertainty as I write this column. Bellies have fallen back to reality, hams are off 30 cents or so from their high, things are not falling apart but the bloom is seemingly off the rose. Where do we go from here? You will find several opinions on this topic, but it is my belief that the party is not over.

Fred Astaire sometimes needed a rest before he went back on the dance floor. I think this reprieve in the hog market may be a healthy hiatus to allow bellies to go into the freezer and prices to reset before we resume our upward momentum. Take a peek at last week’s export numbers. To paraphrase our president, they were “yuge!” Have you noticed what is happening to volume in the negotiated market? Numbers are rising. People are coming out of the storm shelter and beginning to offer more open market animals to the Iowa-southern Minnesota or the western Corn Belt. The USDA in their report March 9 increased their export projections and, with it, their expectations of price for 2017 – albeit, still below values offered by the CME. Good stuff. We still have the threat of the current administration getting into a squabble with Mexico and/or China – both of which would negatively impact export prospects for our pork.

Producers need to recognize this real and tangible threat, and I still believe the use of put options below the market makes sense as just-in-case insurance.

Bottom line

I do not want to be blinded by the recent rally and I still like the referenced put options for protecting the revenue side of our business. I just want to let the line run a little more if we have a Big Fish on the hook.

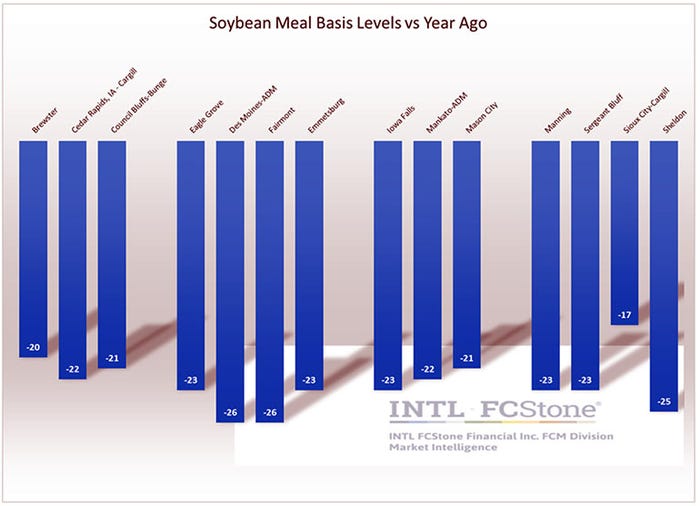

It’s not just the hogs; other markets are wacky, too. When was the last time you saw basis numbers like we are experiencing in soybean meal? Forty under in the west is common. I have attached a chart that shows the difference in soybean meal basis year-over-year. Wow. One thing that still frustrates me though is the lack of deliveries in the meal market (Writer’s note: I can really get on my soapbox on this issue so if you want an earful just give me a call. But you had better have a fresh cup of coffee because I can rant on for a bit.).

Recall that corn and beans converge at option expiration with deliveries taking place along the Illinois River. It is not a perfect system, but it does seem to work reliably. Soybean meal deliveries can only occur if processors register certificates. You, as a grain producer, can participate in the delivery process, if you choose, in corn or soybeans. You, as a soybean meal consumer, are at the mercy of the handful of bean crushers that have a collective vested interest in maintaining margin, a feat partially accomplished by supporting something called “board crush” via the lack of registering deliverable stocks and widening out spreads. Consumers of soybean meal are powerless to “force” the crusher to deliver whereas the grain markets either side can influence the trade. This has to change, and the sooner the better.

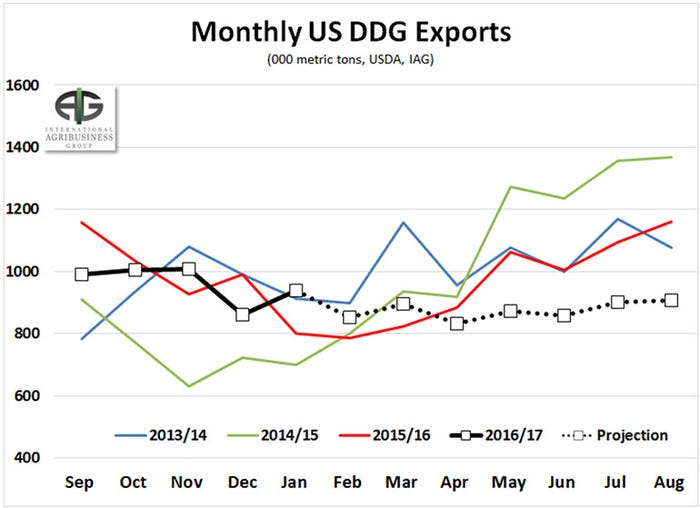

The ethanol byproduct guys are in a pickle, too. They have done an excellent job in the last few months of finding export homes when their largest market, China, and third largest, Vietnam, either suspended imports or placed prohibitive import tariffs on U.S. dried distillers grains with solubles. In fact, their January exports were the highest ever for that month. The problem is when the weather warms in the United States and pastures come back into play, the export market has traditionally been the saving grace of the DDGS market. I suspect going forward the export market is going to prove to be a tougher environment and the domestic market will have to absorb more product – at a price. Read: “lower values.” My friends at IAG in Detroit put together the attached chart with their expectations of exports rolling forward. This looks sane to me.

This week’s USDA report did not do anything to shake up the market. Balance sheets in the United States were pretty benign with the exception of a little hint from the USDA regarding bean exports. If there was a surprise in the report, it was the aggressiveness of the normally timid USDA when it comes to increasing the crop prospects in Brazil which they moved up 4 million metric tons – not an insignificant number. Remember when we tried to kill the U.S. crop last year with the “wettest drought in history” and it resulted in record production? Similar gig in Brazil. It was not a perfect start to their growing season, but it improved and is improving as time wears on and production numbers are beginning to reflect this reality. Even though the U.S. crop is settled for 2016 and has not started for 2017, we cannot deny the pressure that the big South American production will have on our export prospects.

The Fed is scheduled to meet this week with the market anticipating a near-certain hike in interest rates. We have been entertaining several discussions with producers looking to convert their variable rate notes to fixed values. We do this via a vehicle called a “swap.” Think of it as hedging your risk against higher rates. Call the office if this is of interest.

Conclusion

I have recently been counseling people to “trade like a dog.” This references the ability of our canine buddies to sniff things out and not overthink things. Are markets trending higher even though hog supplies are 3.8% higher than last year?

Human: my superior logic and multi-regression equation indicates values should be moving lower even though they are appreciating.

Dog: do I smell bacon?

(Writer’s note: have you ever noticed that the dog does not quiz you about where you are going or how long you will be gone when you open the door to the truck and invite them to go with you? They just jump in and go for a ride. We should, too.)

Human: I am not going to ingest too many calories or I may gain weight and compromise my health. Dog: BACON!

Enjoy the ride.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like