September 21, 2015

First today, I’ll make a plug on behalf of my veterinarian friends. The continued appearance of Seneca Valley Virus has them in a bit of a tizzy for darn good reason.

It is not that this virus is particularly dangerous or costly. It presents itself as a high fever and vesicles (blisters) around the nose, mouth and hoof. Death loss is pretty much nil and most pigs recover though a few have had to be euthanized when severe hoof problems developed. None of us ever finds sick pigs to be acceptable and we want to stop this virus just like all the others that make them suffer. We are charged with their care and keeping them healthy is Job 1.

The tizzy-ness of veterinarians is due to the possibility that SVV could make producers complacent about an unthrifty pig that may have a fever and some blisters around its nose and/or mouth and/or hooves. A response of “Oh, that’s just that something-or-the-other valley virus!” is the worst thing that could happen.

Based on the fact that hoof and mouth disease has not been in the United States since 1929, the chances are overwhelming that the statement is true, but we mustn’t get lulled to sleep by these look-alike symptoms.

If you see these symptoms, stop moving any pigs and call your veterinarian immediately. This is nothing to be trifled with. Should, heaven forbid, hoof and mouth disease find its way to the United States once again, identifying the first case (or at least as close to the first case as possible) will be a key factor to limiting its spread. One producer who incorrectly assumes that a lame pig with some blisters just has SVV could give hoof and mouth disease a head start that will confound control efforts for months.

So why is the economist writing about this? Because, we export 22% of all pork and about 10% of all beef produced in this country. All of those exports would be stopped immediately and all of that product would have to find a home within our borders for the duration of the export interruption. A retail price elasticity of minus-0.67 or so implies a price response of 1.5% for every 1% of extra pork on the market. The resulting 33% decline at retail is probably too small since beef prices will fall as well. The demand for hogs is even more inelastic (-0.33 to -0.50), implying an even larger (-2.0 to -3.0) price response. Hog prices would fall by 40 to 60% very quickly.

That is just the price response to an immediate increase in domestic supplies. News coverage, pictures of piles of dead animals, etc., will not likely have a positive impact on domestic demand. And don’t think for a minute that our detractors will not pile on to producers’ misery. They will have a field day. “We told you so” and “They deserve it” will fly without one bit of hesitancy.

Assume nothing if you see a pig with these symptoms! Call your veterinarian immediately. The chances are it will be a scare and a good exercise in disaster preparedness for everyone. But if it is more than that, your quick response may save you and your fellow producers billions.

Cattle On Feed report deserves notice

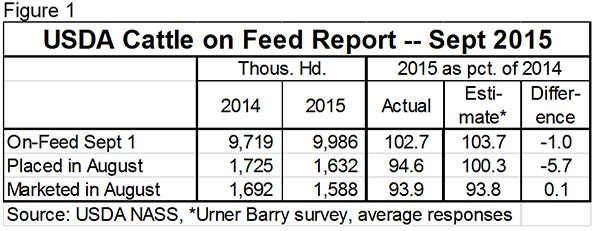

The USDA’s monthly Cattle On Feed report indicated sharply lower-than-expected placements of cattle in August but also confirms that there are ample supplies of market-ready cattle in the short term. The key data from Friday’s report appear in Figure 1.

The USDA’s actual numbers are, as can be seen, pretty close to pre-report estimates for both feedlot inventories and August marketings. But the placement number was a big surprise. It is likely driven by continued good pasture conditions in much of the country and the ability to add low-cost gains before moving cattle to lots. Add that to the fact that feeders have not been able to pencil a profit on incoming cattle for the past several months and there is a) good reason that sellers haven’t sold and b) even better reasons that buyers haven’t bought.

But the data also reveal a continuing trend: Slow turnover rates in feedlots. Inventories are 2.7% higher, but marketings are 6.1% lower than one year ago. That implies slow movement, a factor demonstrated by record large weights and driven at least partially by the fact that Holstein cattle represent an unusually high percentage of total cattle on feed. Holsteins are fed much longer than beef breeds and generally go to higher slaughter weights. It’s not so much that there are more Holsteins but this mix change is primarily due to fewer beef-breed cattle, especially heifers, in feedlots this year.

Cattle and beef prices will remain under pressure in the short run as the supply of cattle that have been on feed 120 days and more is up 18% from last year.

Fall hog markets showing no fatigue

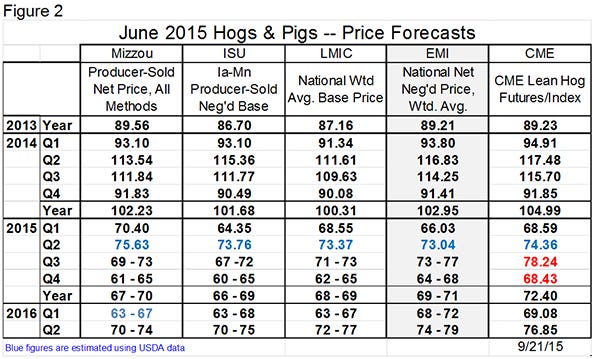

That will take a bit of the “pork opportunity” away this fall but hog markets are showing no fatigue from their latest climb back to respectability. We still think larger Q4 supplies will weigh on this market and urge producers to consider some price protection going in to this Friday’s Hogs and Pigs report. These futures prices – as can be seen in Figure 2 – are beyond the top of my cash hog price forecasts for the rest of 2015. I may get new info on Friday that will improve those forecasts but these values look good given the data we have now – and even what I expect we are going to see on Friday. Pricing first and second quarter 2016 hogs is not so much of a slam dunk but the futures are now within my price forecast ranges. Some price protection at these levels going in to the report—with reaction strategies for next Monday clearly thought out – may well be wise. Every one of those quarterly prices in Figure 2 is profitable given my latest cost estimates.

Every one of those quarterly prices in Figure 2 is profitable given my latest cost estimates.

About the Author(s)

You May Also Like