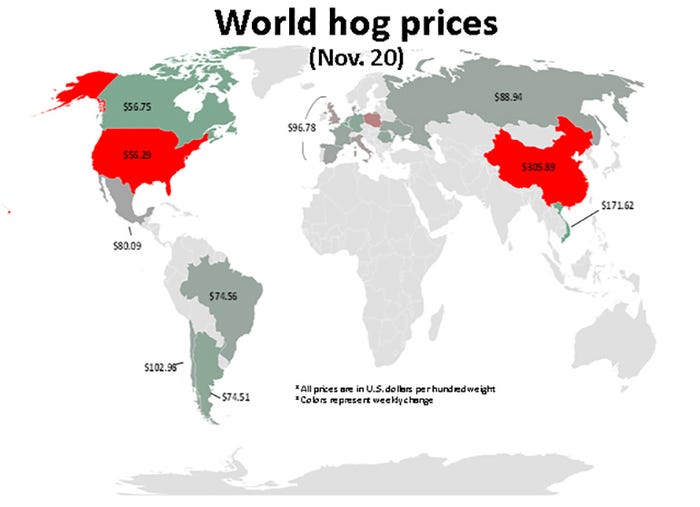

The trade war and resulting 50% retaliatory tariff on U.S. pork imposed by China has created a dramatic distortion in hog prices across the globe.

November 25, 2019

Lean hog futures continue to waste away, seemingly unimpressed with the long-term bullish implications of the African swine fever outbreak. If someone would have told me one year ago that U.S. hog producers would be losing money at the end of 2019 and that futures would be locked into a spiral downtrend, I simply would not have believed it. Here we are.

The market is focused on two items. The first is record large production and the second is fear, great fear that ASF will eventually show up in the United States. The first focus, record large production, while accurate is not a legitimate concern or fear. Over the last several weeks cutout prices have soared higher, led by surging ham prices, pushing pork packer operating margins to record high levels. At one point recently, pork packer processing margins were approaching $100 per pig. The fact that independent hog producers are losing money as the cash hog market continues to grind lower is confirmation that there is a real lack of competition at the packer level. Most thought this problem would be solved when new packing plants were built, expanding capacity and supposedly increasing competition. That has not been the case.

Expanding capacity has prevented slotting and the backing up of hogs and thus avoiding a situation like what occurred in the fall of 1998. Because hog prices are a touch higher than they were last year does not indicate that there's increased competition. Increased demand for pork, yes, increased competition for live hogs, no. Record high packer profits in the face of producer losses does not occur if there's pure competition.

The second item, the fear that ASF will eventually be discovered in the United States is preventing money, serious speculative money, from entering the lean hog futures market. One result is that futures are not able to move upward, anticipating future events. With the possibility that ASF may strike in the United States the future is simply too risky, too uncertain to put large amounts of money at risk. So what we're developing is a serious participation problem, regardless of the bullish nature of the fundamental situation.

What's happening in the world is blowing the mind of fundamental traders and analysts like myself. China, apparently, has stopped reporting pig herd data. ASF continues to spread. The most recent outbreak appears to have hit a large biosecure facility that had recently repopulated. I'm hearing that as soon as pigs are weaned the sow goes to market because prices are record high. In other words, while the Chinese government is telling the world that repopulating is occurring at a rapid rate, likely just the opposite is happening.

ASF is destroying the hog herd in Vietnam and creating huge problems due to the high density of the pig population in South Korea. Recently, several cases of ASF in wild boar were reported in western Poland for the first time and within 100 miles of the border with Germany. Germany, by the way, is the largest EU exporter to China.

Recent data indicate that commercial hog traders are covering their short positions as futures prices move lower while the managed money is liquidating their long positions and about to start going short to the market. The small spec trader is already short. The Foreign Agricultural Service, a division of the USDA, issued a final rule, effective Nov. 25 stating that split hog carcasses must be considered muscle cuts of pork and thus reported as pork exports. It's been a known fact that a large chunk of pork exports destined to China has been going unreported due to confusion over this rule. Perhaps this will help to clear the muddy water a bit.

In the meantime, U.S. pork producers continue to expand production despite widespread losses in the industry. It would appear the highly integrated nature of the industry is fostering decisions based upon other considerations that exclude profit and/or losses. One can easily make the case that large integrators are in the process of squeezing out the independent hog producer. Do we really want to see the pork industry structured so that all of the pigs in the United States are owned or controlled by four or five firms?

At some point in the months ahead, when U.S. pork exports to Asia accelerate dramatically, and when the true nature of the disaster befalling China in their hog herd becomes more widely understood, I anticipate that lean hog prices, pork cutout values and lean hog futures prices will soar higher. Because I have no confidence on when this will occur, bull call spreads has been our strategy to date.

The trade war and resulting 50% retaliatory tariff on U.S. pork imposed by China has created a dramatic distortion in hog prices across the globe. Pig prices in the United States and Canada are much lower than anywhere else in the world. Consider the graphic below.

Source: Dennis Smith, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like